Mexican cartels recruit AZ children to smuggle drugs

Cartels recruit AZ youth to smuggle drugs

Organized crime and drug cartels south of the border could soon receive a swell of cash if a new bill passes in Mexico next month, compelling the Central Bank to buy money of questionable origin.

The hotly contested bank bill, which already has won Senate approval, was slated for a vote by the lower house of congress late last year but was delayed until February despite ardent backing by President Andrés Manuel López Obrador's and his Morena party.

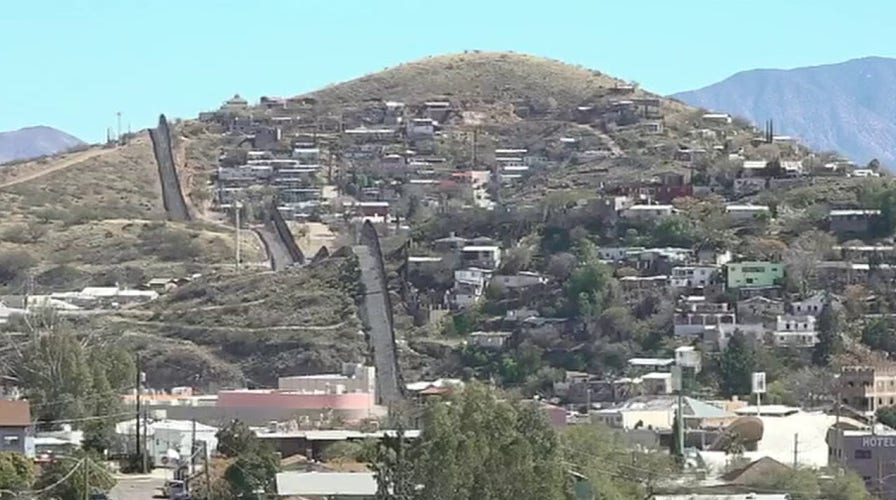

In this March 2, 2019 photo, a Customs and Border Control agent patrols on the U.S. side of a razor-wire-covered border wall along Mexico east of Nogales, Ariz. (AP Photo/Charlie Riedel, File)

The legislation would ultimately force Mexico's central bank -- Banxico -- to purchase foreign currency, generally surplus dollars from tourism and remittances, from local banks. However, much of the money rotating through the local system stems from drug trafficking, money laundering and other illicit operations rather than tourism spending.

"Mandating the Central Bank's commitment to buy up U.S. dollars from private banks could expose it to significant money laundering schemes, since Mexico's drug cartels, unlike migrants and temporary workers, are known to spend heaps of cash back home," Ryan Berg, political scientist and fellow at the American Enterprise Institute told Fox News. "If this bill passes, Mexico risks becoming a hub for money laundering, and not just for its powerful drug cartels."

MEXICO PASSES BILL THAT COULD SET BACK US PARTNERSHIP IN DRUG WAR BY DECADES

From his view, "the level of money laundering in Mexico is already deeply concerning, and the ability of private banks to sell their U.S. dollars to the Central Bank has led to justifiable concerns about a relaxation of anti-money laundering laws."

The Mexican opposition and the bank itself staunchly oppose the bill, which they fear will become a means of churning dirty money through a clean system.

"In the long run, evidence of so-called 'dirty money' circulating in Mexico's Central Bank could leave the institution open to U.S. sanctions – a grave concern for any central bank," Berg said.

The bill also could render the central bank vulnerable to U.S. sanctions if they cannot verify funds' starting point or if evidence emerged that it was violating international treaties by acquiring illicit foreign monies.

In addition, the Bank of Mexico and opposition groups are concerned that the pending legislation would force it to acquire cartel cash and breach the financial institution's self-rule.

Yet Ignacio Mier, Morena's leader in the lower house, also has said that the leadership in no way wants to hamper the independence of the Bank of Mexico.

(Hollie McKay/Fox News)

The Bank of Mexico's pushback against the proposed legislation garnered support from several private banks throughout the country, and from the influential Association of Mexican Banks. Those opposed fear that international confidence will be undermined should the bill be passed into law and cause schisms in Mexico's economy.

MEXICO'S CORONAVIRUS CZAR FACES BACKLASH AFTER BEACH TRIP

However, Obrador and his political allies argue that the law, which is centered on the central bank buying and building up its reserves, would help guarantee that migrants send money homebound in cash. The bill's backers further contend that an excessive pileup of foreign funds in Mexico runs the risk of rattling foreign currency markets and providing a ripe climate for illegal trading in which migrants end up having to sell their currencies at inferior exchange rates.

But according to statements from the Bank of Mexico, only around 1% of the money that migrants send to family members abroad is in U.S. dollars or other currencies; the vast majority is conducted via bank or wire exchanges.

Evan Ellis, a research professor of Latin American studies at the U.S. Army War College Strategic Studies Institute, said that while obligating Banxico to buy dollars for pesos sounds like a reasonable way to keep working-class Mexicans from getting fleeced when they send money to their families, the argument makes less sense.

"Virtually all of those earning dollars in Mexico send the money to their loved ones through wire transfers," he said.

And changing dollars for pesos isn't a problem for tourists, he said.

At issue is the concern that narcotraffickers and other criminal organizations have the greatest interest in repatriating bulk cash because they obtain physical American dollars through illicit transactions in the United States and they do not want to register those transactions on the in the U.S., he said.

Complicating the issue in the United States is the transfer of power between the Trump and Biden administrations.

"There is an understanding that even if the U.S. presidential transition precludes a response from the outgoing Trump administration, the incoming Biden administration will take a hard look at this."

CLICK HERE TO GET THE FOX NEWS APP

Mexico's lower house is now expected to vote on the act in February, and it already is causing ripples in global markets.

"The biggest problem with this proposal is not what it would definitely do, but the extraordinary uncertainty it would introduce with extremely unpredictable consequences," said David Johnson, a longstanding member of the U.N.'s International Narcotics Control Board and its vice president chairing its standing committee on estimates.

"AMLO has working majorities in Mexico's legislature, so he could conceivably move forward with this," he said referring to Mexican President Obrador. "I suspect, however, that should this get legislative legs, the market would punish the peso in such a way that it would prove very costly."