Joe Biden suggests he will repeal Trump's tax cuts if elected

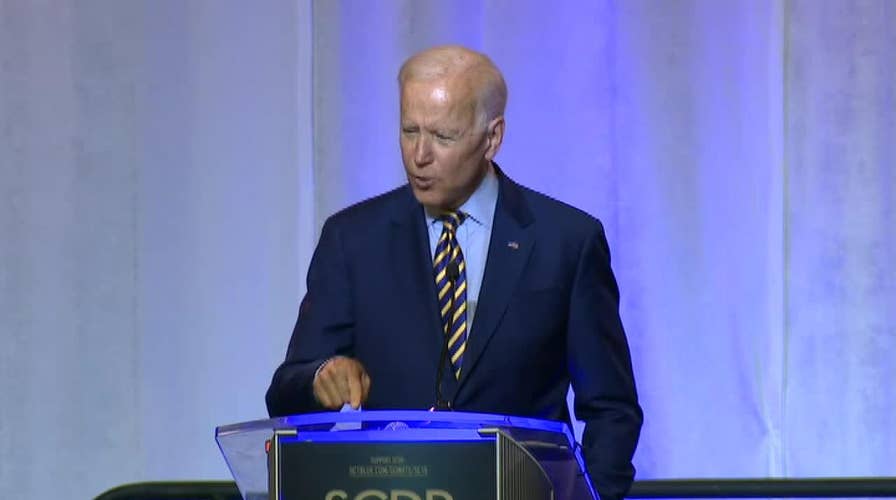

Joe Biden speaks at the South Carolina Democratic Convention.

In dueling campaign rallies, former Vice President Joe Biden and President Trump made their argument to voters in Iowa. Biden joined his Democratic opponents in calling for higher capital gains taxes to pay for his pet programs.

Democrats are racing to the left in a desperate attempt to mollify their radicalized base. Almost every 2020 Democratic presidential candidate is abandoning capitalism.

Sen. Elizabeth Warren, D-Mass., who has said she is a "capitalist to my bones," sings the same chorus with her massive wealth tax plan. Her campaign estimates that it would cost the American people $3 trillion over 10 years.

Taxing the rich is never the answer, and it’s proven to bring in far less revenue than one may optimistically estimate due to many factors.

Sen. Bernie Sanders, I-Vt., introduced a bill earlier this year called "For the 99.8 Percent." This legislation would heavily tax the 0.2 percent of the country by taxing the estates of those who inherit more than $3.5 million. This would eliminate the ability to pass hard-earned companies, such as family farms, down to new generations.

Despite the left’s best efforts, the Trump economic plan keep fueling the incredible growing economy we’re currently experiencing in the United States. For the large field of Democratic candidates, that's a big problem. Not one can deny Trump’s "America first" economic policies are working.

We have seen Democratic candidates across the board rail against Trump’s tax cuts in a completely falsified messaging campaign. They want to implement more taxes instead. A gas tax, a carbon tax, a wealth tax, higher capital gains tax, carried-interest capital gains, you name it, they will raise it! But despite the left’s best efforts, the Trump economic plan keep fueling the incredible growing economy we’re currently experiencing in the United States.

For the large field of Democratic candidates, that's a big problem. Not one can deny Trump’s "America first" economic policies are working.

American workers are seeing their wages increase at a rate not seen in more than a decade. The New York Times earlier this month even ran a column, the headline of which reads “Why Wages Are Finally Rising, 10 Years After the Recession.”If our nation wants to remain the economic powerhouse it has become in recent years, it is imperative that policy proposals which would stunt domestic growth remain on the cutting-room floor.

A higher gas tax? No! Motor fuel is one of the most taxed goods in America. A higher gas tax would hurt working Americans and increase the cost of goods. Some estimates suggest that raising the gas tax by even 1 percent takes a whopping $1 billion out hardworking families' pockets. Raising the gas tax simply doesn’t solve the real problem, but lowering it does.

A higher carbon tax? No! What Americans don’t know is that carbon taxes hit consumers hard almost everywhere imaginable — grocery stores, shopping centers, you name it. And if we want to get to the root of our world’s pollution problems, let’s start with China, which emits more carbon dioxide than America and the European Union combined.

A wealth tax? No! This is not only a radical idea but a terrible one no matter how you slice it. It would wreak havoc on our healthy economy. Taxing the wealthy even more than we already do would drain resources that go toward the entrepreneurs who create startups and small businesses.

Higher capital gains taxes? No! Taxing long-term investment would be a blow to thousands of good-paying jobs. This would hurt our local communities and job creators the most. Why would we want to punish entrepreneurs who risk everything to start small businesses on "main street" and bring new jobs to our neighborhoods?

CLICK HERE TO GET THE FOX NEWS APP

Higher taxes are never the solution. Trump’s economy is doing better than ever thanks to the tax reform he signed into law in December 2017. The unemployment rate is at the lowest level in over 50 years, wages are at a 10-year high, and over four million jobs have been created since Trump took office.

When we lower taxes, Americans are better off because they keep more of their hard-earned income instead of letting the fiscally reckless government dictate where it is spent.