Kevin McCarthy blasts Build Back Better: 'Big government socialism isn't working'

The House minority leader discussed the legislation after giving the longest speech in House-floor history, ringing in at eight hours and 32 minutes.

The Democrats’ self-stated effort to "change America," and to do so unilaterally through the budget reconciliation process, has revolved around an ever-changing menu of tax hikes guided not by sound tax policy, but by the revenue they want to raise.

These reckless tax hikes are being sold under the guise of "taxing the rich," "leveling the playing field" or having people pay their "fair share." The truth is Democrats seek to tax everyone, and a large portion of tax relief, if the state and local tax (SALT) cap is repealed, will go to the wealthiest 1%.

Before the Tax Cuts and Jobs Act (TCJA) was signed into law in 2017, the SALT deduction was one of the biggest itemized deductions available to taxpayers, mainly benefiting wealthy individuals living in high-tax states.

BERNIE SANDERS GETS HIS $5T BILL

The TCJA ended this federal subsidy, putting residents of California and Connecticut on more equal footing with residents of Idaho and West Virginia.

Since then, members of Congress from high-tax states have been fighting to remove the cap. The SALT cap issue is awkward for Democrats, so it is no surprise it was not publicly debated during House consideration of the latest tax-and-spending bill. Instead, they have stealthily airdropped the proposal into the most recent version of their reckless Build Back Better legislation.

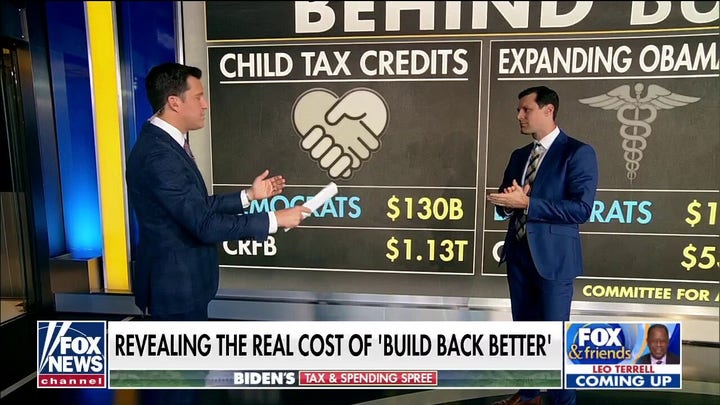

While the updated proposal uses a number of accounting tricks to make it appear less costly, analysis from the Committee for a Responsible Federal Budget says the proposal is the second-most expensive item in the legislation over the next five years. It is more costly than establishing a paid family and medical leave program, and nearly twice as expensive as funding home-medical services for the elderly and disabled. The Congressional Budget Office, Congress’s nonpartisan scorekeeper, recently confirmed these figures.

Budget gimmickry also tries to obscure the actual tax cut provided to rich taxpayers living in high-tax states.

The Tax Policy Center says the latest plan would provide little or no benefit for low- and middle-income households, but would generate a substantial tax windfall for those with much higher incomes. Further, an analysis by the American Enterprise Institute shows the majority of the tax benefit will be felt by the 10 largest states, with taxpayers in California, New York, New Jersey and Illinois alone accounting for 46% of the cost.

The truth is Democrats seek to tax everyone, and a large portion of tax relief, if the state and local tax (SALT) cap is repealed, will go to the wealthiest 1%.

Budget gimmickry also tries to obscure the actual tax cut provided to rich taxpayers living in high-tax states. The proposal substantially increases the current SALT cap right away, front-loading relief for rich taxpayers, which will add inflationary fuel to economic fires. It then re-imposes the lower cap years down the road, back-loading corresponding tax increases advocates claim will "pay for" the giveaway.

CLICK HERE TO GET THE OPINION NEWSLETTER

This dynamic makes it certain that at least some rich taxpayers – for example, those who move between states – will benefit from relief, but never actually pay the cost.

Predictably, a recent analysis by the nonpartisan Joint Committee on Taxation confirmed the bill provides fleeting benefits for low- and middle-income earners, but generous, longer-lived tax benefits to the wealthy.

While much of this reality stems from the inclusion of the SALT deduction, the analysis doesn’t even account for other provisions expected to primarily benefit the wealthy, like tax credits for purchasing union-made electric vehicles or electric bikes.

CLICK HERE TO GET THE FOX NEWS APP

Any suggestion this bill constitutes a broad-based, middle-class tax cut is clearly false. The SALT deduction is ultimately a wealth transfer from low-tax to high-tax state residents, and punishes residents of low-tax states for their states’ fiscal prudence.

As multiple analyses show, the largest amount of relief from the Democrats’ bill will go to those at the very top, with Idahoans and others in low-tax jurisdictions footing the bill.