Fox News Flash top headlines for June 28

Fox News Flash top headlines are here. Check out what's clicking on Foxnews.com.

Editor’s note: This essay is adapted from the new book "You Will Own Nothing," by Carol Roth, coming out July 18.

Social credit systems, whether formal or informal, are used to keep individuals in line with the elites’ narratives-of-the-day. Step out of line, and you may find that your social standing, job or assets are targeted as a means to attack your freedoms, including your wealth-building opportunities.

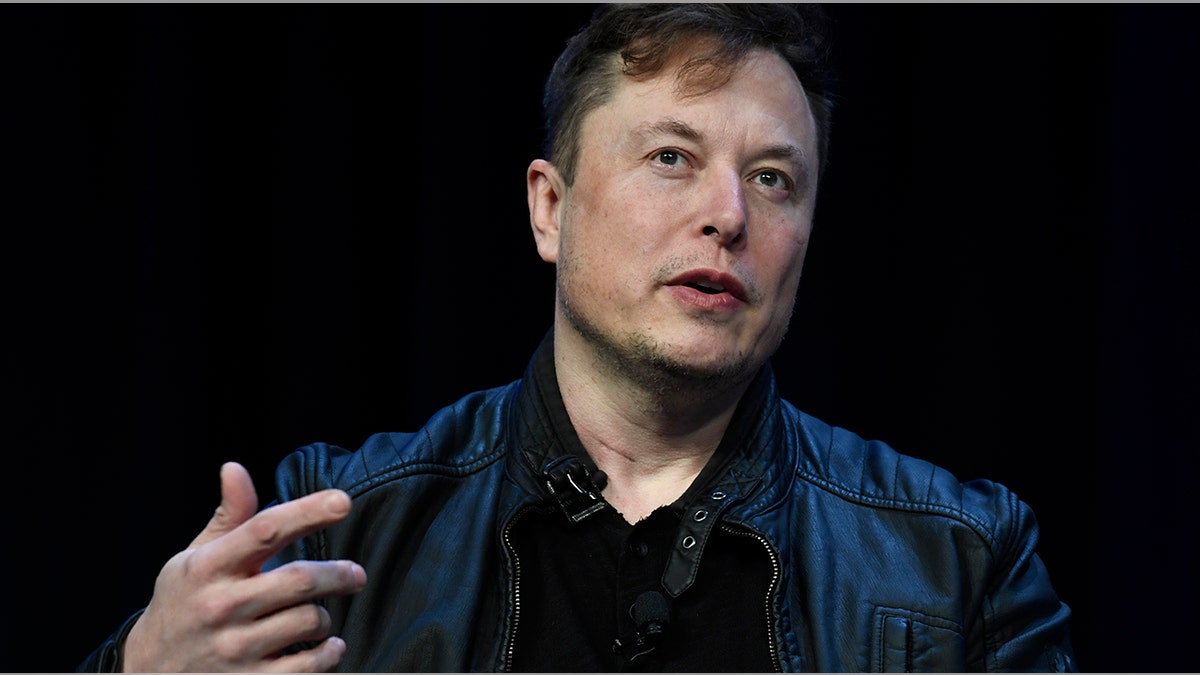

If you are a businessperson and you step out of line, or even don’t conform to the desires of the elites, you are attacked using an emerging business social credit system: ESG. This bastardization of capital allocation is so powerful that it can even come for those with substantial wealth and power, like the richest man in the universe — Elon Musk.

ESG, which stands for environmental, social, and corporate governance, and is also referred to in concept with terms like "stakeholder capitalism" and "sustainable investing," encompasses various nonfinancial criteria for companies and their investors. ESG is based on some elites’ own decisions around morality and "what is good for society." (That always ends well, doesn’t it?)

It is somewhat difficult to explain what ESG is because it shifts and changes around a moral code dictated by a relatively small number of people without specificity. This shifting is deliberate, so ESG can serve the elites’ whims as their ideas and priorities shift.

Tesla Chief Executive Officer Elon Musk was targeted by ESG because he supported free speech as part of his takeover of Twitter. (AP Photo/Susan Walsh, File)

Like many bad and dangerous ideas, ESG sounds like it makes sense on the surface. Most people would concur that we want to be good environmental stewards. On the social and governance side, it makes sense to treat employees well and incorporate diversity in many forms. Where ESG goes sideways is in its actions.

Basic free-market economic tenets largely solve many social, governance, and even environmental issues. People don’t want to do business with companies that don’t treat employees well. As a business, your employees are stewards of your brand; unhappy employees become unhappy brand stewards who often engender negative customer responses. Self-regulating and reaching equilibrium is all built into the model.

The same goes for diversity. Those who seek out diverse perspectives and experiences and incorporate them in an authentic manner often see better business results.

So, ESG concepts make general sense. However, once they have been co-opted by the elites for their own agenda, they become bastardized and guided to central planning outcomes. As we have learned throughout history, and paid the price for in recent years, this is never to anyone’s benefit other than the central planners and their cronies.

