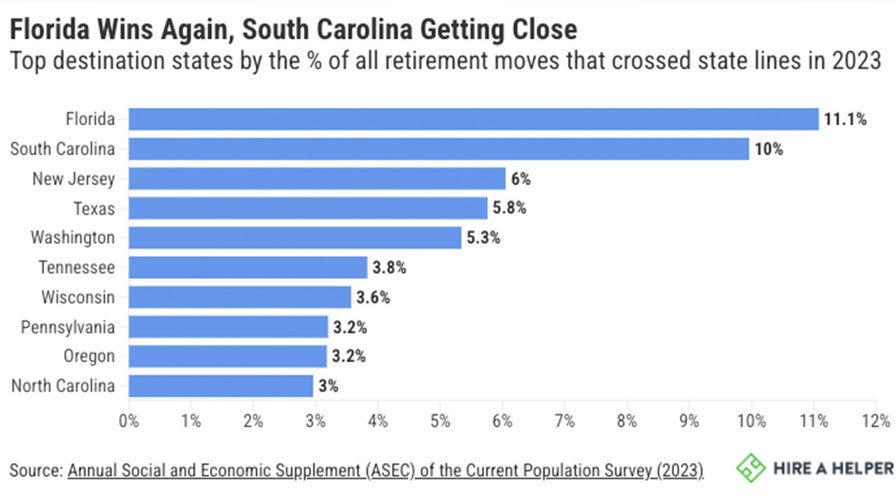

Retirement moves reached a three-year high in 2023 with Americans flocking to Florida

HireAHelper spokesperson Miranda Marquit breaks down the 3rd annual retiree migration study.

The lending institutions are taking advantage of senior citizens by squeezing their cash flow and penalizing their kids by overcharging them.

Adults over 65 years old account for more than 17% of the U.S. population, or close to 58 million. They enjoy a higher level of credit score at an average of 750 as compared to millennials (age of about 26 to 41) averaging a 687 score and Gen X (age 42 to about 57) averaging 706.

The FICO score disparity indicates that seniors represent less risk and have the discipline and financial responsibility of paying their bills on time and managing their debt effectively – a 740 or above represents very good and exceptional.

Over 63% of people over 65 have managed to pay off their mortgage. (iStock)

When it comes to home mortgages, their delinquency rate averages about 1.5% as compared to millennials and GenX's average of 2.4%. Baby boomers and the 65-plus represent a much more stable and steady mindset with a more reliable employment track record (average employment duration of 10 years as compared to two years and nine months for millennials.

MANY OLDER AMERICANS HAVING DIFFICULTY MANAGING DEBT, AARP SURVEY INDICATES

On average, they have less debt as compared to other age groups and have managed to reduce that debt by 7.5% in less than a decade or so. Although the seniors represent slightly over 17% of Americans they hold close to 10% of outstanding mortgages in the US.

Over 63% of people over 65 have managed to pay off their mortgage. To make matters worse, when seniors pay off their mortgages, they also lose any tax benefits from mortgage interest payments on any income they have!

Banks have strict lending qualifications, but penalizing seniors with higher interest rates is an unacceptable policy. (iStock)

Overall, the 65-plus are a much better bet and represent less risk than the other age groups that are subject to "at will" employment and are always a few weeks away from losing their so-called steady (W2) income. But that is not the way the mortgage industry views them.

The fact is that "research shows that borrowers face higher rejection rates as they age." According to Philadelphia Fed economist Natee Amornsiripanitch, "Overall, the results suggest that older individuals systematically face higher barriers to mortgage access." In simple words, seniors are discriminated against despite key indicators of their low-risk status.

MOST SENIORS IN AMERICAN CAN'T AFFORD NURSING HOMES OR ASSISTED LIVING, STUDY FINDS

Although a good number of seniors have savings, IRA accounts and homes with value over 100% of what their mortgage is, they are either not able to get a loan or have to pay a considerably higher rate to get a loan. This situation defies logic. If seniors are at higher risk because they don't have a steady W2, why should they be forced to pay a higher monthly payment and suffer higher financial pressure?

If banks keep turning them away, seniors are left with one option that eats away at their home value. (iStock)

Banks have strict lending qualifications, but penalizing seniors with higher interest rates is an unacceptable policy. Congress should prevent banks from continuing these discriminatory lending practices that squeeze the middle class and eat younger generations’ inheritance. The additional interest payments made to the banks are directly taken from what parents can leave their kids.

I understand that seniors can’t be given a free pass for financial services based on "good deeds" alone, but something needs to change. Even if older adults can’t be given discounted loan rates, they should at least receive the same treatment as younger people taking on the same financial burdens.

If banks keep turning them away, seniors are left with one option that eats away at their home value and widens the wealth gap. Reverse mortgages are touted as a solution for seniors' financial woes but they never resolve systemic issues. If anything, they jeopardize the value of an older adult's most precious asset.

Overall, the 65-plus are a much better bet and represent less financial risk than other age groups. (iStock)

CLICK HERE FOR MORE FOX NEWS OPINION

At the benefit of the mortgage industry, we are diminishing senior wealth. Seniors and younger generations who plan to inherit these properties both receive the short end of the stick.

Addressing this crisis requires decisive action on multiple fronts. First, regulatory bodies like the FDIC must amend regulations to mandate equitable lending practices, aligning loan allocation with demographic proportions to mitigate discriminatory practices.

Second, to ensure that this happens, seniors and their supporters must leverage their collective voting power to pressure Congress into enacting legislation that holds banks accountable for rectifying this systemic injustice and preserving economic security.

Additional interest payments made to the banks are directly taken from what parents can leave their kids. (iStock)

CLICK HERE TO GET THE FOX NEWS APP

Implementing these reforms promises substantial economic contributions, a sustained increase in consumer spending, and lower dependence on government support programs. Today seniors are paying for over $1 trillion of mortgage value – every 1% of adjustment in unreasonable rate impositions will deliver close to $10 billion to the economy.

It’s time to redesign the flawed, ageist financial system to uphold the principles of economic justice for all.