Member explains that something ‘practical’ needs to be done about YMCA transgender rule

YMCA member Rebecca explains her concern over seeing a naked man in the YMCA bathroom and speaking up about it on ‘Tucker Carlson Tonight.’

EXCLUSIVE: Over 25,000 organizations are supporting bipartisan legislation that would allow Americans to increase the amount of money that can be deducted in their federal taxes for charitable giving.

The bill led by Sens. James Lankford, R-Okla., and Chris Coons, D-Del., would specifically "extend the expired non-itemized deduction" for charitable giving that would ensure "Americans who donate to charities, houses of worship, religious organizations, and other nonprofits of their choice are able to deduct that donation from their federal taxes at a higher level than the previous $300 deduction."

According to the senators, the bill would allow taxpayers who did not itemize on their tax returns for 2023 and 2024 to get a deduction "valued at up to one-third of the standard deduction," which amounts to $4,500 for individuals and $9,000 for those married who file jointly.

Sens. James Lankford, R-Ky., is working on a bill to allow Americans to increase the amount of money that can be deducted in their federal taxes for charitable giving. (Lankford Press Office)

According to the IRS, the standard deductions for the 2023 tax year are $13,850 for individuals $27,700 for those who are married and filing jointly.

The Charitable Giving Coalition, which contains 175 member organizations, and the National Council of Nonprofits, which has over 25,000 member organizations, are backing the bill. In addition, United Way Worldwide, the YMCA and Salvation Army are main advocates of the legislation.

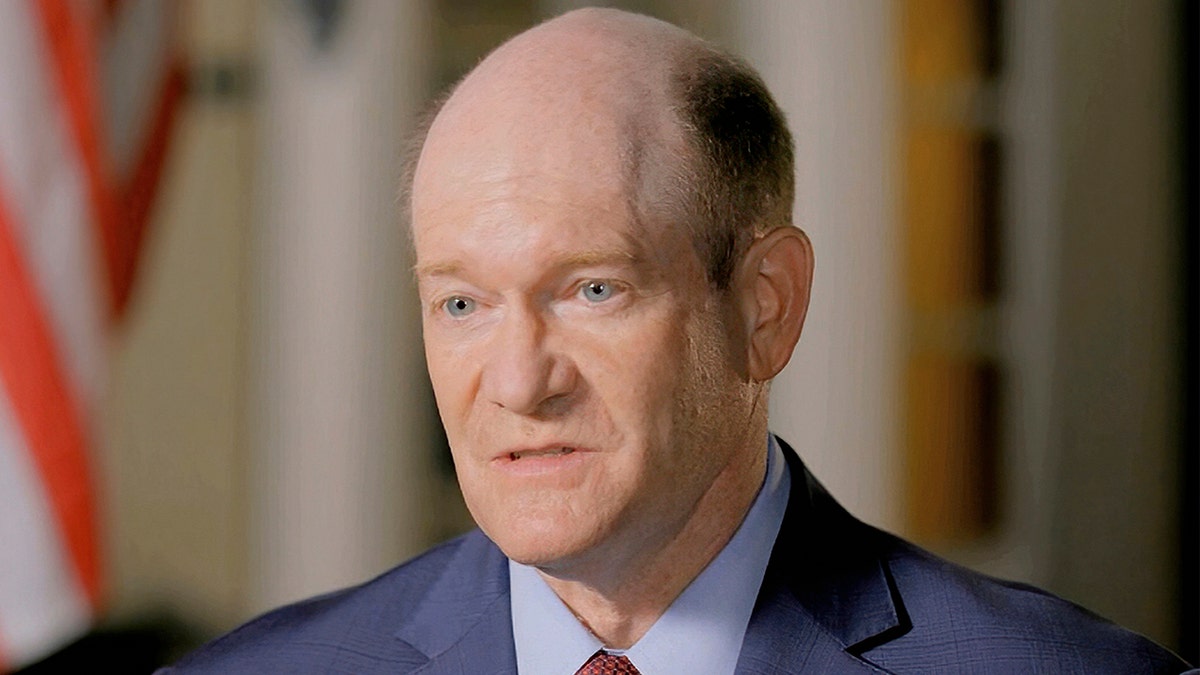

The bill is being led by Sen. Chris Coons, D-Del. (AP)

The Nonprofit Alliance, United Philanthropy Forum, The National Philanthropic Trust, Jewish Federations of North America, Independent Sector, Philanthropy Southwest, The Association of Fundraising Professionals, Council for Advancement and Support of Education, Faith & Giving and more also are backing the bill.

"Our families, our churches and other nonprofits are the first and most important safety net for the most vulnerable in our communities," Lankford told Fox News Digital. "Our nonprofits provide our neighborhoods and families vital job training, compassionate homeless assistance, food in times of crisis, and spiritual counsel during our best and worst days."

"As Oklahomans and Americans donate their time, money, and resources to our nation’s nonprofits, so they can serve people, they should be able to deduct more from their federal taxes as an incentive to financially support non-profits since these services are often in place of government benefits," he continued.

IRS ACCUSED OF USING ‘RACIAL EQUITY’ FOR AUDITS TARGETING WHITE, ASIAN TAXPAYERS

Federal tax forms are distributed at the offices of the Internal Revenue Service in Chicago. (Getty Images)

A federal non-itemized tax deduction for charitable giving of $300 was created by Congress in the Coronavirus Aid, Relief, and Economic Security (CARES) Act of March 2020. After the CARES Act provision expired in December 2020, the Taxpayer Certainty and Disaster Tax Relief Act of 2020 included a yearlong continuation through 2021.

According to a GOP aide, the Taxpayer Certainty and Disaster Tax Relief Act provision also moved the deduction below the line as to not impact taxpayer’s adjusted gross income. Lankford's proposed legislation expands it up to one-third of the standard deduction, but will keep it "below the line."

CLICK HERE TO GET THE FOX NEWS APP

Sens. Catherine Cortez Masto, D-Nev., Marco Rubio, R-Fla., Maggie Hasson, D-N.H., Raphael Wanock, D-Ga., Susan Colllins, R-Maine, Jeanne Shaheen, D-N.H., Tim Scott, R-S.C., Gary Peters, D-Mich., and Amy Klobuchar, D-Minn., also cosponsored the bill.