Senate coronavirus stimulus package: What’s in it

Here are the main takeaways of what is in the $2 trillion stimulus package the Senate is working on to ease some of the economic turmoil caused by the coronavirus.

Get all the latest news on coronavirus and more delivered daily to your inbox. Sign up here.

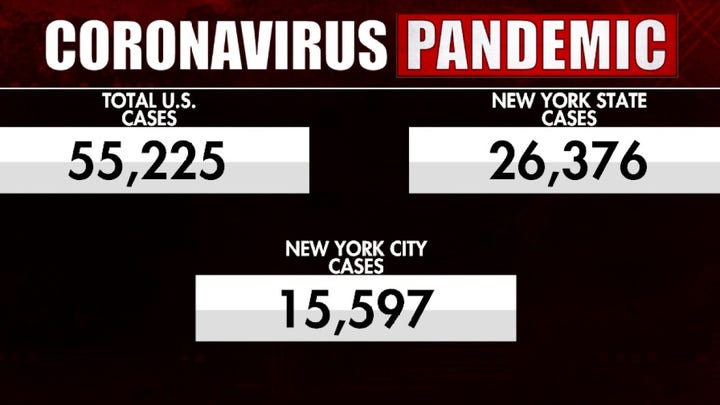

The Senate on Wednesday passed an unprecedented $2 trillion stimulus package to provide health care and economic aid amid the coronavirus outbreak and national shutdown of American daily life.

It now has to pass the House before going to the president's desk for his signature.

Here's a look at some of the highlights included in the sprawling, 500 page-plus measure.

Checks and Unemployment

The package provides direct financial help to Americans in the form of stimulus checks sent out to many Americans. The proposal would include a one-time payment of $1,200 per adult, $2,400 per couple in the U.S. and $500 a child.

The stimulus checks would phase out for individuals making more than $75,000 and would no longer qualify for those making more than $99,000. Those thresholds double for couples.

Democrats said the package specifically would help replace the salaries of furloughed workers for four months, rather than the three months first proposed. Furloughed workers would get whatever amount a state usually provides for unemployment, plus a $600 per week add-on, with gig workers like Uber drivers covered for the first time.

SENATE DEMS PROPOSE ADDITIONAL $200 IN MONTHLY SOCIAL SECURITY BENEFITS, AMID CORONAVIRUS OUTBREAK

Small Business Support

The massive economic relief package would provide a $367 billion program for small businesses to keep making payroll while workers are forced to stay home.

In addition, $562 million is also being put aside to help small businesses by ensuring SBA has the resources to provide Economic Injury Disaster Loans (EIDL) to businesses that need financial support. These loans will be available during an emergency period that ends June 30 and will be forgiven if the employer continues to pay workers for the duration of the public health and financial crisis.

Funding for Public Health

A large chunk of the bill focuses on public health, including $100 billion for a new program to provide direct aid to health care institutions on the front line of the coronavirus pandemic and $16 billion being allocated to replenish the Strategic National Stockpile supplies of pharmaceuticals, personal protective equipment, and other medical supplies, which are distributed to state and local health agencies, hospitals and other healthcare entities facing shortages during emergencies.

Another $4.3 billion will go to federal, state, and local public health agencies to prevent, prepare for, and respond to the coronavirus, including for the purchase of personal protective equipment; laboratory testing to detect positive cases; infection control and mitigation at the local level to prevent the spread of the virus; and other public health preparedness and response activities.

An additional $1 billion will be put into the Defense Production Act to bolster domestic supply chains, enabling the industry to quickly ramp up production of personal protective equipment, ventilators, and other urgently needed medical supplies, and billions dollars more for federal, state, and local health agencies to purchase such equipment.

CLICK HERE FOR COMPLETE CORONAVIRUS COVERAGE

Big Company Loans

One of the last issues to close concerned $500 billion for guaranteed, subsidized loans to larger industries, including a fight over how generous to be with the airlines, given that Democrats wanted them to abide by new carbon emissions restrictions. It includes $10 billion in grants to help the country's airports as the aviation sector grapples with the steepest and potentially sustained decline in air travel in history.

For airlines in particular, the bill includes $46 billion in total for the industry, with $25 billion going to passenger airlines, $4 billion for cargo companies, and $17 billion for companies deemed important to national security.

Republicans also won the inclusion of an "employee retention" tax credit that's estimated to provide $50 billion to companies that retain employees on payroll and cover 50 percent of workers' paychecks. Companies would also be able to defer payment of the 6.2 percent Social Security payroll tax.

With memories of the 2008 financial crisis still on the minds of many lawmakers, the bill will also the immediate disclosure of the recipients of any loans and stronger oversight. This includes installing an inspector general and congressionally appointed board to monitor and making sure companies can't use the loans for stock buybacks.

A final facet of the bill ensures that companies owned by President Trump's family can't receive any loans from the fund.

Fox News’ Ronn Blitzer, Tyler Olsen and The Associated Press contributed to this report.