President Biden announced Wednesday that he will cancel $10,000 of federal student loan debt for certain borrowers making less than $125,000 per year, and up to $20,000 for Pell Grant recipients, while extending the pause on federal student loan payments through the end of the year.

"In keeping with my campaign promise, my Administration is announcing a plan to give working and middle class families breathing room as they prepare to resume federal student loan payments in January 2023," Biden tweeted.

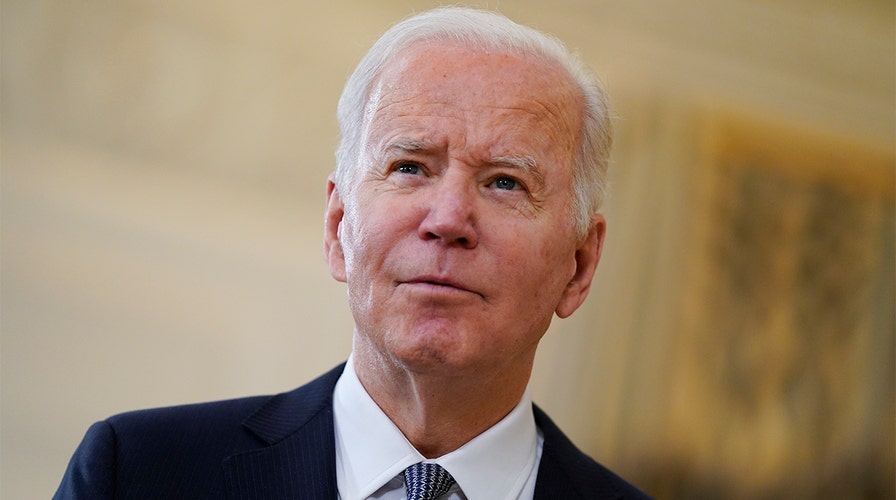

Biden gave remarks on the plan Wednesday afternoon.

The nation's federal student debt now tops $1.6 trillion after ballooning for years. More than 43 million Americans have federal student debt, with almost a third owing less than $10,000 and more than half owing less than $20,000, according to the latest federal data.

AMERICANS ALREADY REACTING TO BIDEN'S STUDENT LOAN HANDOUT PLAN: 'HIGHLY SUSPICIOUS'

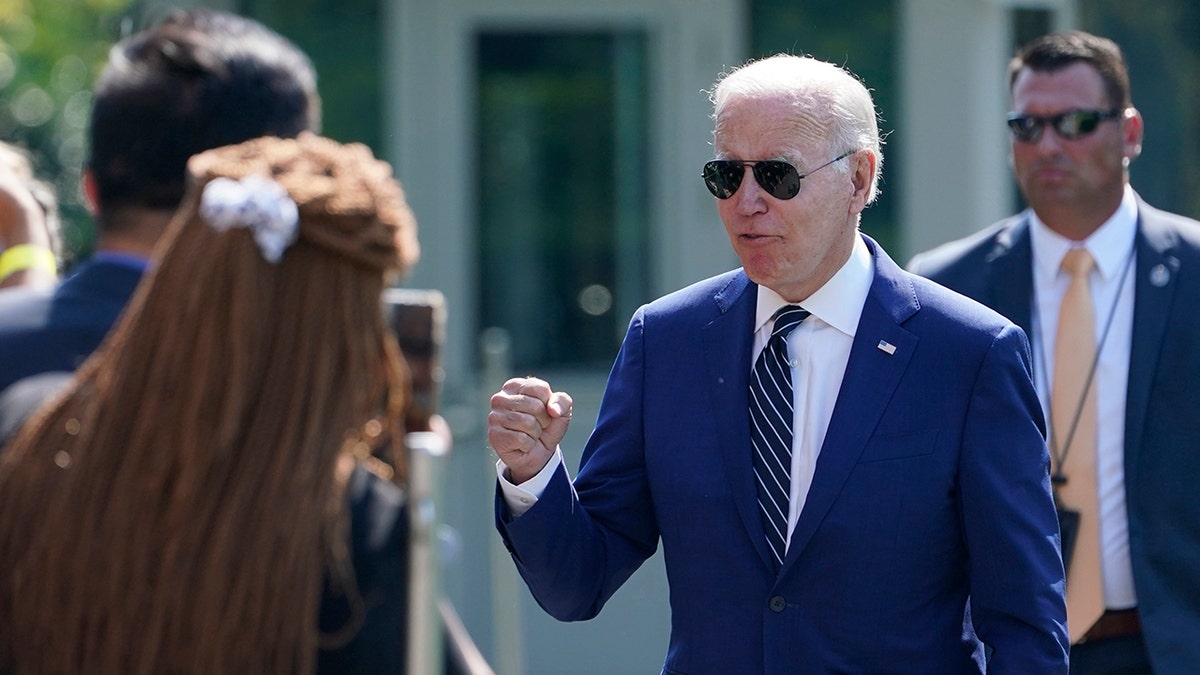

President Biden waves after returning to the White House in Washington on Wednesday, Aug. 24, 2022. (AP Photo/Susan Walsh)

The national debt, according to the Treasury Department, currently sits at $30.7 trillion.

