Fox News Flash top headlines for June 24

Fox News Flash top headlines are here. Check out what's clicking on Foxnews.com.

Rep. Jamie Raskin, D-Md., made an unusual historical comparison as he and other Democrats pushed to eliminate or relax the $10,000 cap on state and local tax deductions.

While speaking in favor of the policy that would chiefly benefit high earners in blue states, Raskin made a joke about Indian leader Mahatma Gandhi's 1930 Salt March protesting British colonial rule.

DEMS PUSH FOR SALT CAP RELAX, REPEAL WOULD LARGELY BENEFIT THE WEALTHIEST, STUDY SHOWS

"We've got to have a SALT march, like Gandhi did," Raskin said, generating laughter among his colleagues, according to NBC News. "Let's have a SALT march in America to restore some common sense to our tax policy."

Raskin claimed middle-class people in his district are "severely affected" by the SALT (state and local tax) cap on Wednesday.

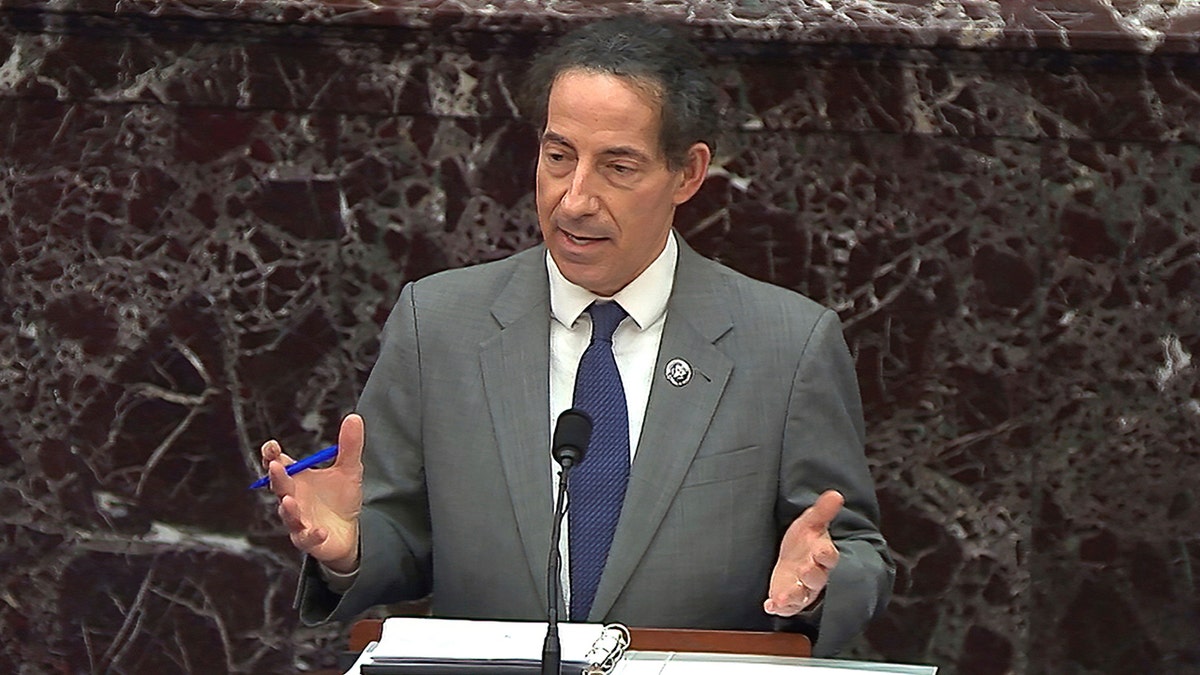

In this image from video, House impeachment manager Rep. Jamie Raskin, D-Md., speaks during the second impeachment trial of former President Donald Trump in the Senate at the U.S. Capitol in Washington, Wednesday, Feb. 10, 2021. (Senate Television via AP) ((Senate Television via AP))

Democrats representing high-tax states say removing the cap will act as a tax break to middle-class families in their districts, where residents face high income and property taxes.

An analysis conducted by independent think tank The Tax Foundation found that three of the adjustments lawmakers are proposing to the $10,000 cap, implemented as part of the 2017 Tax Cuts and Jobs Act, will solely help high earners.

Doubling the cap to $20,000 for joint filers, for example, would increase the after-tax incomes of people in the top 20% by an average of 0.2% — but more heavily favoring those in the top 10%.

Moving the cap to $15,000 for individual filers and $30,000 for joint filers would benefit those in the 95th to 99th income percentiles the most, according to the Tax Foundation. This group would see its after-tax incomes rise by 0.8%, while the top 1% would see a 0.4% increase.

Repealing the cap entirely favors those in the top 1% — with an expected 2.8% boost to the after-tax income of this group.

1% FRIENDLY SALT CAP REPEAL IS 'PART OF THE DISCUSSION' ON BIDEN'S $2.2T SPENDING BILL, PSAKI SAYS

None of the scenarios benefit any taxpayers in the 0%-to-80% income percentiles by more than 0.05%.

President Biden has repeatedly mentioned that his policies and tax proposals are designed to help middle-class families and not the millionaire and billionaire classes.

CLICK HERE TO GET THE FOX NEWS APP

"So for folks at home, I’d like to ask a question, do we want to give the wealthiest people in America another tax cut?" Biden previously said. "Or do you want to give every high school graduate the ability to earn a community college degree on their way to good-paying jobs or on the way to four years of school?"

The cap was implemented as part of 2017's Tax Cuts and Jobs Act.

FOX Business' Brittany De Lea contributed to this report.