Fox News Flash top headlines for August 6

Fox News Flash top headlines for August 6 are here. Check out what's clicking on Foxnews.com

Apple began to roll out its entry into the credit card business, Apple Card, on Tuesday, following comments from CEO Tim Cook last month.

Cupertino, Calif.-based Apple has sent a limited number of sign-up invitations for the credit card, a card that the tech giant is trying to differentiate from others on the market. The card, which works with both iPhones and iPads, is being positioned differently from other credit cards on the market, including giving consumers cash back for their purchases, as opposed to rewards points.

On the company's fiscal third-quarter earnings call last month, Cook said that "thousands of Apple employees are using Apple Card every day in our beta test," adding that a rollout would come shortly.

(Credit: Apple)

APPLE ANNOUNCES NEW IPADS AHEAD OF BIG SERVICES PUSH

News that the invitations were going out was first reported by TechCrunch.

Initially unveiled in March, Apple Card was created by the tech giant and built on ideals the company values, such as privacy, simplicity and transparency, Cook said at the time of the announcement.

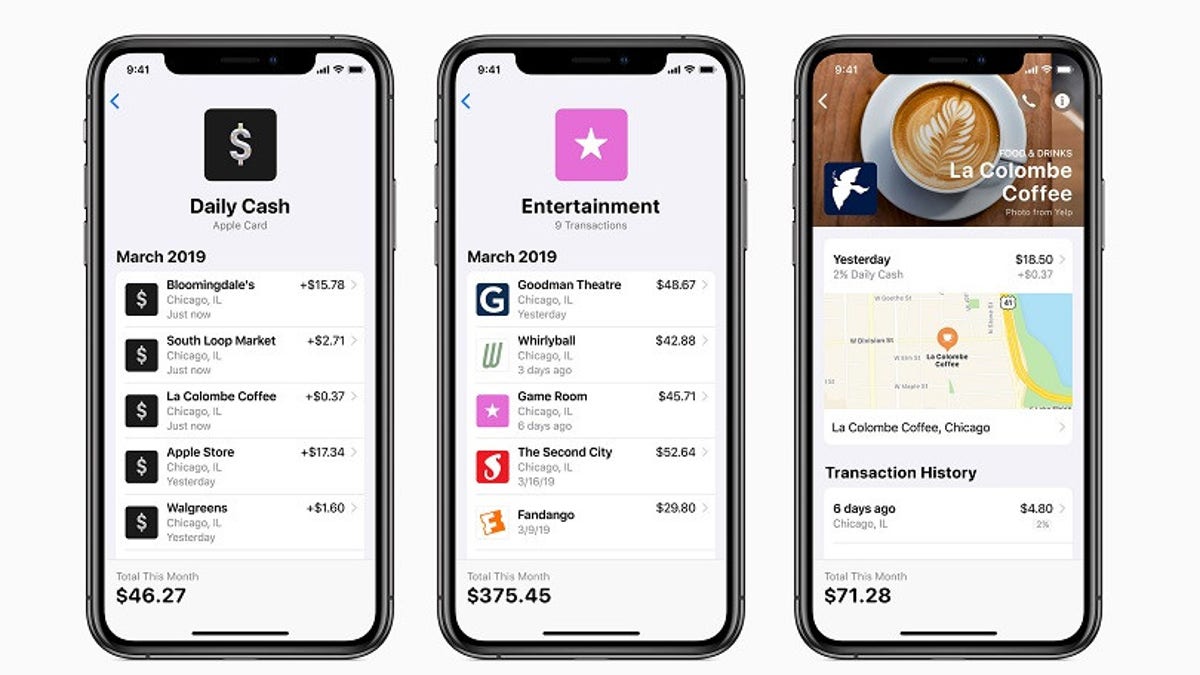

At the March event, Jennifer Bailey, VP of Apple Pay, said the titanium card would be available immediately in the Wallet app upon release and would offer 2 percent cash back for purchases made through the Wallet app, a feature that would be credited every day. That amount would increase to 3 percent if a person bought something from Apple, but would drop to 1 percent if a user used the physical card.

Bailey added the goal is to make it easier to pay down the balance, adding that it will have lower interest rates and no penalty interest rates. Apple has partnered with Goldman Sachs and Mastercard for its global payment network.

Reiterating the privacy theme, Bailey said Apple does not know what you bought and Goldman Sachs would never share or sell your data for third-party advertising.

FILE- In this March 25, 2019, file photo, Jennifer Bailey, vice president of Apple Pay, speaks about the Apple Card at the Steve Jobs Theater during an event to announce new products in Cupertino, Calif. The Apple-branded credit card that’s designed primarily for mobile use will start rolling out on Tuesday, Aug. 6. (AP Photo/Tony Avelar, File)

What sets Apple Card apart from other cards is its reliance on the iPhone. Though customers can request a physical card for free, an iPhone is required to apply, check statements and pay balances.

The app will offer tools to manage spending and suggest payment amounts based on past payments and spending. And cash back rewards return to customers through an Apple Cash account, which can be used for other purchases, credit card payments and transfers to traditional bank accounts.

Unlike most credit cards, there are no annual, late, international, or over-the-limit fees associated with Apple Card, which aims to have among the lowest rates in the industry. The variable annual percentage rate ranges between 12.99 percent to 23.99 percent, depending on credit history.

As Apple looks to offset a decline in the iPhone portion of its business, some analysts expect the card to give its services business a boost. "We also see accelerating growth within Services, aided by the upcoming launch of the Apple Card in August as well as Apple Arcade and Apple TV+ this fall," CFRA analyst Angelo Zino said in a research note to investors after Apple's quarterly results.

CLICK HERE TO GET THE FOX NEWS APP

The Associated Press contributed to this story.