(Credit: Apple)

Promising lenient payment terms, low interest rates, and no fees, the new Apple Card seeks to be a revolutionary credit card for the rest of us. But many of its features aren't actually new but an evolution of the rewards and fee structures other cards already offer.

One of the most compelling existing no-annual-fee cash back cards is the Citi Double Cash, which earns 1 percent cash back on every purchase, and then another 1 percent when you pay your bill. This is essentially a 2 percent bonus on every dollar you spend, assuming you pay your bill in full and on time every month.

The Citi Double Cash's archrival is the Fidelity Rewards card, another no-annual-fee card that offers 2 percent cash back on everything. You don't have to pay your balance in full to get the 2 percent, but you do have to deposit or invest your rewards in a Fidelity brokerage or cash management account.

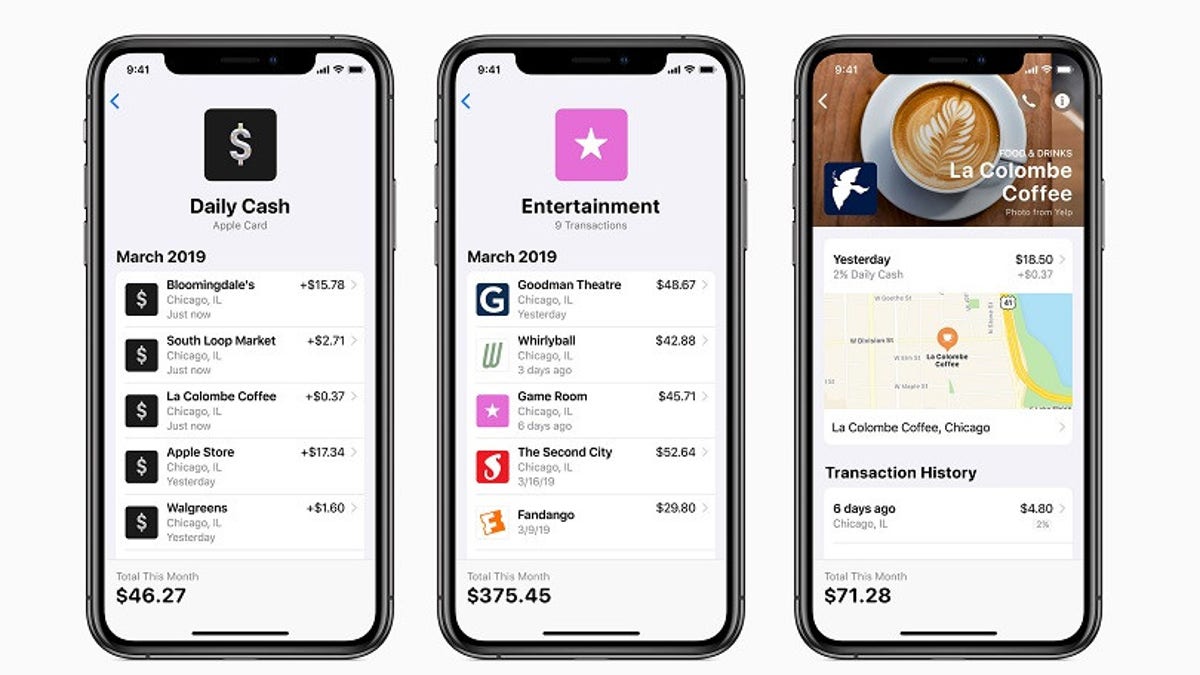

With the Apple Card, you'll get 2 percent cash back, but only on transactions you make via Apple Pay, whose acceptance is spreading but far from ubiquitous. Essentially, how much cash back you earn depends on how quickly Apple conquers the mobile payments market, and how often you remember to whip out your phone instead of your credit card in the checkout line.

More From PCmag

But lots of Americans don't pay their credit card bills in full and on time, as evidenced by the billions of dollars that banks make on fees and interest charges. That means many people don't get the full benefit of the Citi Double Cash's 2 percent cash back, at least in the short term. By contrast, since the full cash back earned on your Apple Card gets deposited every day no matter when your last payment was, many people could come out ahead by switching to it.

And there are almost certainly more Americans who own or dream of owning an Apple iPhone than a Fidelity brokerage account, so the Apple Card could be more compelling than Fidelity's card, too. Add in no late payment fees, which Fidelity and Citi both charge, and the Apple Card is indeed shaping up to be the credit card Americans never knew they needed.

But the giant catch with the Apple Card is that it's still issued by a bank—Goldman Sachs, in this case. Banks have to make money, which means that just like every other credit card, the Apple Card charges interest as high as 24 percent, depending on your credit. The interest rates here are just as punitive as any other credit card, but it's even more likely that you'll pay them, since there are no late fees to incentivize paying on time. A tracker will show how much interest you'll be charged based on how much of the balance you pay down, but that's way more boring than Citi's approach of doling out an extra 1 percent reward on each dollar you pay.

It's clear the Apple Card really is a card for the rest of us; those who don't always use credit responsibly but still want rewards. In that respect, it's worse than Citi Double Cash and Fidelity Rewards, which still generate immense profits from consumers' irresponsibility but at least incentivize us to pay bills on time.

This article originally appeared on PCMag.com.