After an unusually bitter election, Democrats will assume control of the House of Representatives in January. This means that the future of the Trump administration’s policy agenda is more tentative than ever, particularly with regard to trade.

As an assistant secretary at the U.S. Treasury and before that the staff director of the U.S. Senate Finance Committee, I spent much of my career advancing many of the president’s policy goals, including policies that impact international trade.

Now, key elements of the president’s trade agenda face major hurdles in Congress at a time when the administration is hoping to make progress with China. This likely will mean more anxiety and instability in the business community.

Trade policy is a key economic issue that affects all Americans. Leaders within the administration must develop a plan to deal with the coming political gridlock. At the same time, business leaders and investors must consider the potential impact a legislative stalemate could have on supply chains, valuations, financial markets, and other key factors in the coming months.

The administration recently struck a deal to replace the North American Free Trade Agreement (NAFTA) with the new United States-Mexico-Canada Agreement (USMCA). While this was one of the president’s most noteworthy achievements to date, the agreement may never be ratified with Democrats controlling the House. That could cause even more uncertainty.

If the USMCA fails to make it through Congress, NAFTA will remain in effect. However, the president could elect to unilaterally withdraw from the existing agreement, either as a strategy for leveraging a vote on the USMCA, or to fulfill a campaign promise.

The U.S. economy continues to hum along, but there are warning signs of potential tough times ahead, and a prolonged trade war, backed by both parties, can only exacerbate such conditions.

While unlikely, such a turn of events would be extremely disruptive for countless American industries, including farmers and auto manufacturers, among many others.

Yet such a scenario does not have to come to pass. House members should abide by their pledge to reach across the aisle and promptly ratify USMCA as a demonstration of its good faith and its commitment to protecting Americans from the destabilizing effects of uncertainty.

Meanwhile, it’s quite possible that the current trade impasse with China will continue or even escalate.

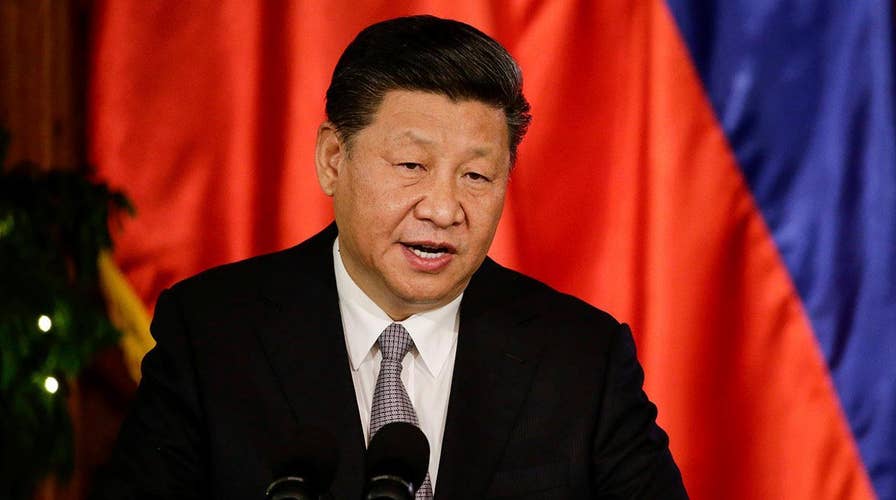

The Asia-Pacific Economic Cooperation summit held earlier this month ended with the leaders failing to produce a joint statement amid U.S.-China trade tensions. Some clarity may emerge from President Trump’s meetings with Chinese President Xi Jinping at the G20 summit in Argentina later this week.

But the president has made it very clear that he will only agree to a deal that puts America back in the driver’s seat on global trade. If these meetings don’t go well, we will likely see another round of tariffs on Chinese imports, perhaps as high as 25 percent on $200 billion worth of goods starting in 2019.

Many have speculated that even Democrats will support and encourage the president’s tough stance on Beijing. Yet I submit that heightened trade rhetoric is in no one’s best interest, particularly in the wake of a slowdown in business spending as recently noted by the Federal Reserve.

The U.S. economy continues to hum along, but there are warning signs of potential tough times ahead, and a prolonged trade war, backed by both parties, can only exacerbate such conditions.

I encourage lawmakers on both sides of the aisle to find common ground and work with the administration to find another way – one that doesn’t drive down profits for major drivers of our domestic economy.

None of these outcomes is set in stone and some even seem improbable. But as the dynamic in Washington changes, responsible business leaders – who are fiduciaries to both their retail and institutional investors – will not be able to stand by with their fingers crossed, hoping it all works out.

Instead, they should take proactive measures to mitigate the risk now. Companies should begin developing contingency plans including relocating production facilities; postponing or adjusting hiring, construction and investment plans; and considering alternative markets.

Take auto manufacturers and parts suppliers as an example of an industry facing substantial impact as the debate over USCMA unfolds. Companies in this industry should be thinking now about potential supply chain disruptions in the coming year, and starting to identify potential secondary suppliers that would allow them to continue production and distribution at a reasonable cost.

Meanwhile, firms that have incorporated Chinese market access into their growth strategies should be anticipating that this access, or its economic appeal, is likely to be curtailed in the near future by rising tariffs on both sides. CEOs and CFOs should be thinking about how this changing global landscape may impact their companies' valuation and financing strategies, and preparing accordingly.

These scenarios will inevitably differ for U.S. companies based on industry, size and global reach. But with the shifting political landscape, these are important considerations for all businesses.

Ultimately, the only thing we can reasonably expect when it comes to trade policy is more uncertainty. Choosing not to think about and plan for the uncertainty is a luxury no business can afford – and one that shareholders should not allow.