Entrepreneur Grant Cardone shares take on regulatory environment for businesses under Biden

Entrepreneur Grant Cardone speaks to Fox News Digital about the Biden administration's aggressive anti-big business agenda.

The Biden administration's aggressive regulatory stance towards big businesses has stymied growth, a cohort of entrepreneurs, venture capitalists and other business sector experts expressed to Fox News Digital.

Earlier this week, Albertsons abandoned its $25 million merger with fellow grocery store chain Kroger, after the Federal Trade Commission (FTC), led by President Biden appointee Lena Khan, sought to challenge the buyout, arguing it would stifle competition and raise prices. The challenge and the merger's eventual failure is the latest example of the Biden administration's offensive against big business.

"We have literally had offers from strategic buyers to buy us, and we go to our counsel and the counsel says, 'Don't even try. The FTC will absolutely flag this thing, and you will spend tens of millions of dollars and be stuck in a bureaucratic hell answering questions in court for a year," said venture capitalist Ravin Gandhi, a former CEO who has been involved in multiple merger and acquisition deals and maintains a stake in a number of startups.

"Lena Khan was explicit in talking about even mid-market M&A as a vehicle for monopoly. And anyone who has built a business and sold it, like I have, knows that's ridiculous."

The headquarters of the Federal Trade Commission in Washington, D.C., is seen on Nov. 18.

The chilling effect described by Gandhi has been echoed by other analysts, who say that the Biden administration's rhetoric and policies have required businesses to take matters into their own hands by abandoning or restructuring their transactions in the face of FTC and Department of Justice antitrust concerns. An analysis by international law firm Morgan Lewis found that under Biden, the vast majority — nearly three-quarters — of all transactions in which the government sought more details from companies about a proposed merger were subject to enforcement action.

"America wants a different choice," said Cardone Capital CEO Grant Cardone. "This idea that Joe Biden is going to make the world more competitive is a red herring."

Cardone, too, expressed frustration over regulatory battles with the Biden administration, noting that they have made it "almost impossible for people to do business."

Cardone Capital CEO Grant Cardone attends Gateway Celebrity Fight Night 2024 in Scottsdale, Arizona, on April 27.

Several other business leaders, venture capitalists and people with detailed knowledge of mergers and acquisitions echoed the concerns shared by Gandhi and Cardone that business growth has been stymied.

"The FTC’s aggressive antitrust enforcement under the Biden administration has significantly dampened M&A activity, particularly in the tech sector," said Kison Patel, a financial tech entrepreneur and the host of "M&A Science," a podcast about mergers and acquisitions. "For example, one Fortune 10 tech company has scaled back its deal making from 30 to fewer than five transactions."

CONSTRUCTION TRADE GROUP LEADERS LOOK FORWARD TO NEW LEADERSHIP UNDER TRUMP: ‘RELIEF ON THE HORIZON’

Armen Martin, a veteran merger and acquisitions attorney, added that in talking to venture capitalists, he had heard optimism about FTC Commissioner Khan's exit. She will be replaced by President-elect Trump's nominee for FTC Commissioner, Andrew Ferguson.

"I think you will see a lot more M&A activity under the Trump administration as companies feel more confident that the government won't get involved," Martin said.

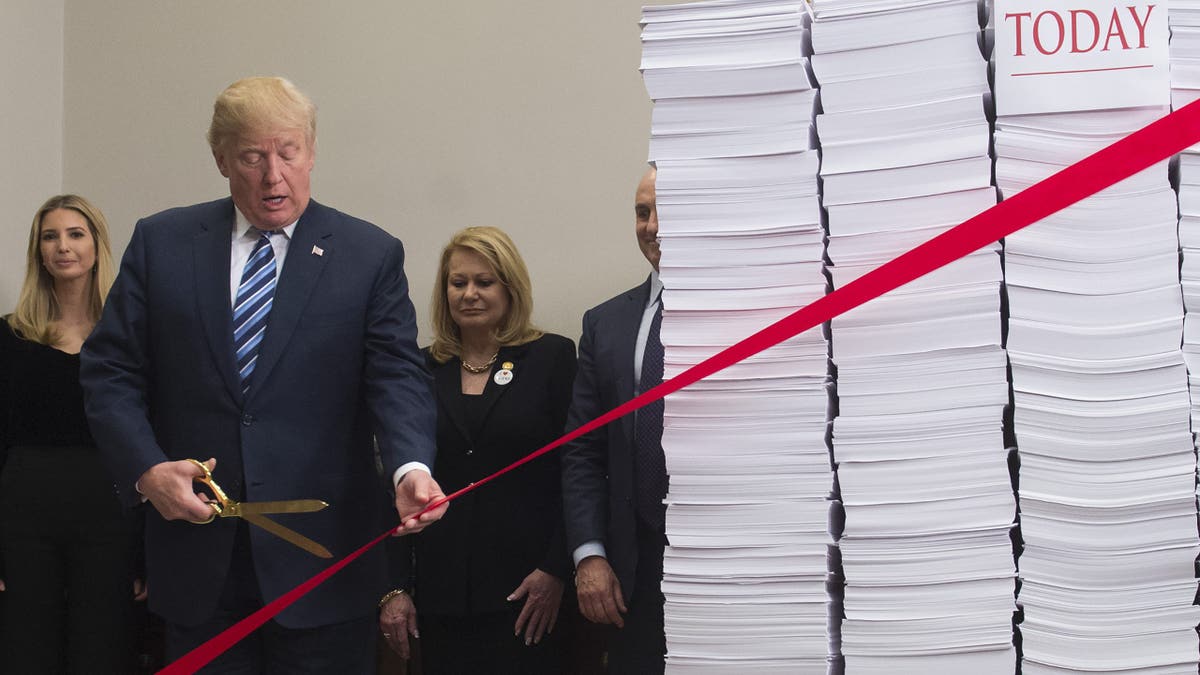

President Trump holds gold scissors as he cuts red tape tied between two stacks of papers representing the government regulations of the 1960s and the regulations of today in the Roosevelt Room of the White House in Washington, D.C., on Dec. 14, 2017.

CLICK HERE TO GET THE FOX NEWS APP

Meanwhile, in a statement to Fox News Digital, FTC spokesperson Douglas Farrar said that the recently blocked grocery store merger "makes it clear that strong, reality-based antitrust enforcement delivers real results for consumers, workers, and small businesses."

"Today's win protects competition in the grocery market, which will prevent prices from rising even more," he added.