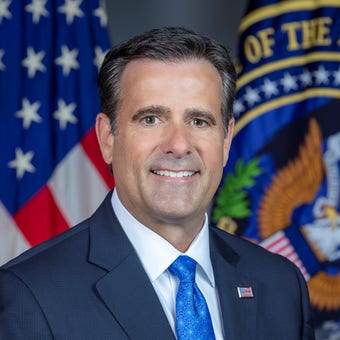

Ratcliffe: China proving to be 'ruthless autocracy' we thought

Former Director of National Intelligence discusses Joe Biden's vague China strategy on 'The Story'

We have achieved a rare moment of political consensus in Washington, D.C. that China and its ruling Chinese Communist Party (CCP) pose the greatest threat to U.S. national security.

However, Silicon Valley and Wall Street have continued fueling the rise of the CCP with massive investments and commitments to bolster China’s economy, while eschewing their patriotic duty to take similar steps here at home.

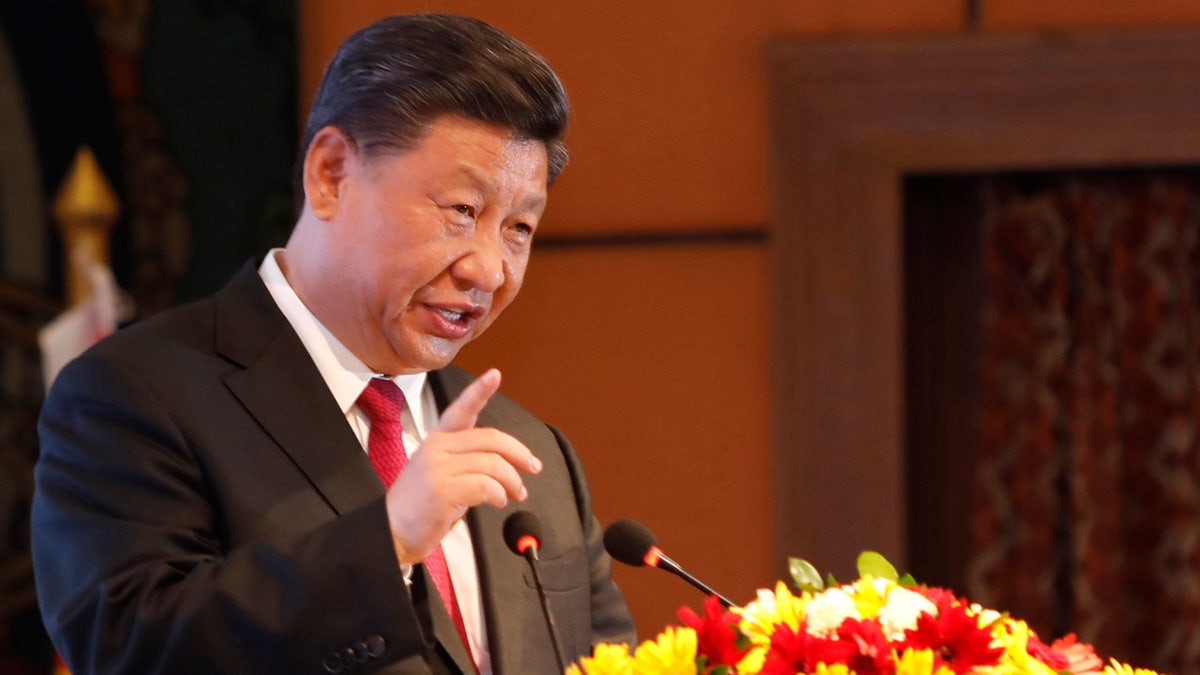

Chinese President Xi Jinping said over the weekend that any attempts to divide China will end in "crushed bodies and shattered bones." (Bikash Dware/The Rising Nepal via AP)

In the absence of moral courage from America’s financial elite, we need a regulatory framework to protect our nation and its people from China’s ambitions to subjugate the world to its authoritarian model, and from the rise of American oligarchs who view themselves as citizens of the world, rather than citizens of the country that made their success possible.

In recent days, journalists uncovered that Apple CEO Tim Cook secretly struck a $275 billion deal with Chinese authorities "promising Apple would do its part to develop China’s economy and technological prowess through investments, business deals and worker training."

