Fox News Flash top headlines for August 20

Fox News Flash top headlines for August 20 are here. Check out what's clicking on FoxNews.com

Tech giant Apple said on Tuesday that its foray into the credit card business, Apple Card, is now available to everyone in the U.S.

Apple Pay Vice President Jennifer Bailey said the company is "thrilled" with the initial interest in the card, which had previously been available via invitation only.

“We’re thrilled with the overwhelming interest in Apple Card and its positive reception,” Bailey exclaimed in a press release. “Customers have told us they love Apple Card’s simplicity and how it gives them a better view of their spending.”

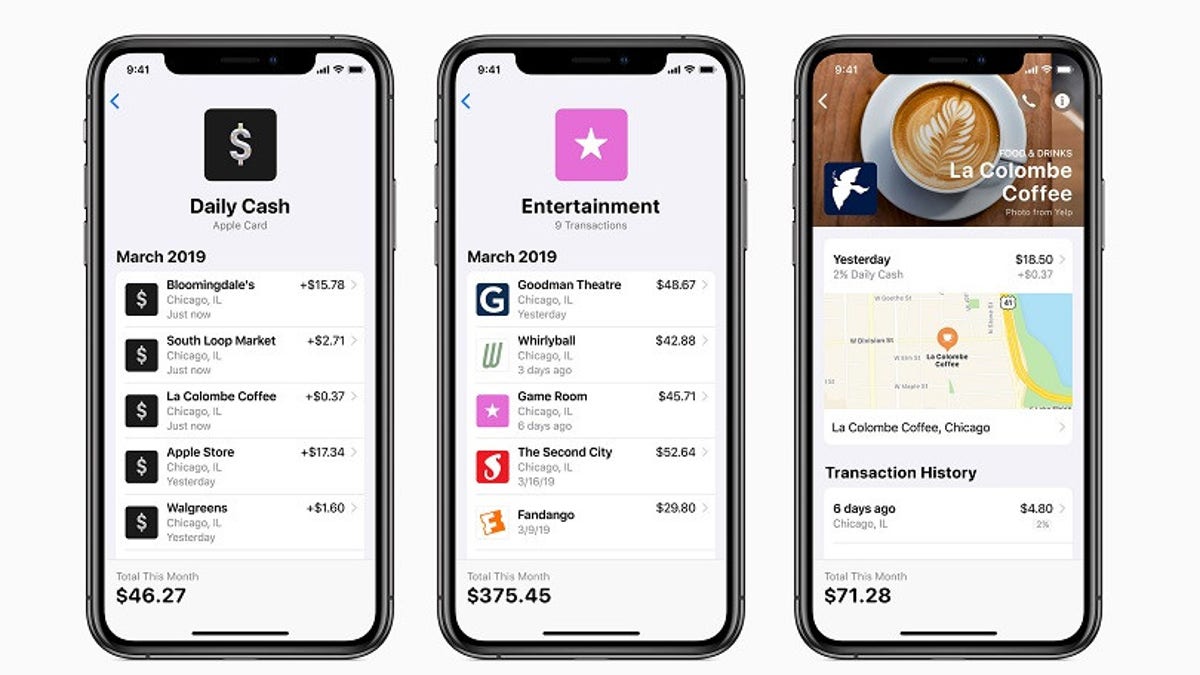

(Credit: Apple)

TRUMP WARNS CHINA AGAINST 'ANOTHER TIANANMEN SQUARE,' SAYS TIM COOK MADE 'COMPELLING' TARIFF CASE

Last month, CEO Tim Cook told analysts on the company's fiscal third-quarter earnings call that the credit card would start rolling out in August.

In addition to the widespread availability of the card, Apple announced a somewhat surprising move that it would extend its 3 percent Daily Cash offer to third-party merchants. It will start with Uber and Uber Eats and add "more popular merchants and apps in the coming months."

To receive the 3 percent, customers have to use Apple Pay for either Uber or Uber Eats. Other Uber services, such as Uber Cash, JUMP and scheduled rides are also part of the cashback program.

Uber CEO Dara Khosrowshahi tweeted that he was "excited" to partner with Apple on the credit card.

Apple had said previously that the 3 percent Daily Cash offer would apply to Apple products, such as iPads or Apple Music, but made no mention of third-party merchants.

First unveiled in March, Apple Card was created by the tech giant and built on ideals the company values, such as privacy, simplicity and transparency, Cook said at the time of the announcement.

As Apple looks to offset a decline in the iPhone portion of its business, some analysts expect the card to give its services business a boost. "We also see accelerating growth within Services, aided by the upcoming launch of the Apple Card in August as well as Apple Arcade and Apple TV+ this fall," CFRA analyst Angelo Zino said in a research note to investors after Apple's quarterly results.

TRUMP LASHES OUT AT APPLE, DENIES REQUEST FOR TARIFF EXEMPTION

At the March event, Bailey said the titanium card would be available immediately in the Wallet app upon release and would offer 2 percent cash back for purchases made through the Wallet app, a feature that would be credited every day. That amount would increase to 3 percent if a person bought something from Apple, but would drop to 1 percent if a user used the physical card.

Bailey added the goal is to make it easier to pay down the balance, adding that it will have lower interest rates and no penalty interest rates. Apple has partnered with Goldman Sachs and Mastercard for its global payment network.

Reiterating the privacy theme, Bailey said Apple does not know what you bought and Goldman Sachs would never share or sell your data for third-party advertising.

Unlike most credit cards, there are no annual, late, international, or over-the-limit fees associated with Apple Card, which aims to have among the lowest rates in the industry. The variable annual percentage rate could be anywhere from 12.99 percent to 23.99 percent, depending upon credit history.