Blackrock and Vanguard are forcing ESG and DEI initiatives on corporate America: Anson Frericks

Former Anheuser-Busch executive Anson Frericks weighs in on why companies like Target and Bud Light are alienating their customers in the name of diversity, equity and inclusion on ‘Jesse Watters Primetime.’

BlackRock CEO Larry Fink is reportedly "ashamed" by the environment, social and governance (ESG) investment criteria debate and argued the term was being "misused by the far left and far right."

"I'm ashamed of being part of this conversation," Fink said, according to Axios.

Fink admitted during a conversation with the outlet at the Aspen Ideas Festival on Sunday that Florida Gov. Ron DeSantis' decision to pull $2 billion in assets from Blackrock in 2022 hurt his firm.

"When I write these [investment] letters, it was never meant to be a political statement. … They were written to identify longterm issues to our longterm investors," he said on Sunday.

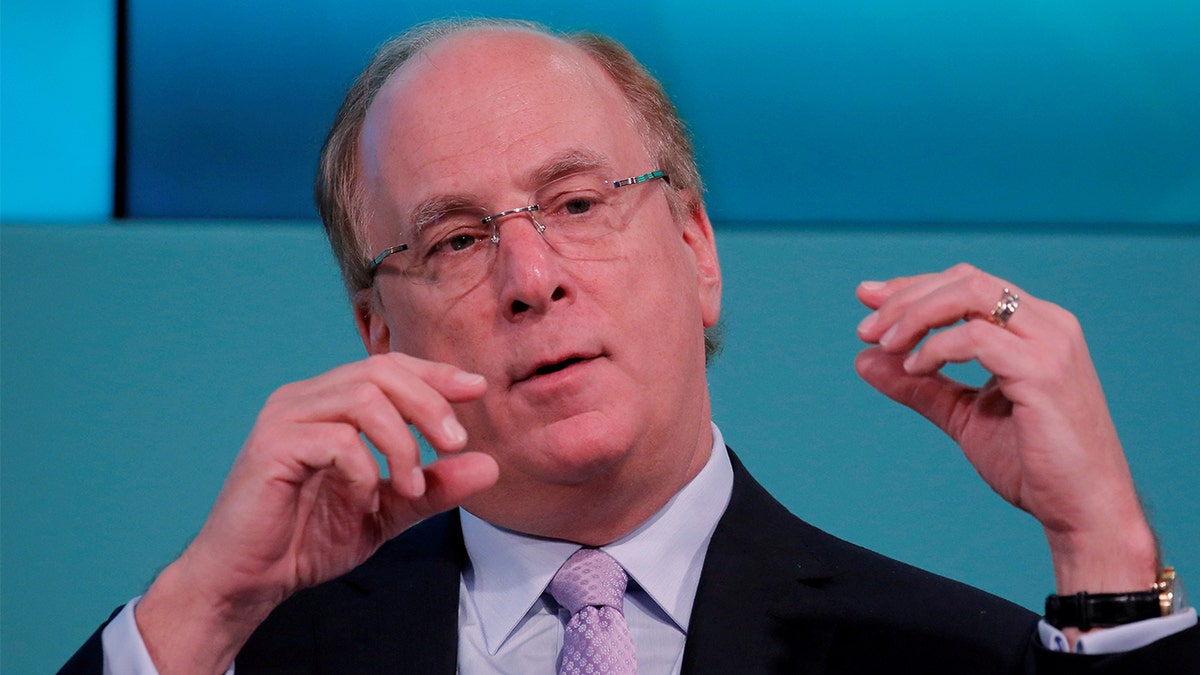

Larry Fink, Chairman and CEO of BlackRock, speaks during an interview with CNBC on the floor of the New York Stock Exchange (NYSE) in New York City, U.S., April 14, 2023. REUTERS/Brendan McDermid (REUTERS/Brendan McDermid)

BLACKROCK AND VANGUARD ARE FORCING ESG AND DEI INITIATIVES ON CORPORATE AMERICA: ANSON FRERICKS

Fink reportedly claimed he was not "ashamed" by it when pressed on his remarks.

"I never said I was ashamed," he said, according to Axios. "I'm not ashamed. I do believe in conscientious capitalism."

"I'm not going to use the word ESG because it's been misused by the far left and the far right," he continued. "We talk a lot about decarbonization, we talk a lot about governance … or social issues, if that's something we need to address."

Critics, including GOP lawmakers, have been pushing back on ESG investing criteria and argued companies are violating their fiduciary responsibilities to their shareholders by sacrificing the main financial objectives of the company for a "woke agenda" and not doing what the shareholders want.

The BlackRock logo is seen outside of its offices in New York City, Oct. 17, 2016. REUTERS/Brendan McDermid/File Photo (REUTERS/Brendan McDermid/File Photo)

OVER 100 GROUPS BACK MANCHIN, GOP PLAN TO BLOCK BIDEN’S ‘WOKE’ ESG INVESTING RULE

Fink, one of corporate America's biggest promoters of ESG, responded to ESG critics in a letter to CEOs in 2022.

The ESG movement "is not about politics. It is not a social or ideological agenda. It is not 'woke,'" wrote Fink. "It is capitalism, driven by mutually beneficial relationships between you and the employees, customers, suppliers, and communities your company relies on to prosper … Make no mistake, the fair pursuit of profit is still what animates markets; and long-term profitability is the measure by which markets will ultimately determine your company's success."

Republican leaders on the House Financial Services Committee created a task force in February to coordinate a response to ESG investment criteria.

Larry Fink, chief executive officer of BlackRock, takes part in the Yahoo Finance All Markets Summit in New York, Feb. 8, 2017. (REUTERS/Lucas Jackson/File Photo)

CLICK HERE TO GET THE FOX NEWS APP

"Progressives are trying to do with American businesses what they already did to our public education system—using our institutions to force their far-left ideology on the American people," Financial Services Committee Chairman Patrick McHenry, R-N.C, said in a statement shared with Fox News Digital. "Their latest tool in these efforts is environmental, social, and governance proposals. This is why I am creating a Republican ESG working group led by Oversight & Investigations Subcommittee Chair Bill Huizenga."

"This group will develop a comprehensive approach to ESG that protects the financial interests of everyday investors and ensures our capital markets remain the envy of the world," he continued. "Financial Services Committee Republicans as a whole will continue our work to expand capital formation, hold Biden’s rogue regulators accountable, and support American job creators."

Fox News' Aaron Kliegman and Thomas Phippen contributed to this report.