Rishi Sunak delivers first speech as UK prime minister

Rishi Sunak made his first remarks to the United Kingdom after officially being named prime minister Tuesday.

Rishi Sunak has won the Conservative Party leadership contest, making him the next prime minister of the United Kingdom and one of the wealthiest men to hold the position, but his wealth comes from a surprising source: His wife.

Akshata Murthy is the daughter of billionaire tech founder Nagavara Ramarao Narayana Murthy, who created the Indian IT company Infosys. King Charles has an estimated wealth of $420 million, and thanks to the shares in her father’s company, Murthy has an estimated wealth of just over $800 million.

The shared wealth with Sunak makes him the only prime minister to date who was wealthier than the sitting monarch.

And that wealth comes from ownership of just shy of 1% ownership in the company. Infosys currently has a market value of 1.005 trillion Indian rupees, which is equivalent to just over $12 billion.

Murthy’s father retired from his company but still owns a minority stake in Infosys, which provides him with a personal wealth of over $4 billion.

Sunak himself worked as a banker for Goldman Sachs and later joined the Children’s Investment Fund Management. He met Murthy while studying as a Fulbright scholar at Stanford to earn his MBA.

Rishi Sunak, with daughters Krisna and Anoushka and wife Akshata Murthy, campaigning on July 23, 2022, in Grantham, England. (Christopher Furlong/Getty Images)

Murthy’s parents left her to live with her grandparents while they worked to establish their company – a company that would make N.R. Narayana Murthy "the father of India’s tech industry."

Her mother, meanwhile, worked as a computer scientist and was the first female engineer at India’s largest carmaker, part of the Tata conglomerate, according to the Guardian.

RISHI SUNAK TO BE THE YOUNGEST UK PRIME MINISTER IN 200 YEARS

That shift in fortunes took some time, but it allowed Murthy to study at Claremont McKenna College in California, where she earned a degree in economics and French before she moved to the Fashion Institute of Design and Merchandising in Los Angeles.

She married Sunak four years after meeting him at Stanford. At the time, Murthy had moved to join a Dutch clean technology incubator in San Francisco, but left shortly after to open her own fashion label, Akshata Designs – a business that failed within three years.

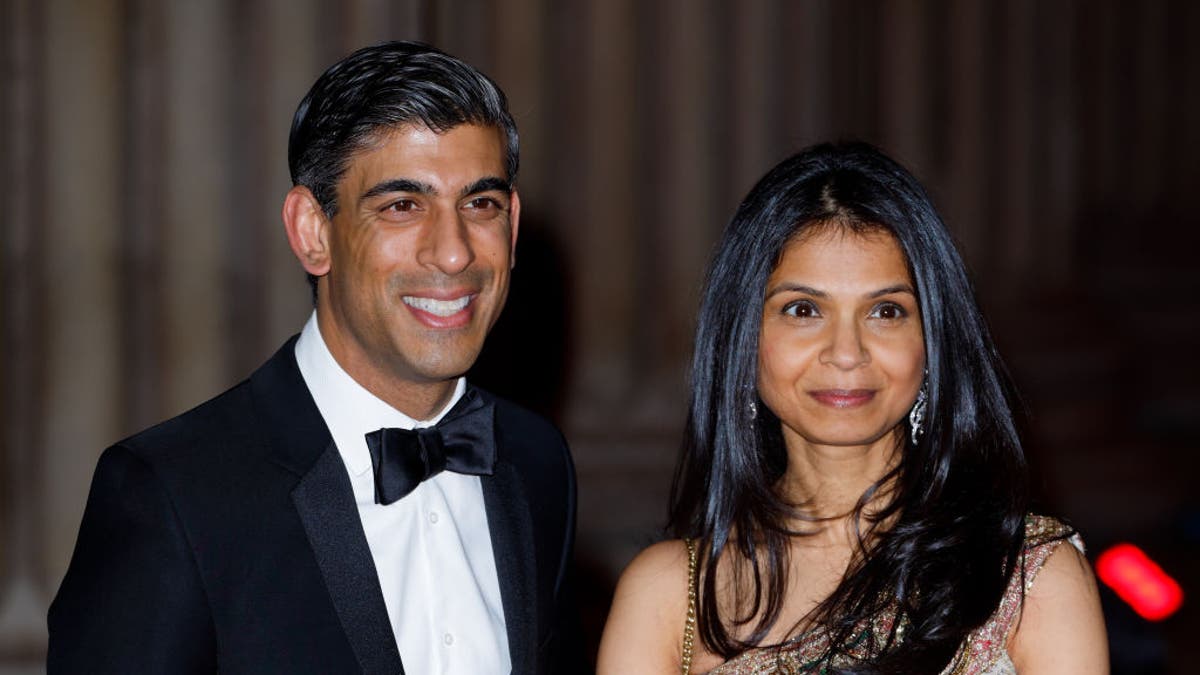

Chancellor of the Exchequer Rishi Sunak and Akshata Murthy attend a reception to celebrate the British Asian Trust at the British Museum on Feb. 9, 2022, in London. (Max Mumby/Indigo/Getty Images)

Murthy’s wealth has proven a difficult topic at times, including a recent tax status dispute over the fact that while she lives in the United Kingdom with her husband, she continued to declare her status as a non-domiciled resident, which meant she was not required to pay U.K. taxes on her overseas income, according to the BBC.

Since her wealth derives almost entirely from her family’s company in India, that meant she paid virtually nothing to the U.K. while living there. The arrangement prompted accusations of hypocrisy against Sunak, who therefore was not paying taxes while the rest of the country struggled with inflation and rising costs.

Murthy would have to pay an estimated $321 million in inheritance tax in the U.K., but her Indian citizenship and non-domiciled status shielded her from such taxes – a privilege she paid around $35,000 a year to maintain.

The couple owns a Georgian manor house in the village of Kirby Sigston in North Yorkshire, valued at over $450,000, which contains an indoor spa and swimming pool, gym, yoga studio, hot tub and tennis court, the Guardian reported.

Akshata Murthy and her daughters attend a Conservative Party leadership campaign event in Grantham, Britain, July 23, 2022. (Reuters/Peter Nicholls)

The great disparity in wealth prompted claims that Sunak was too wealthy to understand the struggles of the average citizen in the U.K., with one Labour MP accusing him of being "out of touch" and "living on another planet."

Murthy eventually agreed to change her tax arrangement as she decided it might create a "distraction" for her husband, saying at the time, "It has become clear that many do not feel it is compatible with my husband’s role as chancellor [of the Exchequer]."

CLICK HERE TO GET THE FOX NEWS APP

"I understand and appreciate the British sense of fairness and I do not wish my tax status to be a distraction for my husband or to affect my family," she added.

She will now pay U.K. tax on all worldwide income, including dividends and capital gains, "wherever in the world that income arises," applying retroactively to the 2021-22 tax year.