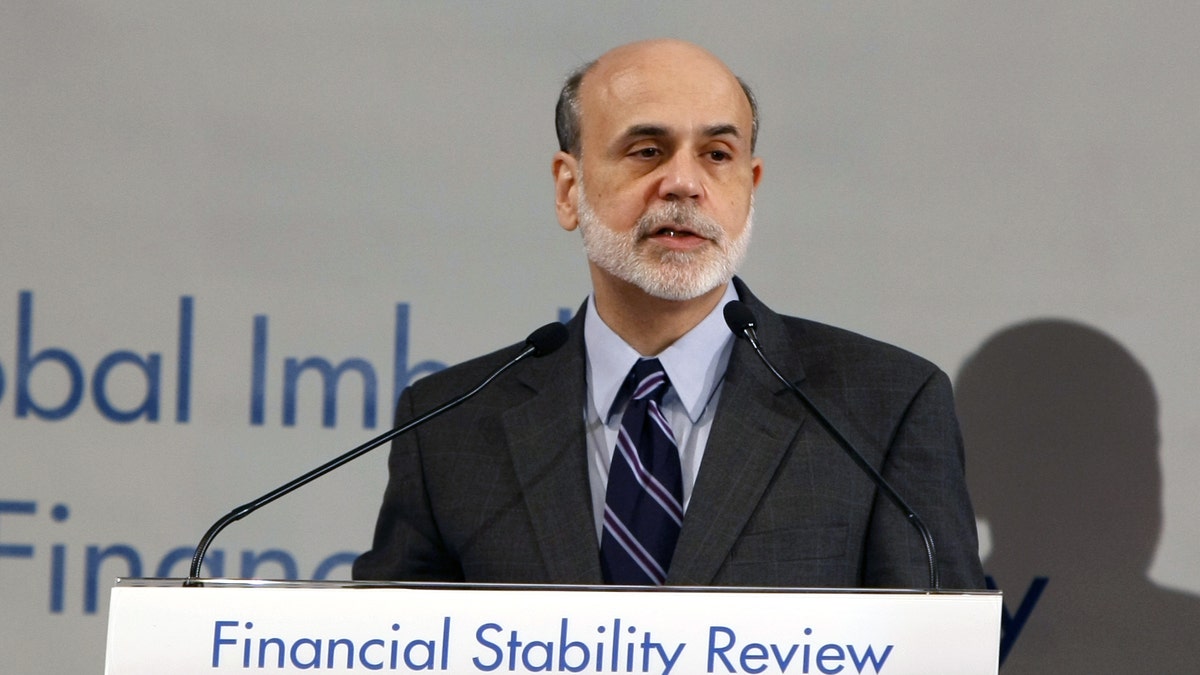

Feb. 18: Federal Reserve Chairman Ben Bernanke delivers a speech during a meeting with G20 central bank governors in Paris ahead of a G20 Finance meeting. (AP)

Federal Reserve Chairman Ben Bernanke on Friday urged countries with large trade surpluses like China to let their currencies rise in value to help prevent another global financial crisis.

He also called on nations with persistent trade deficits like the United States to narrow their budget shortfalls and save more.

Both steps would help balance trade and investment flows among countries, Bernanke said in prepared remarks to a financial conference in Paris. Many countries worry about speculative money flooding their economies and inflating assets like real estate or stocks.

"None of these changes will be easy or immediate," Bernanke said.

The flow of capital will be a topic for the Group of 20 industrialized and emerging nations when they meet in Paris later Friday and on Saturday. Bernanke and Treasury Secretary Timothy Geithner will represent the United States.

The Fed chairman singled out no specific countries. Instead, he called on those with large trade surpluses to let their currencies rise freely, encourage consumers to spend more and rely less on export-led growth. That was a reference to China.

Similarly, Bernanke said countries with sizable trade deficits must reduce government spending over time. This reference was to the United States.

The Fed chief's tone was milder than in a speech he gave in mid-November. At the time, he struck back at China and other global critics for challenging the Fed's $600 billion Treasury bond-purchase program. The purchases are intended to lower interest rates, lift stock prices and encourage more spending by U.S. consumers and businesses.

Critics have said the bond purchases could eventually help ignite inflation or speculative investment. China and some other countries called the purchases a scheme to drive down the dollar and give U.S. exporters an unfair edge. A lower dollar makes U.S. products cheaper for foreigners and foreign goods costlier in the United States.

Emerging countries like Thailand and Indonesia feared that falling Treasury yields would send money flooding their way in search of higher returns. Those markets could be left vulnerable to a crash if investors later decided to pull out and move their money elsewhere. In the months since the bond program began, however, Treasury yields have risen.

In his November speech, Bernanke warned China that it and other developing nations were putting the global economy at risk by keeping their currencies artificially low.

Bernanke struck a more professorial tone in his remarks Friday. He stressed that countries must collaborate to confront financial threats. And he didn't specifically discuss the Fed's bond-purchase program.

Looking back at the global financial crisis, the Fed chief said the United States and other countries share blame. Countries with trade surpluses plowed money into mortgage and other investments in the United States, helping escalate their value. Bernanke said a paper he co-wrote and presented to the financial stability forum in Paris confirms this.

But he also said the United States failed to safely absorb money flooding in from emerging nations like China, Middle Eastern oil countries and industrialized countries in Europe. U.S. financial companies turned risky loans into highly rated investments through inflated credit ratings. Mortgage securities of low credit quality ended up with high ratings, Bernanke noted.

Bernanke repeated his observation that the global economy is undergoing a "two-speed" recovery. Emerging countries like China are growing quickly, while industrialized countries like the United States are expanding only slowly.

And the Fed chief said the run-up in global commodities prices reflects strong demand from China and other fast-growing countries.