Tax reform should be something ‘American people, media’ can agree on: Soave

Democratic strategist Laura Fink and Reason senior editor Robby Soave react to the media’s coverage of former President Trump’s tax returns in wake of a House committee’s recent decision to make them public.

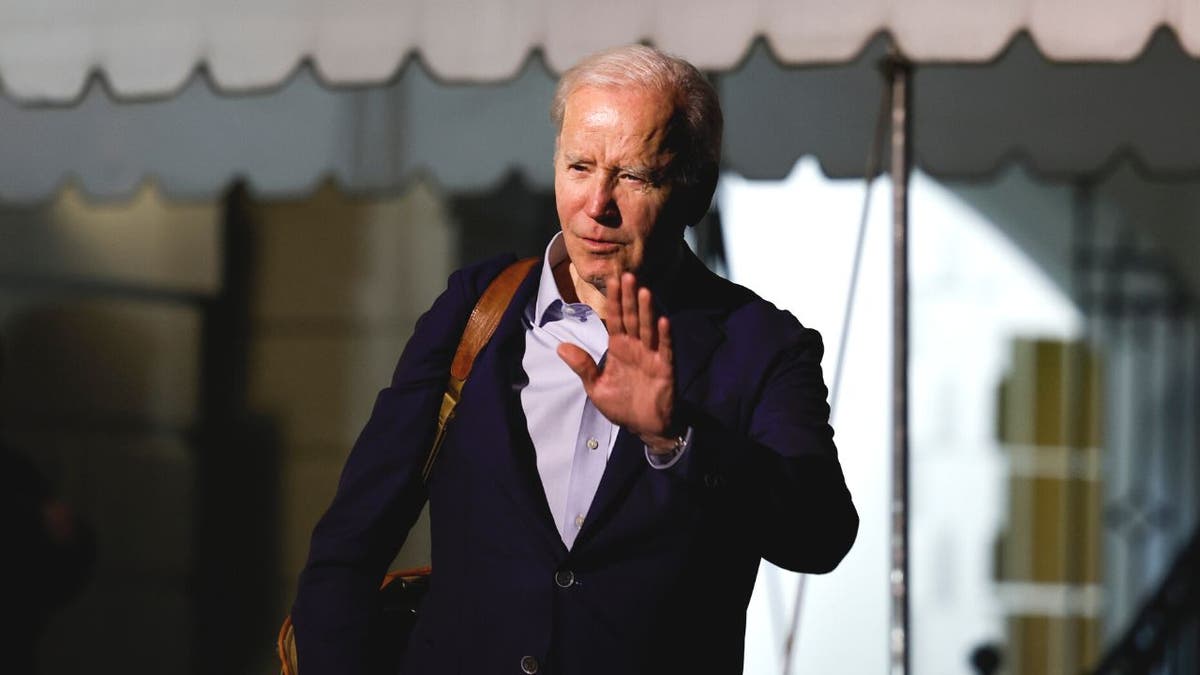

EXCLUSIVE: President Joe Biden "adamantly opposes" a Republican bill that the House of Representatives plans to vote on that would abolish the Internal Revenue Service (IRS) and eliminate the national income tax, and he warns that the bill would end up raising taxes on middle-class families.

The House is set to vote on Georgia Republican Rep. Buddy Carter’s reintroduced Fair Tax Act, which aims to reel in the IRS and remove the national income tax and other taxes and replace them with a single consumption tax.

But the White House is warning that the legislation would "overwhelmingly shift the federal tax burden onto the American middle class and working people, while simultaneously causing prices to spike across the board."

"President Biden adamantly opposes House Republicans’ plans to force an unprecedented tax hike onto middle-class families in exchange for yet more tax welfare for the rich and big corporations," White House deputy press secretary Andrew Bates told Fox News Digital on Wednesday.

President Biden "adamantly opposes" a GOP House bill to abolish the IRS, the White House said Wednesday. (Anna Moneymaker/File)

"The president’s top priority is to make more progress cutting costs for the American people, who broadly support his efforts to have multinational corporations and the richest taxpayers pay their fair share," Bates said.

The White House cited former President George W. Bush’s panel on Federal Tax Reform, which found that lower- and middle-income families "would be especially hard-hit by a standalone retail sales tax."

The White House said that the "theme of tax handouts to the wealthy on the backs of the middle class is fast becoming a theme of the new Congress" — a theme that the White House said voters rejected in the midterm elections.

Internal Revenue Service (iStock)

"We need to fight inflation together and stand up for working families, not worsen inflation and then raise taxes on everyone but the top as the result of a backroom deal," Bates told Fox News Digital.

The plans for a vote on Carter’s bill came as part of the deal between House Speaker Kevin McCarthy, R-Calif., and members of the House Freedom Caucus as he sought to gain their support in his bid for the gavel.

"Instead of adding 87,000 new agents to weaponize the IRS against small business owners and middle America, this bill will eliminate the need for the department entirely by simplifying the tax code with provisions that work for the American people and encourage growth and innovation," Carter has told Fox News Digital. "Armed, unelected bureaucrats should not have more power over your paycheck than you do."

IRS TARGETED POOREST TAXPAYERS WHILE MILLIONAIRES WENT MOSTLY UNSCATHED IN 2022: REPORT

Rep. Buddy Carter, R-Ga., will get a vote on his bill to abolish the IRS. (Tom Williams/CQ-Roll Call Inc. via Getty Images/File)

Specifically, the bill gets rid of the national personal and corporate income taxes and abolishes the IRS — which is slated to hire thousands of new staff over the next decade unless congressional Republicans can stop it — and implements a national sales tax.

The bill also gets rid of the death, gift and payroll taxes, and it would replace the current tax code with a national consumption tax.

Eleven members have sponsored the bill, including Rep. Kat Cammack, R-Fla., Rep. Jeff Duncan, R-S.C., Rep. Bob Good, R-Va., Rep. Andrew Clyde, R-Ga., and House Freedom Caucus Chairman Rep. Scott Perry, R-Pa.

The bill illustrates the hard-line stance House Republicans are taking with the Biden administration and its push to expand the federal government, including the new funding that would expand the IRS.

On Friday night when Rep. Kevin McCarthy was elected Speaker of the House, special coverage on "FOX News @ Night" averaged 3.4 million viewers to thump competition. (Kent Nishimura/Los Angeles Times via Getty Images/File)

The House of Representatives on Monday evening voted to rescind more than $70 billion in funding to the IRS – fulfilling McCarthy's campaign promise to prevent the agency from hiring tens of thousands of new agents and conducting new audits on Americans.

The bill — dubbed the Family and Small Business Taxpayer Protection Act and sponsored by Rep. Adrian Smith, R-Neb., and Rep. Michelle Steel, R-Calif. — passed the House, 221-210.

The legislation would roll back billions of dollars of funding for the IRS approved in the Inflation Reduction Act last year but leaves in place funding for customer service and improvements to IT services.

CLICK HERE TO GET THE FOX NEWS APP

The bill rescinds any funding that could be used to conduct new audits on Americans and funding that would double the agency's current size.

The Inflation Reduction Act granted an $80 billion boost to the IRS over a 10-year period, with more than half of those funds approved with the intention of helping the agency to crack down on tax evasion.