Carafano: China could lock US out of Asia if they take Taiwan

Heritage Foundation VP of Foreign Policy James Carafano on China escalating threats after House Speaker Nancy Pelosi visited Taiwan.

Southeast Asia presents a ripe opportunity for the United States and western allies to diversify their supply chain away from China, making it the next major economic battleground between the rival nations.

"China is a geographical fact in the region - it's an economic fact," Ashok Mirpuri, Ambassador of Singapore to the U.S., said during July’s Aspen Security Forum. "It's been there for generations: It's risen, it's come down, it's risen again, but the region has had to learn to live with China."

"The United States has been in many ways a stabilizing force in the region, and we don't see the United States as an outsider," he continued. "We see them as a resident power in the region as well. So the both of them, dealing with a region of Southeast Asia [with] 600 million people, is really where the competition is taking place day by day, week by week, month by month."

Secretary of State Antony Blinken began his visit Tuesday when he met with leaders in Cambodia, which currently serves as the head of the 10-country trading block known as the Association of Southeast Asian Nations (ASEAN).

ASEAN has found itself in the spotlight not just due to its proximity to China, but also for the promising business opportunities present in the region. Blinken is also due to attend a Ministerial meeting with ASEAN foreign ministers, Wednesday.

REPORTER'S NOTEBOOK: CHINA, PELOSI AND THE IDES OF AUGUST

Mirpuri highlighted Southeast Asia’s role at the "heart of this competitive dynamic between China and the United States," which has turned the region into a budding economic battleground between the two world powers. China's "Zero-COVID" policy caused global disruption to the supply chain, and the threat of an invasion of Taiwan has caused many trading partners to consider back-up options.

Ford opened a factory in Cambodia in April after investing $21 million to build facilities in the Pursat Province, which Minister Delegate to the Prime Minister Keo Rattanak said was part of trying to attract new business and partners to the region. Apple, meanwhile, opened a new iPad factory in Vietnam in 2021 – a process started in 2019 as part of avoiding U.S. tariffs on Chinese goods, the New York Times reported.

