(Credit: Apple)

Apple announced a new digital credit card service for iPhone users this week in what CEO Tim Cook described as “the most significant change to the credit card in 50 years.”

While that is overstating it quite a bit, the move is an interesting one from Apple and highlights its plan to pull users into a bunch of different services to keep them leaving its iPhone user base.

For now, it’s only available to US customers and Apple hopes it will drive more iPhone customers towards using Apple Pay and make purchases within its iOS ecosystem such as its App Store, micropayments in games, and peer-to-peer payments with Apple Cash, a feature only available in the US.

When customers use the card they get 2 percent cash back on all purchases and 3 percent when purchasing an Apple product or service.

According to Apple, its digital credit card will have no late fees, no annual fees, no international fees and an interest rate among the lowest in the industry, however the fine print on this last point shows a pretty standard range of interest.

That sounds all very good, but many of its features aren’t actually new but rather an evolution of the rewards and fee structures already offered by other cards in the US market, critics were quick to point out.

“I think the strange optic here is that credit cards are not necessarily innovation in payments, even with better rates and loyalty,” Rivka Gewirtz Little, a global research director at analyst firm IDC who specializes in payments told The Verge.

“So, to see a big tech firm, which hangs its hat on innovation, go such a traditional route — that’s what I think is a bit odd here. I’d like to see Apple get more innovative in transforming the way we pay.”

Apple has partnered with global investment bank Goldman Sachs and Mastercard to bring its Apple Card to life.

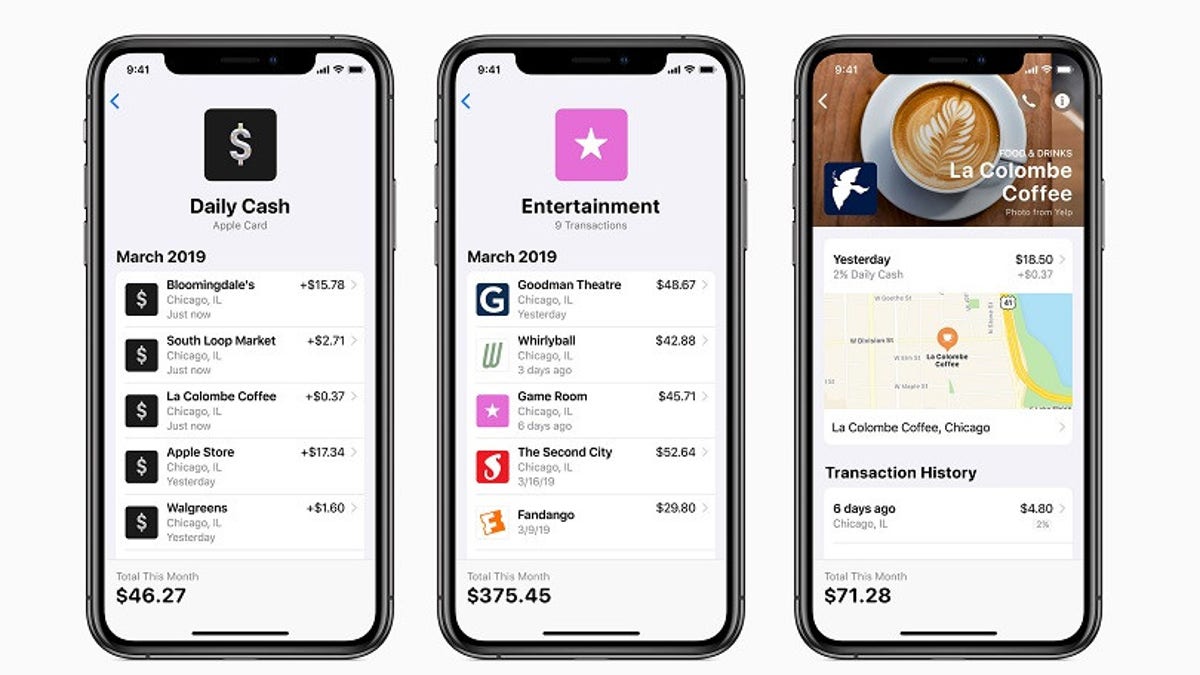

“There are some things about the credit card experience that could be so much better,” Tim Cook said during the announcement. The card will decipher statements into something that’s easier for people to read and understand and will automatically group purchases into categories and help customers track and develop insight into their spending habits. And interestingly, Apple says none of the purchasing data will be shared or sold to advertisers or third-party data brokers.

While it may not be the revolutionary change Apple is making it out to be, it is an interesting boost to the tech giant’s digital wallet.

As a former Visa exec Peter Berg observed, the push to keep payments inside the Apple ecosystem could prove worrying for card networks if Apple succeeds in the long run.

“Apple pushing people to keep cash inside the Apple ecosystem is not to be underestimated!” he wrote on Twitter.

“They are playing a long game here. If successful, this is very bad for the card networks.”

Apple Card is unlikely to come to Australia any time soon, but it will be interesting to see if it has the desired result for the iPhone maker.

On top of its revamped TV app and original content streaming service, the company also announced a new service for magazines and a couple major US newspapers this week. For $10 a month in the US, subscribers can get cover-to-cover access to about 300 major magazine titles as well as the Los Angeles Times and Wall Street Journal. It will come to Australia in the second half of the year but pricing is still to be announced.

Apple will share the revenue with publishers in an undisclosed commercial arrangement. In a note to investors Goldman Sachs analyst Rod Hall said it was unlikely the new services would boost Apple’s earnings in the short term but “are interesting from a platform churn point of view.”

As iPhone sales (and smartphone sales in general) are slowing, Apple wants to pull you deeper into its services ecosystem and make you uninterested in leaving. When you do get around to buying a new device, it’ll have to be an iPhone.

It’s also expected that Apple could one day bundle them together with its other services like Apple Music, iCloud storage and Apple Warranties to offer a discounted super Apple bundle.

This story originally appeared in news.com.au.