The socially conscious Mr. Cook once opined that "human rights is about...treating people with dignity and respect" and declared that Apple is "about changing the world" and "you don’t do that by staying quiet on things that matter." But Mr. Cook and Apple have been conspicuously silent about the CCP’s mass surveillance state and the ongoing genocide of Uyghurs in Xinjiang.

Apple's CEO Tim Cook speaks during a news conference Wednesday, Oct. 13, 2021, in Salt Lake City. Cook and NBA All-Star Dwyane Wade joined Utah leaders to announce the completion of a local advocacy group's campaign to build eight new homes for LGBTQ youth in the U.S. West. ((AP Photo/Rick Bowmer))

In another example of the moral depravity of some American business tycoons, billionaire Ray Dalio dismissed a question about Beijing’s human-rights abuses by asking if he should also look at America’s "own human-rights issues." He continued this absurd line of moral relativism by shrugging off China’s policy of "disappearing people" who disagree with the regime, saying, "that is their approach, we have our approach."

These two darlings of the American business world are emblematic of a broader sentiment in Silicon Valley and on Wall Street. They believe that doing business with the CCP simply means more opportunities for growth, or as Mr. Cook naively put it, "world peace through world trade."

Ray Dalio, Bridgewater's Co-Chairman and Co-Chief Investment Officer speaks during the Skybridge Capital SALT New York 2021 conference in New York City, U.S., September 15, 2021. REUTERS/Brendan McDermid

However, while it is unreasonable to expect financiers and business leaders to play the role of morality police across the planet, China is a unique and undeniable case. The intelligence we consumed daily in our roles in the U.S. government made it clear that the CCP is the only regime with both the intent and resources to destroy the American model of free people and fair trade that has proliferated around the world in recent decades, lifting billions of people out of poverty along the way.

The U.S.-China conflict is at its core an ideological struggle. In 2013, shortly after Xi Jinping assumed his perch as Chinese dictator, CCP leadership was warned in a secret document of the "perils" that the Party faces, including "constitutional democracy," "universal values," "civil society" and "the West's idea of journalism." The Cold War was also an ideological struggle, but the U.S. and global economies were not so intertwined with the U.S.S.R. as they are with China. U.S. financial interests also were not funding the rise of our nemesis; it would have been unconscionable. But that is exactly what is happening with China, and not only among the business elite.

Millions of Americans -- often unknowingly -- remain invested in index funds with Chinese holdings. And since there is no such thing as a truly private company in China, these investments are funding the CCP’s human rights abuses at home and its economic, diplomatic and military ambitions abroad. Even the Thrift Savings Plan, which houses the retirement investments of members of the U.S. armed services, had to be shamed into rolling back a plan to invest in an index fund that included Chinese government-owned entities like Aviation Industry Corporation, the sole supplier of Chinese military aircraft.

To put a finer point on it, if the big money managers had gotten their way, American military personnel would have been unwittingly helping to finance the building of planes that could one day be used to attack them or U.S. interests.

A Chinese J-31 stealth fighter performs at the Airshow China 2014 in Zhuhai, south China's Guangdong province on November 11, 2014 - file photo. ( JOHANNES EISELE/AFP via Getty Images)

The flow of American capital into China’s economy is becoming a serious national security issue for the United States, right alongside the CCP’s mass theft of American intellectual property and technology. And as the Wall Street Journal editorial board recently warned, if U.S. business titans continue conveying "contempt for America’s system of government, then voters will curtail their prerogatives through the political process."

Elected leaders should consider what policy tools are at their disposal to prevent wealthy and powerful American financiers and corporations from trading away our way of life in exchange for access to slave labor and a billion new consumers.

CLICK HERE TO GET THE OPINION NEWSLETTER

For example, The Committee on Foreign Investment in the United States (CFIUS) exists to review certain foreign investments in the U.S. to determine the effect they might have on our national security. We do not, however, have a similar framework for U.S. investments flowing out to China, but it is worth strong consideration.

CLICK HERE TO GET THE FOX NEWS APP

There are many differences between the Cold War of the 1980s and the current U.S.-China dynamic. But one thing we could undoubtedly use from that era is the clarity that President Ronald Reagan provided when he declared, "Here's my strategy… We win, they lose."

We need that kind of forthrightness from our political leaders, but we also need it from our financial powerhouses. Because our response to China cannot just be whole-of-government. Paradoxically, in this one instance our approach must be more like China’s approach to the United States: it must be whole-of-society.

Cliff Sims served as U.S. Deputy Director of National Intelligence for Strategy and Communications.