Kudos to the Democrats for finally noticing that the people want the president and Congress to focus on job creation. Yes folks, Obama is talking jobs again. At a recent town hall event, he announced, "I'm calling on Congress to pass a jobs bill to put more Americans to work — building off our Recovery Act — put more Americans back to work rebuilding roads and railways; provide tax breaks to small businesses for hiring people; offer families incentives to make their homes more energy efficient, saving them money while creating jobs."

But before we congratulate the Democrats too much for listening to the people, we need to ask will this new job stimulus be any better for the economy than the old job stimulus? Let’s see whether the government’s stimulus is actually creating good private sector jobs as was promised – or whether the next job stimulus plan will do any better.

Last winter, as the economy continued to slide into the worst recession since the Depression, Democrats pushed hard for a massive “stimulus package” that would supposedly reduce unemployment and get the economy back on track. To put it mildly, it hasn’t worked out that way.

The audacity of spending in a $787 billion package was breathtaking. This final package, the “American Reinvestment and Recovery Act,” was signed into law on February 17, 2009. The Democrats promised the bill would “save or create at least 3.5 million jobs,” yet these promises remain unfulfilled. Even the federal government has had a hard time counting jobs that were created and saved by the stimulus. But that fact is that whatever the stimulus’ effect, America has actually lost over 2.4 million jobs since the stimulus became law – and unemployment has skyrocketed from 7.6% to over 10.0%. If you add in discouraged workers who have stopped looking for work altogether and the “underemployed,” the real figure is 17%.

One reason for soaring unemployment is that the February 2009 stimulus actually created incentives for people to remain unemployed longer—and they did. The average length of time that people have spent unemployed during this recession has increased dramatically from 16.5 weeks to over 29 weeks. This is in part because the stimulus bill encouraged states to extend the number of weeks that unemployment benefits are paid. And while extending benefits seems humanitarian, it has a terrible effect on unemployment. The data shows that people take available jobs right before their unemployment benefits are about to run out—not before. The extension of unemployment benefits resulting from the February 2009 stimulus bill actually added two more points to the unemployment rate.

The main reason the February 2009 stimulus failed to help our economy is that it did not address the major cause of growing unemployment—low job creation in the private sector. Entrepreneurs who don’t receive government contracts are not going to expand their workforce in this economy. Stimulus items in the February 2009 package such as increasing federal funding for the arts and Pell Grants for college students--whatever their other merits--do not lead to much job creation or retention. And the sharp increase in federal spending from the stimulus also crowded out spending by the private sector that could have generated new jobs. This will get worse later when the real costs of the stimulus hit us--when the bills for all this spending come due to us, the taxpayers. It’s been estimated that every $1 of stimulus spending will lead to a future fall in GDP of $1.23.

