Douglas Murray on SVB collapse: Banking industry dominated by diversity not expertise

Fox News contributor Douglas Murray blasts woke agendas in the banking system in the fallout of the Silicon Valley Bank collapse.

Since Silicon Valley Bank collapsed, critics have called out the bank's "woke" priorities, and left-wing political agendas, questioning the banking and investing experience of the company's leaders.

"Like everything else in our age, the obsession is not to do with expertise. It is to do with this madness of the so-called D.E.I. project," Fox News contributor Douglas Murray said on "Fox & Friends" Wednesday. "And if we don't learn from this, if banking sectors and others don't learn from this, I don't know when we will."

The New York Post reported Tuesday that among the 12 members of SVB’s board of directors was a Hillary Clinton mega-donor who went to a Shinto shrine to pray after Donald Trump won the White House, a former President Barack Obama political appointee, and a prolific contributor to Democrats who owns a Napa Valley vineyard 15 minutes from the home of former House Speaker Nancy Pelosi, D-Calif.

The board members donated to Obama, Clinton, President Joe Biden, local Democrat congressional reps such as Pelosi, as well as political action committees for Senate Majority Leader Chuck Schumer, D-N.Y., and Sen. Mark Warner, D-Va., a longtime member of the powerful Senate Banking Committee, according to the Post.

FORMER DEMS INCLUDING CLINTON DONOR, OBAMA OFFICIAL DOMINATED SVB'S BOARD OF DIRECTORS

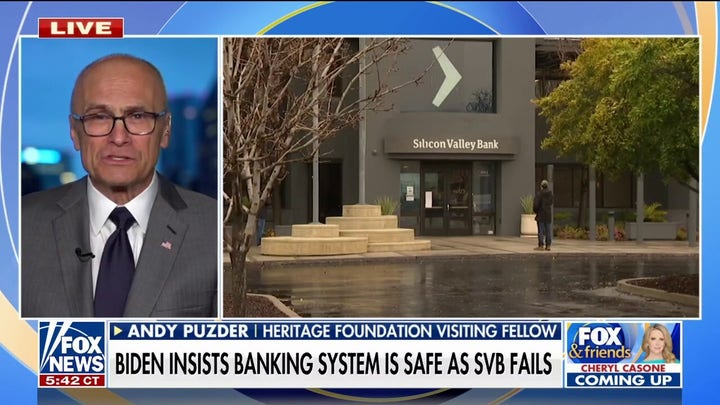

A customer stands outside of a shuttered Silicon Valley Bank (SVB) headquarters on March 10, 2023 in Santa Clara, California. Silicon Valley Bank was shut down on Friday morning by California regulators and was put in control of the U.S. Federal Deposit Insurance Corporation. (Justin Sullivan/Getty Images)

The report alleges that most of the SVB board lacked actual banking expertise, except for Tom King, a factor that's likely to be part of the Justice Department's probe into the bank's collapse.

"Everyone knew it was the go-to bank for woke CEOs," one source told the New York Post. "They knew they were aligned politically. The companies SVB loaned money to all had a woke agenda.

"It's an unbelievable mess and in many ways completely predictable," Murray said.

SVB COLLAPSE ONLY ‘THE TIP OF THE ICEBERG’ UNDER BIDEN SPENDING POLICIES, ECONOMIST WARNS

"If you look at the criteria that SVP had out there for not just who they wanted to employ, but who they were going to loan to, they consistently emphasized not whether the bank was going to get its money back in this mad financial arrangement that it had, but whether or not it was lending to enough minority businesses and enough female-run businesses and so on," Murray explained.

SVB reportedly gave roughly $73 million to Black Lives Matter and other related organizations.

"There was a lot of fashionable, rich girl politics underway at Silicon Valley Bank, but banking not so much," Tucker Carlson said Tuesday, noting how the company's risk manager spent months on LGBTQ campaigns for the company.

Jay Ersapah (LinkedIn/Silicon Valley Bank)

Carlson further unpacked woke agendas dominating the banking industry including in companies like Signature and J.P. Morgan.

Signature Bank also failed this week after Silicon Valley Bank was shut down by regulators and the Federal Deposit Insurance Corporation (FDIC) stepped in to take over the bank's operations.

"Why did Signature Bank fail?" Carlson asked. "We could give you the technical math-based answer, but here's the real reason Signature Bank failed: because it was corrupt."

Carlson argued that actions taken by the bank sparked scrutiny over their commitment to actual banking.

"How does it work If you run a bank like this and people just talk about themselves and their identities as if those are interesting topics?" he said.

CLICK HERE TO GET THE FOX NEWS APP

Murray warned that the banking industry and other sectors of the economy should heed the SVB and Signature Bank collapse.

"When will we stop playing this mad obsessive diversity inclusion equity game? When will we stop playing it? Because at some point, the bridges fall down" Murray cautioned.

"At some point, if you don't focus on expertise and instead just endlessly focus on identity, the bridges start to come down. Turns out the first thing to come down is the banks."

Fox News' Brianna Herlihy contributed to this report.