Biden hit for ESG agenda: 'Price goes up,' 'energy becomes less reliable'

Former EPA Chief of Staff Mandy Gunasekara prepares to testify at a House hearing on the president's agenda.

EXCLUSIVE: House Judiciary Chair Jim Jordan, R-Ohio, cheered the news that multiple major U.S. banks and financial institutions are leaving a $68 trillion climate alliance founded at the United Nations.

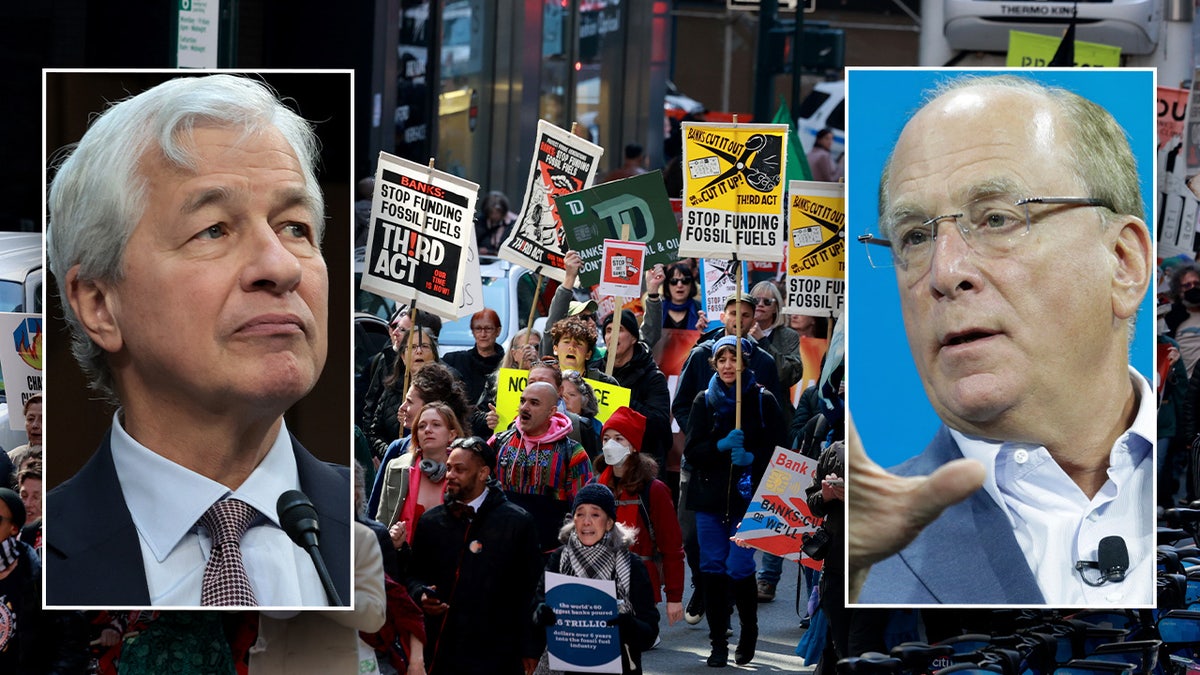

In a series of unexpected announcements on Thursday, JPMorgan Chase, the world's largest bank, and State Street Global Advisors, an institutional investor with $3.5 trillion in assets under management, withdrew from the so-called Climate Action 100+ investor group. At the same time, BlackRock, which has more than $10 trillion in assets under management, dramatically scaled back its involvement in the alliance.

"This is great news because you're supposed to make investment decisions based on just good common business sense, your fiduciary responsibility to your investors, not based on left-wing woke politics," Jordan told Fox News Digital in an interview. "So, yeah, this is a win for America, a win for the economy, a win for Americans and investors and, more importantly, it's a win for freedom."

"The folks who are involved in these banks are smart people, successful people. They've done well. I think deep down they know decisions should be based on the market, on principles of capitalism, not on politics," he added.

Rep. Jim Jordan, R-Ohio, chair of the House Judiciary Committee, has led an investigation into major banks and nonprofit climate groups over their coordination on net-zero ambitions. (Al Drago/Bloomberg via Getty Images)

Under Jordan's leadership, the House Judiciary Committee launched a sprawling investigation into what he dubbed the "climate-obsessed corporate ‘cartel’" in December 2022 as Republicans prepared to take majority control of the chamber. The panel's main objective has been to probe whether the financial sector, aided by nonprofit activist climate groups, are violating U.S. antitrust laws.

