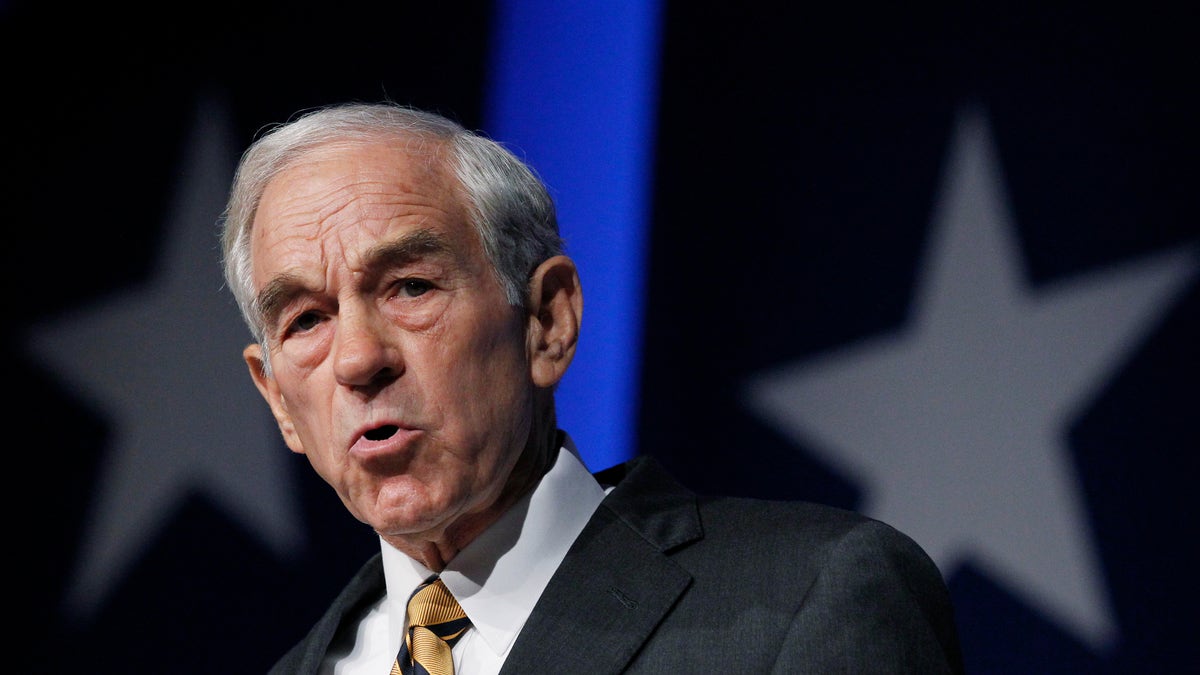

Oct. 8: Republican presidential candidate, Rep. Ron Paul, R-Texas, speaks at the Values Voter Summit in Washington. (AP2011)

Republican presidential candidate Ron Paul on Monday laid out an economic plan that would lower corporate and individual taxes and cut federal spending by $1 trillion during his first year in office, achieved partly by eliminating five cabinet-level departments.

Paul, a longtime Texas congressman, said he would close the departments of Education, Energy, Commerce, Interior and Housing and Urban Development, as part of a broader plan to cut federal spending. The federal work force would be cut by 10 percent. Mr. Paul also called for stopping foreign aid and "ending foreign wars.''

His "Plan to Restore America'' would end the estate tax and taxes on personal savings, "allowing families to build a nest egg.'' He would extend tax cuts on personal income, capital gains and dividends that were enacted under former President George W. Bush.

Mr. Paul has said he would support amending the Constitution to abolish the income tax, though that does not come up in his economic plan.

The corporate tax rate would fall under Mr. Paul's plan, to 15 percent from the current 35 percent, and corporations would be allowed to repatriate capital without paying additional U.S. taxes.

Some lawmakers have recently proposed a repatriation measure, saying it would free up capital to spur job growth. Critics of the idea argue that a tax holiday for companies with money abroad would not lead to domestic job creation.

The congressman also pledged to limit his presidential salary to $39,336, which his campaign says is "approximately equal to the median personal income of the American worker." The current salary for the president is $400,000 a year.