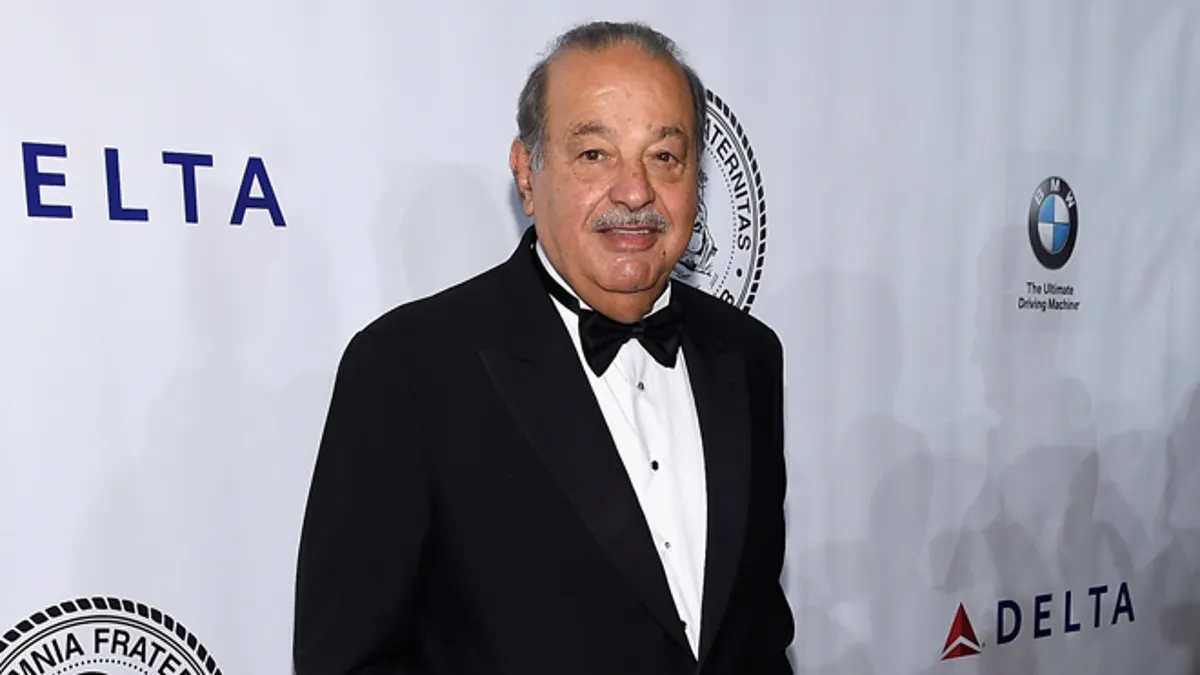

NEW YORK, NY - OCTOBER 07: Carlos Slim attends the Friars Foundation Gala honoring Robert De Niro and Carlos Slim at The Waldorf=Astoria on October 7, 2014 in New York City. (Photo by Larry Busacca/Getty Images) (2014 Getty Images)

NEW YORK (AP) – The New York Times Co. says Mexican billionaire Carlos Slim is now the largest holder of its publicly traded shares.

The business magnate, who built his fortune by amassing a range of retail, industrial and telecom companies, is ranked by Forbes as the world's second-richest person with an estimated net worth of $72 billion.

Slim lent the newspaper company $250 million at the height of the recession, as print advertising sales dropped across the industry and the company slashed staff and sold off most of its midtown Manhattan headquarters to raise cash. New York Times later refinanced the high-interest loan and paid it off three years early.

The company said Wednesday that Slim and entities he controls recently spent nearly $101.1 million to exercise warrants he received for that investment, acquiring 15.9 million shares for about $6.36 each, roughly half the stock's current price. The purchase brings his stake to about 27.8 million Class A shares, or 16.8 percent.

The ownership doesn't change control of the company. The Sulzberger family controls The New York Times Co. through a trust that owns 90 percent of its Class B stock, which isn't publicly traded, and 3.8 percent of Class A shares. Holders of Class B stock can elect 70 percent of the company's board.

Investment manager Fairpointe Capital LLC, based in Chicago, is now the second-largest holder with a little more than 14 million Class A shares, according to S&P Capital IQ.