Imagine a bunch of entitled elites and bad actors sitting around a conference table and asking, "How can we give businesses a social credit score so that they do what we want them to do instead of what’s in the best interests of their shareholders, customers, and business model?" That’s ESG at its core.

What started with perhaps good intentions has now become a hybrid scam and capital diverter.

Enter Musk. Surely the richest man in the universe and one who is well-connected like Musk could escape the ESG fate? Not so much.

In mid-May 2022, after the billionaire serial entrepreneur announced his takeover bid for Twitter to fix its widely perceived censorship issues, Musk found that another one of his businesses had been impacted. Tesla, the world’s leading electric vehicle manufacturer, was removed from the S&P ESG 500 index.

The new Carol Roth book "You Will Own Nothing" comes out July 18 and shows how the left abuses strategies like ESG to gain power.

Maggie Dorn, head of ESG Indices North America at S&P Dow Jones Indices, who decides which companies are put in and removed from the index, wrote in a post about Tesla’s removal, "A few of the factors contributing to its 2021 S&P DJI ESG Score were a decline in criteria level scores related to Tesla’s (lack of) low carbon strategy and codes of business conduct."

The "codes of business conduct" part sounds an awful lot like they disapproved of Elon’s recent stances and affirm the notion that ESG is a corporate social credit score.

Musk responded in a tweet, "Exxon is rated top ten best in world for environment, social & governance (ESG) by S&P 500, while Tesla didn’t make the list! ESG is a scam. It has been weaponized by phony social justice warriors." He also said that the ratings firm had lost its integrity and warned that political attacks on him would escalate in the coming months.

Leveraging ESG in this way was not just a direct attack on Musk, but also Tesla’s shareholders, who would lose the benefits attached to being part of the index.

If Musk could be targeted by negative business social credit for daring to champion free speech, what chance do other companies and their management have?

The entire fossil fuel industry found itself short on capital when ESG directives moved capital away from the industry, a maneuver that has led to not only more expensive prices for direct and derivative products alike over the past several years, but also has created massive underfunding in the sector for the future.

So, when you see CEOs and other company executives making decisions that may seem to be counter to the interest of the company, its customers, and even its shareholders, know that it may be an ESG-led bullying or hostage situation.

An executive may decide to sacrifice what is best in the short term for actual shareholders and those personally and otherwise invested in the company so that the powerful ESG-purveyors don’t target them in the long run.

So, ESG concepts make general sense. However, once they have been co-opted by the elites for their own agenda, they become bastardized and guided to central planning outcomes. As we have learned throughout history, and paid the price for in recent years, this is never to anyone’s benefit other than the central planners and their cronies.

ESG, which has been entrenched throughout the business ecosystem by players including the United Nations, the World Economic Forum, leading wealth management firm BlackRock and others, is a powerful tool being wielded by equally powerful individuals, businesses and institutions.

Moreover, there is a ton of money to be made in it. Dan Katz, a former senior advisor at the Treasury Department, wrote in Barron’s that ESG had attracted more than $40 trillion in assets. With all of the money to be made and power to be leveraged, it’s a significant, sticky problem.

Under President Joe Biden, the Department of Labor’s Employee Benefits Security Administration put in place a rule effectively saying benefit plan managers no longer have to invest in your best financial interest; now they can favor ESG and economically targeted investments (ETIs). This codifies business social credit at your expense.

It throws the long-held fiduciary duty standard that employee benefit plans must follow in terms of picking investments that maximize shareholder value to the wind and allows nonfinancial criteria, such as, you guessed it, ESG, whatever the powers that be deem it to be that day, to take precedence.

BlackRock CEO Larry Fink reportedly argued the term ESG was being "misused by the far left and far right." (REUTERS/Brendan McDermid)

You lose twice, as your wealth is being used to strong-arm businesses and their management, who then can’t run their business in a way that maximizes value for you as a shareholder.

CLICK HERE TO GET THE OPINION NEWSLETTER

BlackRock, the largest asset manager in the world, has been very vocal about these tactics. In a 2020 letter to CEOs, BlackRock said, "…we will be increasingly disposed to vote against management and board directors when companies are not making sufficient progress on sustainability-related disclosures and the business practices and plans underlying them." The message is clear — you will not succeed if you are not aligned with the elite. That is not capitalism; that is a corporate version of fascism.

As more people have started call out ESG, now its shepherds are trying to backtrack — but in name only. BlackRock’s Larry Fink at the Aspen Ideas Festival said he was going to not use ESG as a term any longer because it has been politicized. (Yeah, thanks to him and his cronies.)

CLICK HERE TO GET THE FOX NEWS APP

It was reported that he said, "I'm not going to use the word ESG because it's been misused by the far left and the far right." Actually, it is ESG that is a misuse in and of itself and nobody cares about the phrase; the issue is the actions being taken under that banner.

Elon Musk has called ESG "the devil" and that seems fairly accurate. A small group of people are holding the economy hostage. We need an exorcism to get rid of this devil in our lives and our businesses — our individual wealth creation opportunities, our freedom and the global economy hangs in the balance.