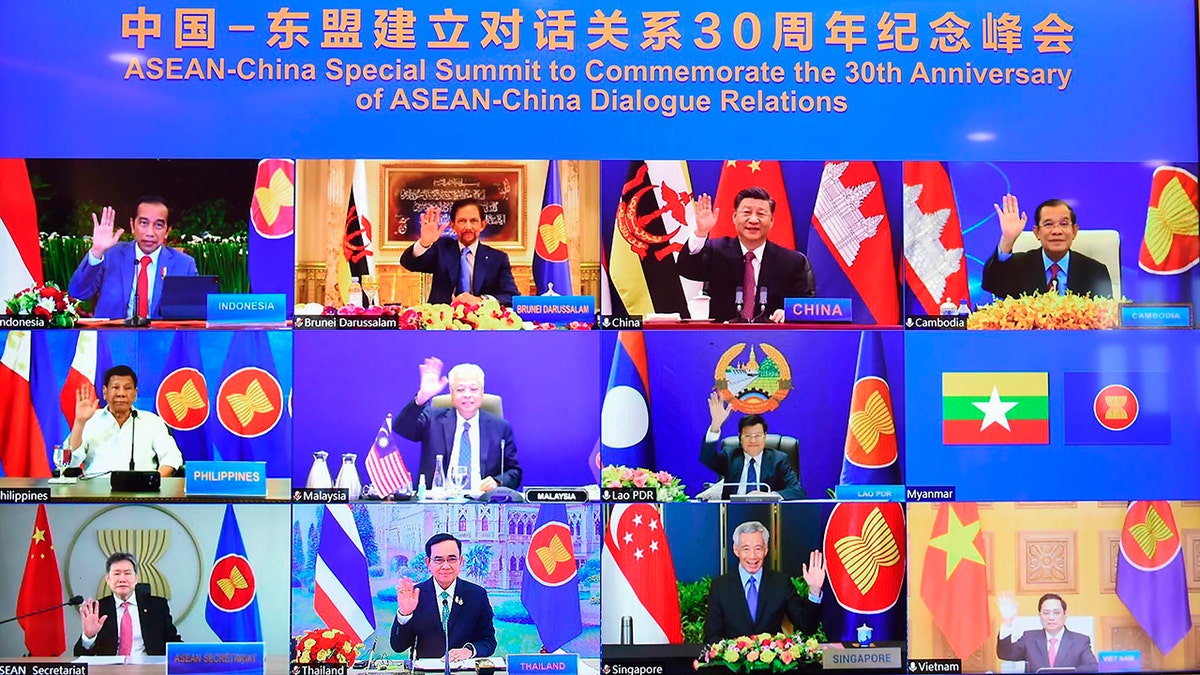

This image provided by Malaysia Prime Minister Office show ASEAN leaders and Chinese President Xi Jinping, top second from right, on screen during an online meeting of the ASEAN-China special summit in Kuala Lumpur, Malaysia, Monday, Nov. 22, 2021. (Malaysia Prime Minister office via AP)

Kao Kim Hourn, minister delegate attached to the Prime Minister of Cambodia, told Fox News Digital that ASEAN allows its members to operate as "one big market" to benefit from each country’s competitive advantages.

"I think it depends on international companies that are investing in those countries and where they want to invest," Kao said, using the example of a Japanese company that he said had remained hesitant of opening a factory in Cambodia but has now commenced building several factories in the country.

PELOSI SHOULD HAVE VISITED TAIWAN YEARS AGO: FOREIGN POLICY EXPERT

"Of course, all of us welcome investment, welcome the relocation of factories and companies in production in Southeast Asia," he said. "This is good for us. It's good for the region."

ASEAN members have tried to pull both the U.S. and China into a more "cooperative and coordinated" relationship in the region to help maximize investment and growth. Mirpuri pointed to other "great powers" in the region, such as India and Japan, who could help ASEAN members as he expressed concern over the "uncertainty" in the U.S.-China relationship.

"We have the trading relationships with both the U.S. and China, [and] we have security relationships around the region, so we’re sort of operating in that space," he said.

ASEAN has kept an eye on the impacts from the Ukraine-Russia war: The war has exacerbated inflation issues, as well as threatened food security.

FORMER STATE DEPARTMENT OFFICIAL: COMPANIES ARE MAKING CHINA CONTINGENCY PLANS

However, that has also presented some trade opportunities for the region, Kao explained. He said that ASEAN countries have produced millions of tons of rice – 6 million from Cambodia alone – that has helped the members maintain a stronger level of food security while also exporting it to other countries.

Maritime states in the group, such as Singapore and the Philippines, have struggled a little more for the fact that they need to import staple crops, but Kao insists that the alliance will be able to "sort it out."

Chinese Foreign Minister Wang Yi speaks during a meeting with Cambodia's Prime Minister Hun Sen in Phnom Penh, Cambodia, August 3, 2022. (Kok Ky/Cambodia's government cabinet/ Handout via Reuters)

Kevin Maher, a senior advisor at NMV Consulting and the former Japan office director at the State Department, told Fox News Digital that the proximity to China makes Southeast Asia "vulnerable" to Chinese claims and advances through its Belt and Road Initiative.

Maher argued that if the U.S. can step up investment in the region, those countries no longer need to take Chinese loans to help build infrastructure, in turn cutting off some of China’s influence in the region while diversifying the U.S. supply chain in a double blow to Beijing’s economic ambitions.

CLICK HERE TO GET THE FOX NEWS APP

"The future is going to be this continued struggle to, not just on the military side, but on the infrastructure investment side, official development assistance and economically, to try to balance these very robust efforts by the Chinese to come in and dominate a lot of the Southeast Asian countries," Maher said.