Sanders, Graham debate Social Security solvency: 'You can't just tax people into oblivion'

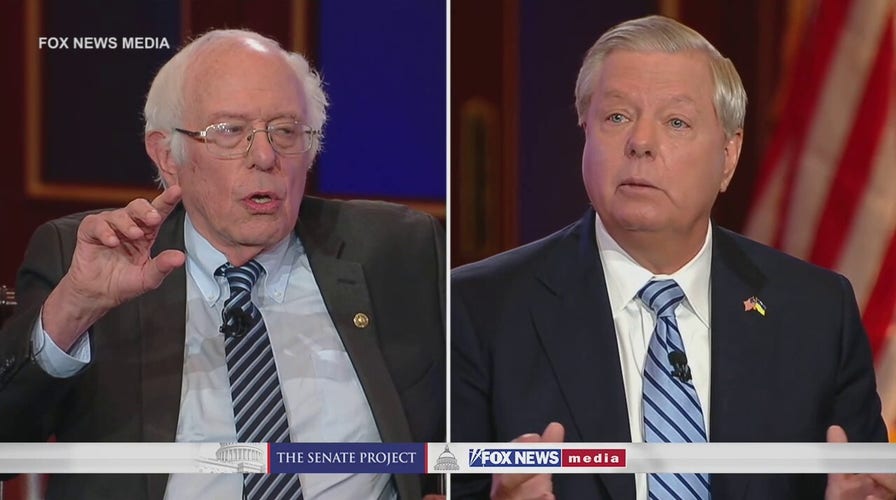

Sen. Bernie Sanders and Sen. Lindsey Graham talk entitlement spending on Fox Nation's live debate series 'The Senate Project.'

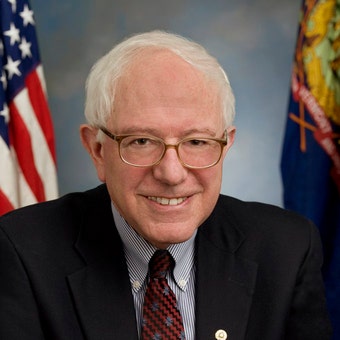

I was delighted to debate South Carolina Republican Sen. Lindsey Graham two weeks ago on some of the most urgent crises facing our country. The debate was sponsored by the Bipartisan Policy Center and the Orrin G. Hatch Foundation, held at the Edward M. Kennedy Institute for the United States Senate in Boston and broadcast on Fox News.

Sen. Graham and I, with moderator Bret Baier, covered a lot of territory, but one of the most important issues we discussed was the future of Social Security – one of the most popular and successful government programs in American history.

Today, while many people take Social Security for granted, let us remember. Before Social Security was created in 1935 by President Franklin Delano Roosevelt, about half of our seniors were living in poverty. Today, though still too high ,the senior poverty rate is just 8.9%.

SANDERS, GRAHAM SIT FOR OXFORD-STYLE DEBATE ON OIL CRISIS, TAXES, SOCIALISM, GUN CONTROL AND TRUMP

Sen. Graham was very honest about his approach to Social Security and the direction in which Republicans should go. His view is that we should raise the retirement age and adopt a plan similar to what Alan Simpson (a former Republican senator from Wyoming) and Erskine Bowles (a former Democratic Wall Street investment banker) proposed nearly a decade ago.

Senate Minority Leader Mitch McConnell, R-Ky., holds a similar view. In 2020, he told Bloomberg reporter Steven Dennis that he "hopes to work with the next Democratic President to trim Social Security, Medicare and Medicaid."

Let’s be clear about the Simpson-Bowles plan, which I strongly opposed. If it had been adopted by Congress in 2013, the retirement age would have been increased to 69, cutting Social Security benefits by 13%.

Average Social Security benefits for middle-class Americans with average lifetime earnings of just $69,000 a year would have been cut by up to 35%. Further, cost of living adjustments (COLAs) for seniors who turned 85 years of age would have been cut by $1,000 a year by adopting a less generous formula. Meanwhile, multimillionaires, billionaires and large, profitable corporations would have seen their income tax rates go down.

I don’t often quote Donald Trump, but when he was campaigning in 2015 he was absolutely correct when he said: "Every Republican wants to do a big number on Social Security, they want to do it on Medicare, they want to do it on Medicaid."

FILE - Social security cards (AP)

Needless to say, I have a much different perspective than Sen. Graham and my Republican colleagues. At a time when half of older Americans have no retirement savings and are worried about their ability to retire with dignity and millions of seniors are living in poverty, I believe that our job is not to cut Social Security. Our job must be to expand Social Security so that every senior citizen in America can retire with the respect they deserve and every person with a disability can live with the security they need.

According to the most recent data, 12% of seniors are trying to live on an income of less than $10,000 a year while 55% are trying to survive on less than $25,000 a year.

NEARLY HALF OF AMERICANS DON'T EXPECT SOCIAL SECURITY TO BE THERE WHEN THEY NEED IT

Think about that. How do you pay the rent, put food on the table and pay for the basic necessities of life on just $10,000 or $25,000 a year? The answer is many cannot. In the richest country in the world that is a national disgrace.

FILE – People line up outside of the Social Security Administration office February 2, 2005 in San Francisco, California.

You might be asking: How can we expand Social Security benefits when the corporate media and a number of politicians keep telling us that "Social Security is going broke"? Simple. What they are saying is not true.

Social Security is not going broke. Social Security has a $2.85 trillion surplus and can pay out every benefit owed to every eligible American for the next 13 years. After that, if no changes are made, Social Security can still pay out 80% of promised benefits. But, obviously, that’s not good enough.

That’s why I introduced the Social Security Expansion Act with seven of my colleagues in the Senate and 22 in the House.

According to the Social Security Administration, our legislation would make Social Security solvent for the next 75 years, expand benefits for seniors and people with disabilities by $2,400 a year, and increase COLAs, which would lift millions of seniors out of poverty.

FILE: Social security card (AP)

How do we do that? At a time of massive income and wealth inequality, when billionaires pay an effective tax rate lower than the average worker, this legislation demands that the wealthiest people start paying their fair share of taxes.

CLICK HERE TO GET THE OPINION NEWSLETTER

Today, absurdly and unfairly, there is a cap on income subject to Social Security taxes which is just $147,000 a year. That means that if you’re a multi-billionaire you pay the same amount into Social Security as someone making $147,000 a year.

It means if you make $147,000 a year or less you pay 6.2% of your income in Social Security taxes. But if you make 10 times more – $1,470,000 – you pay just 0.62% of your income in Social Security taxes. That may make sense to someone. It doesn’t make sense to me.

Our legislation applies the Social Security payroll tax to all income – including capital gains and dividends – for those who make over $250,000 a year, the wealthiest 6.4% of Americans. Under this bill, 93.6% of households would not see their taxes go up by one penny.

Let me, once again, thank the Kennedy Institute and Fox News for giving Sen. Graham and me the opportunity to make our views known to the public.

CLICK HERE TO GET THE FOX NEWS APP

As any viewer of that debate will attest, we hold very different perspectives on a number of issues. Perhaps, most importantly, are our contrasting views on Social Security.

In my view, it would be extremely cruel to cut Social Security benefits for seniors and people with disabilities. In fact, we can and must expand them. Sen. Graham disagrees.