Supreme Court precedent on student’s side: Swoyer

Attorney Alex Swoyer discusses a Michigan school district that is facing a lawsuit over a student choosing to wear Trump-related gear on "Fox News @ Night."

A Minnesota grandmother appeared to receive broad support from the Supreme Court on Wednesday over her state's seizure of her home for delinquent taxes. The property rights dispute could have nationwide implications over a state's authority to order homeowners to pay or risk losing everything.

In the nearly two-hour oral arguments on Wednesday, a clear majority of justices on both the left and the right appeared to be receptive to arguments from lawyers for Geraldine Tyler, 94, whose condominium was seized by Hennepin County, Minnesota, in 2015. The seizure was carried out as payment for approximately $15,000 in outstanding property taxes, penalties, interest and costs.

Tyler's home was then sold for $40,000, and under the state's forfeiture laws, the county kept the surplus proceeds. Minnesota is one of more than a dozen states (along with Washington, D.C.) that allows the practice.

Her lawyers called the state's policy a "home equity theft scheme."

The home of a 94-year-old grandmother, Geraldine Tyler, was seized by Minnesota for unpaid taxes. (Pacific Legal Foundation)

The case centered around the Fifth Amendment’s "Takings Clause," which states that "private property shall not be taken for public use, without just compensation."

Christina Martin of the Pacific Legal Foundation, representing Tyler, argued before the court that United States history is rich with examples of limitations on how and what the government can collect in taxes.

"When you look at the history of tax collection, it’s very clear that there were limits on how much could be taken throughout our nation’s history, and then also dating all the way back to Magna Carta," Martin said.

A ruling in the elderly homeowner's favor could give her a chance to go back and recoup some of the proceeds from the forced sale.