Biden said his administration will forgive student loan debt up to $20,000 for borrowers who attended college on Pell Grants and $10,000 for borrowers who did not receive Pell Grants. He said the forgiveness "only applies to those earning less than $125,000."

Biden also said that borrowers with undergraduate student loans are able to "cap repayment at 5% of your monthly income."

STUDENT LOAN DEAL COULD COST $900B AND FAVOR TOP EARNERS, ANALYSIS SHOWS

President Biden greets people after returning to the White House in Washington on Wednesday, Aug. 24, 2022. (AP Photo/Susan Walsh)

Pandemic-era payment freezes were set to end on Aug. 31, but Biden on Wednesday also extended the payment pause "one final time through Dec. 31, 2022."

The Department of Education on Wednesday said the application for loan cancellation will become available "no later than when the pause on federal student loan repayments terminates at the end of the year."

"Earning a college degree or certificate should give every person in America a leg up in securing a bright future. But for too many people, student loan debt has hindered their ability to achieve their dreams — including buying a home, starting a business, or providing for their family," Education Secretary Miguel Cardona said in a statement Wednesday. "Getting an education should set us free; not strap us down! That’s why, since Day One, the Biden-Harris administration has worked to fix broken federal student aid programs and deliver unprecedented relief to borrowers."

Cardona added that the Biden administration is "delivering targeted relief that will help ensure borrowers are not placed in a worse position financially because of the pandemic, and restore trust in a system that should be creating opportunity, not a debt trap."

As for the income-driven repayment plan, the Education Department said the update will "substantially reduce future monthly payments for lower- and middle-income borrowers."

The proposed rule would cut in half the amount borrowers have to pay each month on undergraduate loans — from 10% to 5%. The rule would also have borrowers with both undergraduate and graduate loans paying a weighted average rate.

That proposed rule would also forgive loan balances after 10 years of payments, instead of the current 20 years under many income-driven repayment plans, for borrowers with original loan balances of $12,000 or less.

CLICK HERE TO GET THE FOX NEWS APP

According to a Penn Wharton Budget Model, a one-time maximum debt forgiveness of $10,000 for borrowers who make less than $125,000 will cost around $300 billion for taxpayers.

The announcement comes as the U.S. is facing record-high inflation. But when asked if the plan would increase inflation, a senior administration official said the steps the Biden administration is taking will offset each other, noting there are "certain conditions and assumptions under which it could well be neutral or deflationary."

The official said that the "combination" of an extension in the pause in loan payments and the "targeted debt relief" will "largely offset" inflation.

"That's our view," the official said, adding that "if all borrowers claim the relief that they are entitled to, 43 million federal student loan borrowers will benefit, and of those, 20 million will have their debt completely canceled."

STUDENT LOAN HANDOUT: WALL STREET JOURNAL ROASTS BIDEN'S ‘INFLATION EXPANSION ACT’

Republicans are blasting the Biden administration's move, with Republican National Committee Chairwoman Ronna McDaniel calling it "Biden's bailout for the wealthy."

"As hardworking Americans struggle with soaring costs and a recession, Biden is giving a handout to the rich," McDaniel said. "Biden's bailout unfairly punishes Americans who saved for college or made a different career choice, and voters see right through this short-sighted, poorly veiled vote-buy."

And Senate Minority Leader Mitch McConnell slammed the move, saying Democrats have "found yet another way to make inflation even worse, reward far-left activists, and achieve nothing for millions of working American families who can barely tread water."

"President Biden’s student loan socialism is a slap in the face to every family who sacrificed to save for college, every graduate who paid their debt, and every American who chose a certain career path or volunteered to serve in our Armed Forces in order to avoid taking on debt," McConnell said. "This policy is astonishingly unfair."

McConnell noted that the "median American with student loans already has a significantly higher income than the median American overall."

"Experts who studied similar past proposals found that the overwhelming benefit of student loan socialism flows to higher-earning Americans," he said. "Democrats specifically wrote this policy to make sure that people earning six figures would benefit."

McConnell added: "This is the one consistent thread that connects Democrats’ policies: Taking money and purchasing power away from working families and redistributing it to their favored friends."