Cyprus passes laws to empower banks to manage toxic loans, clear way for more European-IMF aid

{{#rendered}} {{/rendered}}Lawmakers in Cyprus on Saturday passed key insolvency laws designed to open the taps for more international bailout cash.

The vote makes it possible to operate foreclosure laws that international creditors have demanded as a condition for extending more loans to Cyprus.

Recession, high unemployment and declining incomes have produced defaults on more than half of all private loans. The new laws should make it easier for banks to demand payment or seize assets, thereby reducing the banks' own liabilities.

{{#rendered}} {{/rendered}}Lawmakers had passed some of the legislative package last year, but delayed enforcement until they could approve other bills also passed Saturday that are designed to offer protection to some vulnerable categories of debtors.

The International Monetary Fund has been withholding 88 million euros ($95 million) in rescue money, citing Cyprus' delay in giving banks the legal tools to deal with their load of bad debt.

One new law permits a bank to write off up to 25,000 euros ($26,800) from an existing loan. Another enables solvent debtors to apply for legal protection against losing their homes or place of business if they're valued at 350,000 euros ($378,500) or less.

{{#rendered}} {{/rendered}}Cyprus government officials said passage of this package of debt-related bills means the country should be able to tap international markets for a second time since its March 2013 bailout. This could include participation in the European Central Bank's bond-buying 1.1 trillion euro ($1.19 trillion) stimulus program.

Cyprus President Nicos Anastasiades hailed the vote, saying the new laws were a product of "tough negotiations" with the country's creditors. In a written statement, Anastasiades said the laws provide "adequate protection to our society's vulnerable groups."

"Today's decision by parliament strengthens the government's efforts to borrow from international markets and, by extension, to eliminate our dependence on our creditors," he said.

{{#rendered}} {{/rendered}}Saturday's vote came as the Cyprus Central Bank warned that the country must abide by the terms of its rescue program if the European Central Bank is to keep accepting Cypriot government bonds as collateral for providing emergency cash to the country's wobbly banks.

In a letter, Central Bank Governor Chrystalla Georghadji warned that further parliamentary delays could spur the European Central Bank to stop accepting Cypriot bonds.

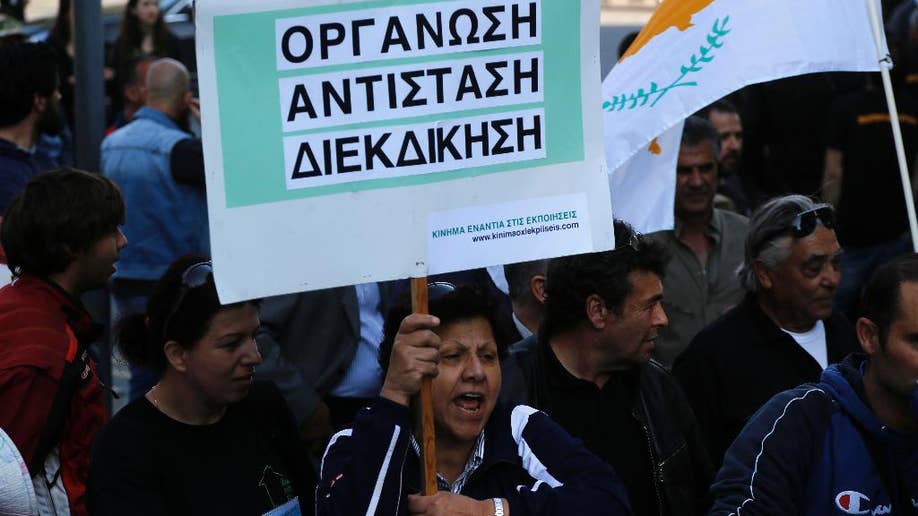

No demonstrators showed up outside parliament Saturday, a day after several dozen staged a noisy protest against implementation of the foreclosure laws.