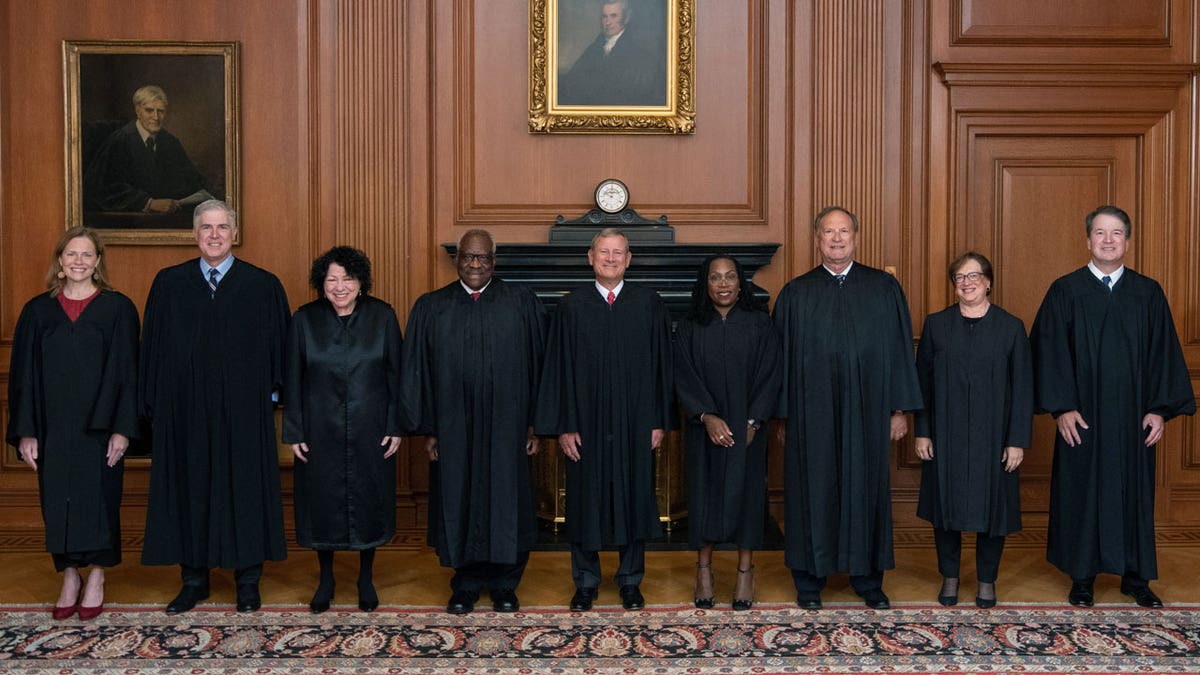

The Supreme Court justices seemed receptive to arguments made on behalf of 94-year-old Geraldine Tyler. (Collection of the Supreme Court of the United States via Getty Images / File)

Several on the bench questioned the state's take-all policy and pushed back against claims that homeowner rights are "extinguished" once the state seizes a property title.

"What's the point of the Takings Clause?" asked Chief Justice John Roberts. "That was something that was pretty important to the framers. Why did they put that in there if, in fact, the states ... were exercising extraordinary authority to take private property?"

"The Constitution seemed to have a different idea in mind," he said.

RED STATES PUT TAX MONEY TO BETTER USE THAN BLUE STATES: STUDY

Tyler owned her one-bedroom condo, but over time she and her family became concerned with rising crime in the neighborhood. After 11 years, the elderly woman began renting an apartment in a different part of town.

Property taxes on the vacant condo went unpaid from 2011 to 2015. The initial bill was $2,300, but the interest and penalties accumulated quickly, bringing the total bill to more than five times the original amount.

The state argues that it tried repeatedly to allow Tyler to retain equity in the home, saying extended repayment plans, financial counseling and special tax deferrals for elderly homeowners were in place to assist her if she had only asked.

Attorney Neal Katyal told the justices that the law was to incentivize residents to pay their taxes or face the consequences, and that the government did not want to be "real estate agents of last resort."

In 2015, after receiving multiple notices that Tyler's property would be forfeited, absolute title transferred to the state, with all debts and liens canceled. After that, officials said Tyler never tried to repurchase her property for the price of her tax debt, and thus recover any equity she may have had.

The condo was sold in November 2016 to a third party for about $40,000, although it had once been valued at $93,000. Under state law, Tyler was not entitled to receive $25,000 from the sale proceeds after satisfying the $15,000 debt. Instead, the county kept the whole amount.

Katyal said the records showed that Tyler no longer had any equity in the home, noting the outstanding mortgage and condo fees were higher than the $40,000 sale price. County officials maintain that the nonagenarian made clear she wanted nothing more to do with her condo after she left it unoccupied.

The state's case was sharply questioned.

"In every other circumstance, whether it's for assessing marital property, child support or private mortgage lender foreclosing, everybody else has to abide by the usual rule that you only take what you're owed," said Justice Neil Gorsuch. "It's just in this particular circumstance, the state favors itself. Why isn't that some indication of a punitive purpose?"

The Supreme Court (AP Photo / J. Scott Applewhite / File)

"Are there any limits to that?" asked Justice Elena Kagan. "I mean, $5,000 tax debt on a $5 million house, [the state can] take the house, don't [the state] give back the rest?"

But Justice Sonia Sotomayor cautioned about handcuffing state authority too greatly, saying that a broad ruling in favor of Tyler would be "a bomb into 240 to [250] years of history with respect to delinquent taxes."

"If you define it as the time the state takes title," Sotomayor said, "the state's being forced into being the agent for the seller, and it's going to have to take all the risk and all of the responsibility for whatever happens to that property until it's sold. Why would any state want to do that and why are you forcing states into that?"

CLICK HERE TO GET THE FOX NEWS APP

As for Geraldine Tyler, being homeless is not at stake. She now lives at a senior living community where her relatives say she enjoys playing bingo. The elderly plaintiff has refused all media requests and expresses amazement her case has attracted so much attention.

If she wins before the Supreme Court? Her lawyers say she may want to use any recovered money to buy a new mattress.

The case is Tyler v. Hennepin County (21-166). A ruling is expected in late June.