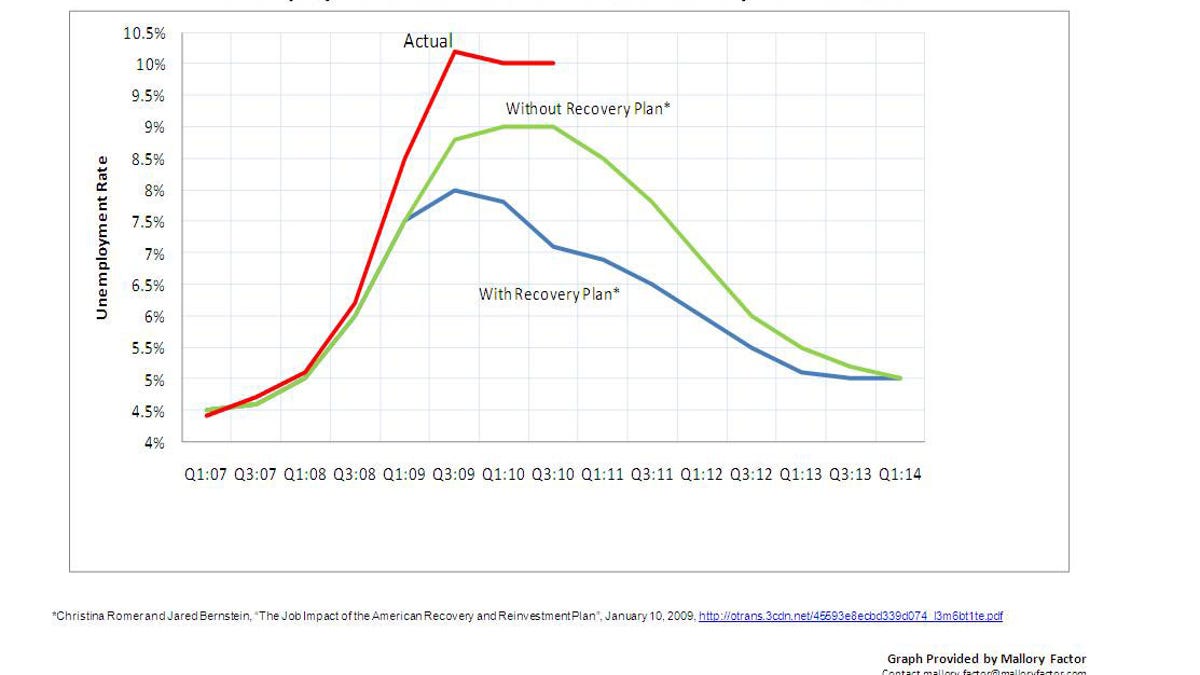

At the top of this piece, I've included an interesting chart that dramatically shows the effect of the February stimulus on unemployment—with figures provided by the president’s own economic team before the stimulus was passed. How wrong they were. The chart shows three lines – the lowest showing the projected lower unemployment that was supposed to result from the stimulus, the middle line showing the projected unemployment disaster scenario if no stimulus were passed, and the highest line showing the real unemployment disaster scenario that did result even with the expensive stimulus. The president’s advisers projected that the unemployment rate would peak at just under 8% in the third quarter of 2009 and decline to 7% by the end of this year if stimulus were passed. Instead, unemployment rose dramatically -- to over 10.0% -- and may still be rising.

This administration has been wrong about many things, but the effect of the stimulus bill has to be at the top of the list. Two of the president’s top economic advisers predicted that unemployment would fall, but it has risen. And they can’t blame President Bush – because these were their own projections. And President Obama is going about proposing his new stimulus plan in exactly the same way—spending, spending, spending.

No offense to the people who have new, stimulus bill-generated jobs in government – but the simple fact is that the economy as a whole is worse off because of the stimulus package, and more Americans are unemployed. In the end, the stimulus package turned out to be far worse for our country than if the White House had simply done nothing. Despite unprecedented sums of stimulus spending, the job market is “bleaker than ever,”, as The New York Times recently reported. “Jobseekers now outnumber openings by 6 to 1, the worst ratio since the government began tracking open positions in 2000.” For those that are employed, wages and salaries have fallen at a 5% rate in nominal terms, the worst hit since the Great Depression. Firms are cutting back, and workers have to make do with less.

What would a real stimulus package have looked like? It would have cut corporate tax rates, which are shockingly high by international standards. It would have included a payroll tax holiday to sharply reduce the cost of hiring a new worker. It would not have interfered with state unemployment insurance benefit schedules. Perhaps most of all, it would have avoided hundreds of billions of dollars in new government spending – which is really new government debt – that we cannot afford.

Instead, the Democrats pushed us down the path of higher spending, higher unemployment, lower wages, and, ultimately, a slower recovery. And now they are expecting to do so again with a new similar stimulus plan. Maybe the solution is to increase unemployment again – among members of Congress who plan to vote for the new stimulus bill.

Mallory Factor is the co-chairman and co-founder of the Monday Meeting, an influential meeting of economic conservatives, journalists and corporate leaders in New York City. Mr. Factor is a well-known merchant banker and speaks and writes frequently on economic and fiscal topics for news stations, leading newspapers and other print and online publications. Mr. Factor writes frequently for the Fox Forum and is seen regularly on Fox News Channel. Mr. Factor can be reached at mallory.factor@malloryfactor.com.