GameStop trading controversy causes market volatility, outcry from hedge funders

Sen. Pat Toomey, R-Pa., tells 'Your World' GameStop trading looks like 'a classic bubble', but no reason yet for SEC involvement

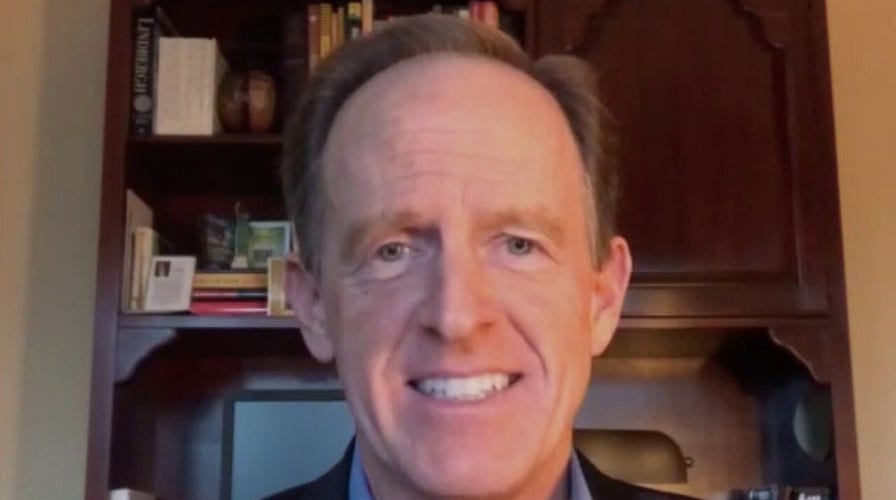

Senate Banking Committee member Pat Toomey, R-Pa., said Friday that the sudden spike of GameStop's stock as a result of Redditors banding together to smite hedge funds short-selling is not something the Securities and Exchange Commission (SEC) should necessarily get involved in at this point.

Toomey told "Your World" that the investors involved in the GameStop and other related stock spikes such as AMC should note the rise has the signs of a market "bubble" that will gravely hurt financially those who invest late or stay in the game too long.

He added the idea of applications that allow the casual or "retail" investor better access to the stock market are a good thing.

SEN. PAT TOOMEY: "This is a wonderful innovation that is bringing investment opportunities to people of modest means who never would have had that opportunity before ...

I do have colleagues that have already been making noises about somehow the SEC stepping in and new regulations and new laws. I see no case for that at this point. I do think we should understand why the brokers made the decision they made, several of them, including Robinhood to limit the ability of people to buy stock. I think there's a plausable explanation that has to do with the additional capital required when stocks are volatile. Let's make sure we understand that ...

CLICK HERE TO GET THE FOX NEWS APP

I'm not aware of any of evidence that there's a systemic risk in the capital markets. Our markets have been awfully fraught. We've had an amazing run-up ...

It's worth pointing out that look, this is a classic bubble. Let's just be honest. It had all the components, a number of events that has caused an unbelievable run-up in a stock that is unsustainable. When this ends, it's going to end badly for the people that buy in late -- just as it went badly for the hedge funds that shorted early. The hedge funds need to live with the consequences. That's life. They're big boys."