As part of the initial effort, Jordan and several fellow House Republicans penned a letter to the Steering Committee for Climate Action 100+, demanding information about the coalition’s network of influence. The letter stated that the alliance "seems to work like a cartel to ‘ensure the world’s largest corporate greenhouse gas emitters take necessary action on climate change.’"

Since then, Jordan's committee has expanded the investigation, firing off inquiries into BlackRock, State Street and Vanguard, in addition to nonprofits Glasgow Financial Alliance for Net Zero and the Net Zero Asset Managers initiative. And late last year he issued subpoenas to BlackRock and State Street, compelling the production of documents related to his investigation into potential antitrust violations.

"I think we've done more subpoenas and more interviews and written more letters than probably most of the rest of Congress combined," Jordan told Fox News Digital.

"We have been pushing for stopping this kind of coordination and collusion that we think is harmful to the economy, to freedom, to investors," the Judiciary Committee chair continued. "So, you know, we're just doing our job, and we're happy to see that three huge banks — the decision they made today, and I think, as I said before, it's a win for the country."

Activists stage a protest outside BlackRock headquarters in New York City on May 25, 2022. (Erik McGregor/LightRocket via Getty Images)

Climate Action 100+ was formally established in December 2017 at the United Nations as a way of aligning the world's largest private sector financiers of greenhouse gas emitters. Since the association was created, it has grown to include more than 700 financial institutions that are collectively responsible for a staggering $68 trillion in assets under management.

The group, which is overseen by a nongovernmental steering committee comprised of ESG activists, calls for members to engage companies on "improving climate change governance," curbing carbon emissions and strengthening climate-related financial disclosure policies. Its actions have largely taken aim at investments that benefit the oil and gas industry while boosting green energy investment strategies.

MEET THE LITTLE-KNOWN GROUP FUNDED BY LEFT-WING DARK MONEY THAT IS SHAPING FEDERAL CLIMATE POLICY

But in June 2023, Climate Action 100+ unveiled its "phase 2" strategy, which calls for member investors to actively engage with companies to reduce their carbon footprint. That program, slated to be implemented in the coming months, sparked concerns from State Street and BlackRock.

"After careful review, State Street Global Advisors has concluded the enhanced Climate Action 100+ Phase 2 requirements for signatories will not be consistent with our independent approach to proxy voting and portfolio company engagement," State Street Global Advisors said in a statement to Fox News Digital. "As a result, we have decided to withdraw from Climate Action 100+."

JPMorgan Chase CEO Jamie Dimon, left, and BlackRock CEO Larry Fink (Getty Images)

BlackRock similarly said in a note Thursday that the "phase 2" strategy caused it to withdraw its U.S. business from Climate Action 100+ in recent weeks, instead shifting involvement in the alliance to its smaller international entity where a majority of clients are pursuing decarbonization goals.

"This new strategy will require signatories to make an overarching commitment to use client assets to pursue emissions reductions in investee companies through stewardship engagement," the firm stated. "In our judgment, making this new commitment across our assets under management would raise legal considerations, particularly in the U.S."

"The majority of the firm’s clients who are seeking investment solutions that help them meet their climate, transition and decarbonization commitments are clients of our international businesses," it added. "To align with these clients and funds, we have transferred our membership in CA100+ to BlackRock International. BlackRock Inc. is no longer a member of CA100+."

UNITED NATIONS FOUNDATION IS QUIETLY FUELING CLIMATE POLICY, FUNDING STAFF IN DEM STATES

And JPMorgan Chase separately explained that it quit the global investor group because of the expansion of its own in-house sustainability team and the establishment of its climate-risk framework in recent years.

The most recent United Nations climate summit took place in Dubai, United Arab Emirates, in late November and early December last year. The conference included various agreements from financial institutions to curb investments in the fossil fuel sector. (Jakub Porzycki/NurPhoto via Getty Images)

Climate Action 100+, in addition to other global climate alliances and investor networks, has also drawn the ire of Republican states, which have argued that their activities may infringe on government policymaking. They have also warned that such associations are harming domestic energy companies that employ thousands of Americans and ensure low consumer prices.

As a result, state attorneys general, financial officers and agriculture commissioners have banded together in recent months to threaten legal action related to nonprofit climate alliances and banks' involvement in such groups.

CLICK HERE TO GET THE FOX NEWS APP

"More than 700 investors are committed to managing climate risk and preserving shareholder value through their participation in the initiative," a spokesperson for Climate Action 100+ told Fox News Digital on Thursday. "Since its inception, Climate Action 100+ has experienced remarkable growth — and that has only continued."

The spokesperson declined to comment on specific members leaving the alliance.