Mike Pence slams Biden’s policies for economic turmoil: All roads lead back to Biden

Former Vice President Mike Pence discusses economic issues facing the Biden administration including the banking crisis and the debt ceiling debate and weighs in on the 2024 race.

After First Republic Bank was seized and sold to JPMorgan Chase on Monday, new concerns are mounting over the state of the U.S. economy. Former Vice President Mike Pence slammed the Biden administration's economic policies on "The Brian Kilmeade Show," arguing that rampant spending and bailouts have created the economic conditions for bank failures and a looming recession.

FDIC ACCEPTS JPMORGAN CHASE'S BID TO BUY FIRST REPUBLIC BANK

MIKE PENCE: [First Republic's collapse is the] second biggest ever in history. Third bank failure in as many months. It is a testament to the failed economic policies of the Biden administration. And it's why we need change in America in 18 months. You can't borrow and spend and bail your way back to a growing economy. But from the outset of this administration, that's exactly what they've been trying to do. They've thrown tax increases on top of that. But, look, this latest bank rescue is just one more bank bailout... I was in Congress during the Wall Street bailout. I helped lead the charge against it. Bailouts are not the answer in a free market economy. We've got to let the market ebb and flow and hold people accountable. But more than anything else, I see it all as an indictment of the economic policies of this administration.

…

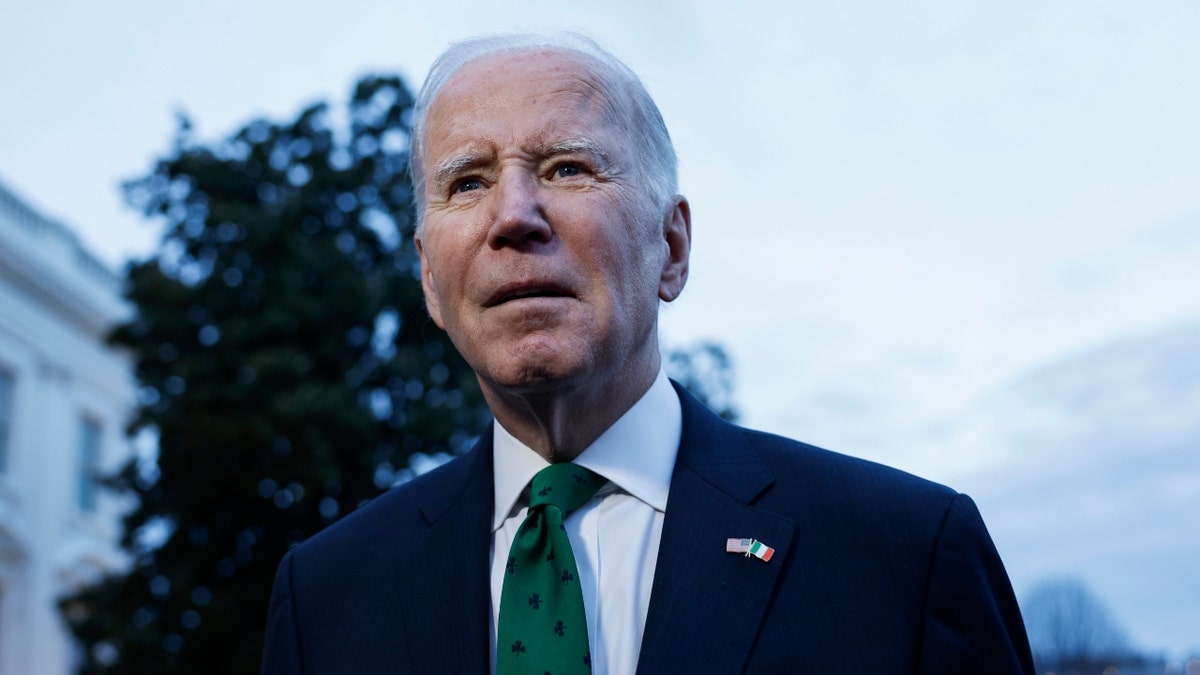

President Joe Biden, 80, announced he would seek re-election. ((Photo by Anna Moneymaker/Getty Images))

Everybody I've talked to had said that because of the highest inflation in 40 years, that we're likely headed to a recession. I was out in Utah the other day, I was talking to some people very involved in real estate out there. They said real estate out that way is already in a recession, has been for several months. But look, come on, let's recognize the fact that, look, the inflation took off like a jackrabbit when Joe Biden took office and the Democrats in the House and Senate passed, on a party-line vote, $1.9 trillion in completely unnecessary spending. That's what lit the pilot light on this inflation. And the economy was getting back on its feet in the wake of COVID. It really was. And then this administration comes in, does what Democrats always do, and that is spend money we don't have and that we don't need to spend... all roads lead back to the Biden administration.

First Republic had struggled since the collapse of Silicon Valley Bank and Signature Bank in early March, and it was widely seen as the bank most likely to collapse next.

The bank used to be the envy of most of the industry and its clients mostly included the rich and powerful, who rarely defaulted on their loans. Many of the bank’s deposits, however, were uninsured as they were above the $250,000 limit set by the FDIC. If First Republic were to fail, its depositors might not get all their money back, worrying analysts and investors alike.

These fears materialized in April when the bank’s recent quarterly results showed that depositors pulled more than $100 billion out of the bank as the banking crisis was affecting Silicon Valley Bank and New York’s Signature Bank.

The Federal Deposit Insurance Corporation's (FDIC) accepted JPMorgan Chase's bid to buy troubled First Republic Bank Monday.

FOX Business' Breck Dumas contributed to this report.