Consumer watchdog on BlackRock's connection to the CCP

A consumer watchdog criticized the largest asset manager in the world, BlackRock, for "going woke" in the U.S. while investing heavily in China.

A consumer watchdog criticized the largest asset manager in the world, BlackRock, for "going woke" in the U.S. while investing heavily in China.

BlackRock has prioritized investments in environmentally and socially conscious companies in the U.S., but has continued to pour money into Chinese companies that don't meet those standards, Consumers' Research executive director Will Hild told Fox News.

WATCH:

"It's going woke here in the United States … while it's funneling U.S. investment dollars over to China," Hild said.

Since China is considered a developing economy and the United States is a developed economy, Chinese corporations are subject to less strict guidelines on green and equity initiatives, putting American companies at a disadvantage, according to Hild.

LARRY FINK'S BLACKROCK TO BENEFIT FROM GOVERNMENT ESG PUSH

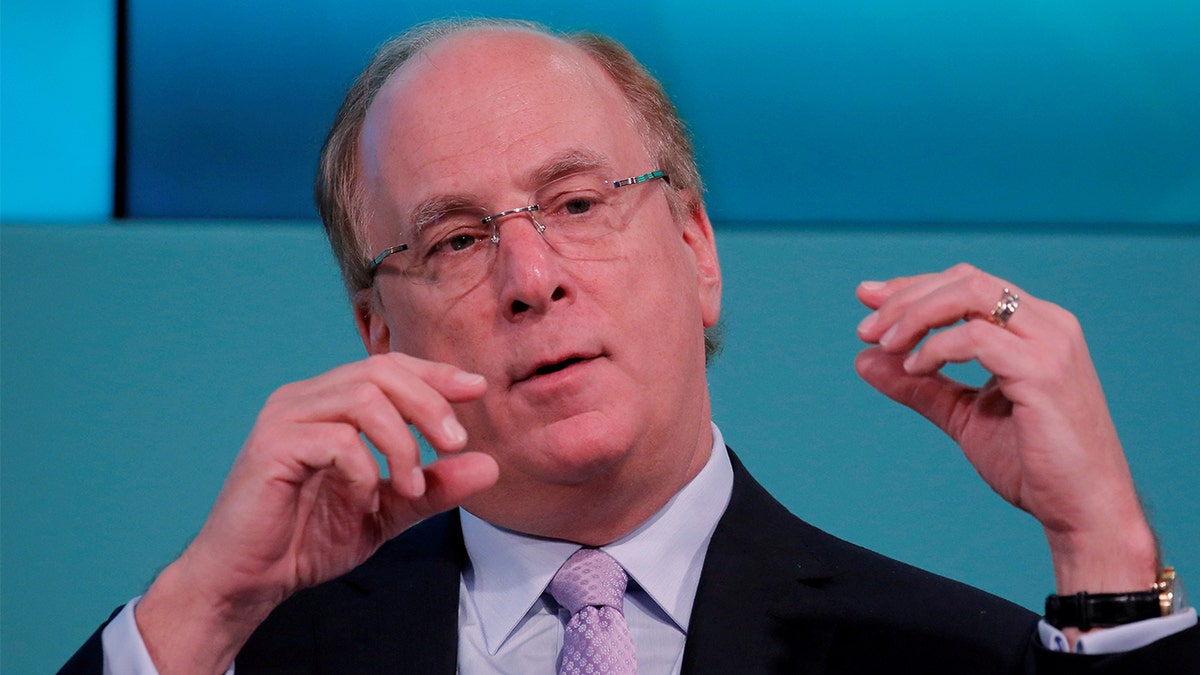

FILE PHOTO: Larry Fink, chief executive officer of BlackRock, takes part in the Yahoo Finance All Markets Summit in New York, Feb. 8, 2017. (REUTERS/Lucas Jackson/File Photo)

Consumers’ Research, a nonprofit consumers watchdog group, recently kicked off a multimillion-dollar campaign that "highlights the ties between BlackRock and the Chinese government," according to its website. The campaign will feature television and billboard ads as well as a digital component.

"BlackRock has nearly 10 trillion in management that's made up of pension funds, 401(k)s, institutional investments like college endowments," Hild told Fox News.

Out of all the $103 trillion of assets managed in the world, BlackRock manages close to 10%. That's more than Apple, Alphabet, Amazon, Saudi Aramco and Microsoft combined.

"BlackRock treats U.S. corporations completely differently than it treats their Chinese companies and the investments that they make over there," Hild said.

Democratic mega-donor George Soros recently wrote a similar message in a Wall Street Journal op-ed.

"Pouring billions of dollars into China now is a tragic mistake," Soros wrote. "It is likely to lose money for BlackRock’s clients and, more important, will damage the national security interests of the U.S. and other democracies."

BlackRock Investment Institute's chief investment strategist, Wei Li, told the Financial Times in August: "China is under-represented in global investors’ portfolios."

FILE PHOTO: The BlackRock logo is seen outside of its offices in New York City, Oct. 17, 2016. (REUTERS/Brendan McDermid/File Photo)

"It should be represented more in portfolios," she said. The institute also recommended increasing allocation to Chinese assets.

"The Chinese market represents a significant opportunity to help meet the long-term goals of investors in China and internationally," BlackRock Chairman Larry Fink wrote in his annual letter.

The BlackRock China Fund, which BlackRock uses to invest in Chinese holdings, is valued at around $1.6 billion.

As recently as the past two years, BlackRock has invested in Chinese companies that the Commerce Department blacklisted over human rights concerns.

BlackRock holds a $15 million stake in Hikvision and a smaller investment in iFlytek, FOX Business previously reported. Both are implicated in China’s persecution of Uyghurs in the Xinjiang region. Hikvision is one of the largest surveillance technology manufacturers in the world, and iFlytek produces vocal recognition software.

A security person watches from a guard tower around a detention facility in Yarkent County in northwestern China's Xinjiang Uyghur Autonomous Region on March 21, 2021. Four years after Beijing's brutal crackdown on largely Muslim minorities native to Xinjiang, Chinese authorities are dialing back the region's high-tech police state and stepping up tourism. But even as a sense of normality returns, fear remains, hidden but pervasive. (AP Photo/Ng Han Guan)

CLICK HERE TO GET THE FOX NEWS APP

"These are companies that were put on a blacklist by the United States government in 2019 … and yet BlackRock sees them as a good investment," Hild told Fox News.

BlackRock did not respond to a request for comment.