Inflation Reduction Act will make inflation 'much, much worse': Stephen Moore

Former Trump economic adviser Stephen Moore spells out his criticisms for Democrats' Inflation Reduction Act set to pass after a House vote.

Vulnerable House Democrats are downplaying concerns over the Internal Revenue Service (IRS) provisions in the Inflation Reduction Act, applauding the bill's focus on climate reform.

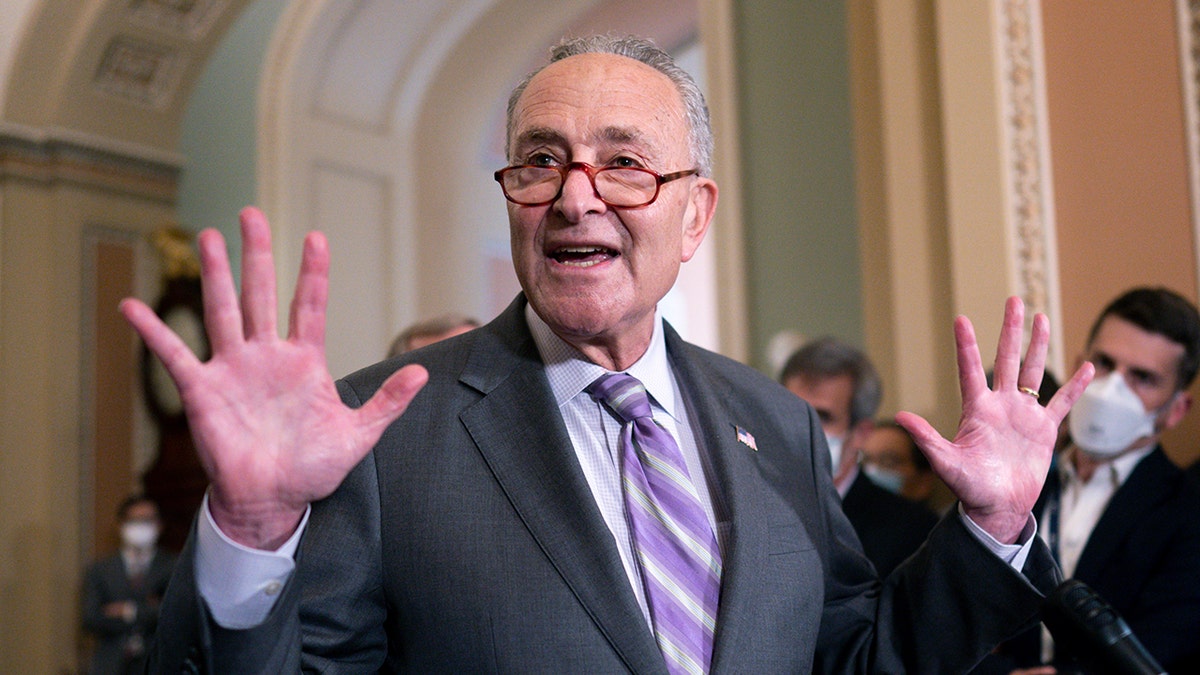

The Inflation Reduction Act of 2022, introduced by Sen. Joe Manchin, D-W.Va., and Senate Majority Leader Chuck Schumer, D-N.Y., is scheduled for a House vote Friday afternoon and contains massive climate spending and provisions to raise federal revenues through increased tax enforcement.

The bill provides nearly $80 billion that could expand the IRS by hiring of tens of thousands of new agents, but most Democrats deny or dismiss concerns that it will lead to more audits of individuals and small businesses.

Fox News Digital requested comment from 20 of the most vulnerable House Democrats, asking them their thoughts on the IRS provisions included in the bill. None of them responded to the question.

Sen. Joe Manchin, D-W.Va., has been pushing for a quick passage of the Inflation Reduction Act, despite voting against "Build Back Better." (Tom Williams/CQ-Roll Call, Inc via Getty Images)

Rep. Susan Wild, D-Pa., claimed that expanding the IRS would not increase taxes on Americans making under $400,000 per year, but would instead "result in people getting their tax returns faster." She shared an infographic that called it a "myth" that the IRS would increase audits on small businesses and individuals.

Rep. Dina Titus, D-Nev., shared on Twitter that she believes the climate is the biggest threat America has ever faced: "When I vote for the Inflation Reduction Act tomorrow, I will be voting to take aggressive action against the largest threat we have ever faced: climate change."

Rep. Steven Horsford, D-Nev., also commented on the climate provisions in the Democrat's new bill: "Not only will the #InflationReductionAct lower health and energy costs, it will also take huge steps to combat the #ClimateCrisis."

In a separate post, Horsford denied claims that the new legislation will raise taxes on working-class Americans.

The Joint Committee on Taxation (JCT) reported that taxes would be raised on Americans in almost every income category as a result of the Inflation Reduction Act, including raising taxes on individuals making under $400,000 per year.

Rep. Angie Craig, D-Minn., also claimed the new bill would not raise taxes on certain individuals: "FACT CHECK: No matter how much @KistnerCongress tries to mislead Minnesotans, the Inflation Reduction Act will NOT raise taxes on the middle class."

Rep. Henry Cuellar, D-Texas, announced Thursday his plan to vote in favor of the legislation: "No bill is perfect. However, compromise, commonsense, and rising above partisan politics to make meaningful and balanced change is our duty as legislators. I look forward to for this bill and President Biden signing the Inflation Reduction Act into law."

Rep. Elaine Luria, D-Va., tweeted, "The high cost of prescription drugs impacts millions of Americans every day, and the Inflation Reduction Act will quickly lower health care costs and put money back into the pockets of working families."

Senate Majority Leader Chuck Schumer, D-N.Y., said the Inflation Reduction Act is "one of the defining legislative feats of the 21st century." (AP Photo/J. Scott Applewhite)

Progressive Sen. Bernie Sanders, I-Vt., has been critical of Democrats' claims about the bill, though he ultimately voted for the legislation. He told CNN on Wednesday that the Inflation Reduction Act would not lower the costs of prescription drugs for four years. Sanders also claimed that the bill will have "minimal impact" on tackling inflation.

Republicans have made clear their opposition to the bill, insisting that it would raise taxes in the midst of the technical recession and target working-class Americans through more tax audits and IRS hires.

CLICK HERE TO GET THE FOX NEWS APP

When the bill is voted on in the House of Representatives, it would only take five Democrats opposing the legislation to derail it, though Democrats expect a final passage Friday.