Bud Light has yet to address the problem ‘head on’: Anson Frericks

Former Anheuser-Busch executive Anson Frericks joined ‘Fox & Friends Weekend’ to discuss the latest Bud Light backlash as the brand continues to struggle to win back customers.

Bud Light has been dethroned, relinquishing the crown after its two-decade reign as America’s best-selling beer came to an end last week.

Its fall from grace is no surprise. The backlash from Bud Light’s controversial partnership with Dylan Mulvaney has been plaguing the company for months. Anheuser-Busch’s bungled response hasn’t helped.

Initially, the company made a massive blunder with its CEO’s flat response that neither mentioned the controversy nor apologized for it. Since then, it’s effectively doubled down on its "nothing to see here" strategy, remaining virtually silent despite a persistent 25% drop in sales and billions of dollars in lost market value.

GARTH BROOKS CONTROVERSY: BUD LIGHT DRAMA FOLLOWS SUPER BOWL WALKOUT

But while the Clydesdales at Anheuser-Busch might be running from customers, they can’t hide from shareholders. Next month, Anheuser-Busch will be forced to answer shareholder concerns on its second quarter earnings call. To avoid another gaffe, it must prepare now.

Bud Light sales have plummeted since a promotional partnership with transgender activist Dylan Mulvaney caused widespread backlash. (Instagram)

Company earnings calls are usually well-scripted affairs. CEOs highlight the company’s business plans and give updates on how much they think the company will earn.

Shareholders and Wall Street analysts take notes so they can update their own predictions of how the company’s stock will perform. If projections go up, stock prices usually increase; if sales fail to meet expectations, or if expectations drop, stock prices typically decline.

But that’s not all that happens. Participants also get to ask questions and ask questions they will. Shareholders can hold Bud Light accountable in a way that its customers can’t. And they have the chance to do so before Anheuser-Busch’s head-in-the-sand strategy causes more precipitous declines.

There’s little doubt that the company is in jeopardy of failing to meet its projections. In 2021, CEO Michel Doukeris told shareholders to expect 4-8% annual EBITDA (Earnings Before Interest Taxes Depreciation and Amortization) growth from 2022-2025.

This was a relatively unambitious target, in line with the historical 6% earnings growth in the five years pre-COVID-19, now barely outpacing inflation. It should have been a layup.

In 2022, it was. Anheuser-Busch grew earnings 7.1%. Its stock outperformed the S&P 500. Analysts expected 2023 to be even better, predicting 7.4% earnings growth.

Anheuser-Busch was set to overdeliver again. In the first quarter of 2023, earnings increased 13.6% over the prior year. Emerging markets like South America, Africa, and Asia saw strong beer volume growth combined with decreased commodity prices and shipping costs, boosting profits.

In the U.S., prices increased ahead of inflation, driving revenue and earnings gains. Shareholders were rewarded as Anheuser-Busch’s stock price grew 12% versus the S&P 500’s 7%.

A picture of the commemorative Bud Light can featuring TikTok influencer Dylan Mulvaney. (Dylan Mulvaney/Instagram)

On April 1, a single Instagram post changed everything. U.S. sales tanked and haven’t recovered.

Anheuser-Busch’s stock declined over 10%. By comparison, the S&P 500 is up 7% and Molson Coors, Anheuser-Busch’s largest rival, is up almost 30%.

During the company’s first quarter earnings call in May, Doukeris projected confidence that Anheuser-Busch could still deliver on its humble 2023 earnings goal. He also downplayed the Bud Light controversy, claiming "[i]t’s too early to have a full view on the impact" and noted that the company has navigated prior challenges, including temporary beer sales bans in certain countries during COVID-19.

Such handwaving is unlikely to satisfy shareholders come July. To the contrary, financial analysts will almost certainly demand more details on how 2023 earnings growth is shaping up, as well as what Anheuser-Busch is doing to right the ship.

Participants also get to ask questions and ask questions they will. Shareholders can hold Bud Light accountable in a way that its customers can’t. And they have the chance to do so before Anheuser-Busch’s head-in-the-sand strategy causes more precipitous declines.

Five analysts have already cut Anheuser-Busch’s ratings and the Wall Street consensus is that the company’s 2023 earnings growth will decrease from 7.4% to 6.5%. More ratings and projections cuts are likely.

The only way to stop the bleeding is for Anheuser-Busch to disclose clear plans on how it intends to regain Bud Light sales. Bud Light represents 30% of the company’s US earnings, which itself constitutes 30% of global sales. That means Bud Light alone represents around 9% of total sales.

Those sales have been down around 30%, implying a 3% hit to earnings if the trend remains. If Bud Light can regain those sales, it can overdeliver the 6.5% consensus number and maybe even meet the 8% goal. If it can’t, it risks falling below the 4% floor.

Analysts must be pointed: "What, specifically, is Bud Light doing to win consumers back?" So far, Anheuser-Busch has tried camouflage bottles, deep discounts and tripling media spending on less controversial Bud Light advertisements.

None of it is working. And it won’t work until Bud Light clearly addresses the issue. The question is whether, and how, it intends to do so.

Analysts must also dig deeper: "What financial trade-offs is Anheuser-Busch making to fund the support for Bud Light?" Talk may be cheap, but the kind of damage control Anheuser-Busch is pursuing costs a pretty penny.

The company is shelling out hundreds of millions of dollars it wasn’t planning to spend on rebates, advertising, sales rep compensation and freight reimbursements — all while sales are plummeting. This money is coming from somewhere.

CLICK HERE TO GET THE OPINION NEWSLETTER

Did it come from marketing cuts in faster growing markets that will now slow? From cutting planned innovation? Were critical IT projects delayed? Is the company taking on additional debt when interest rates are at all-decade highs?

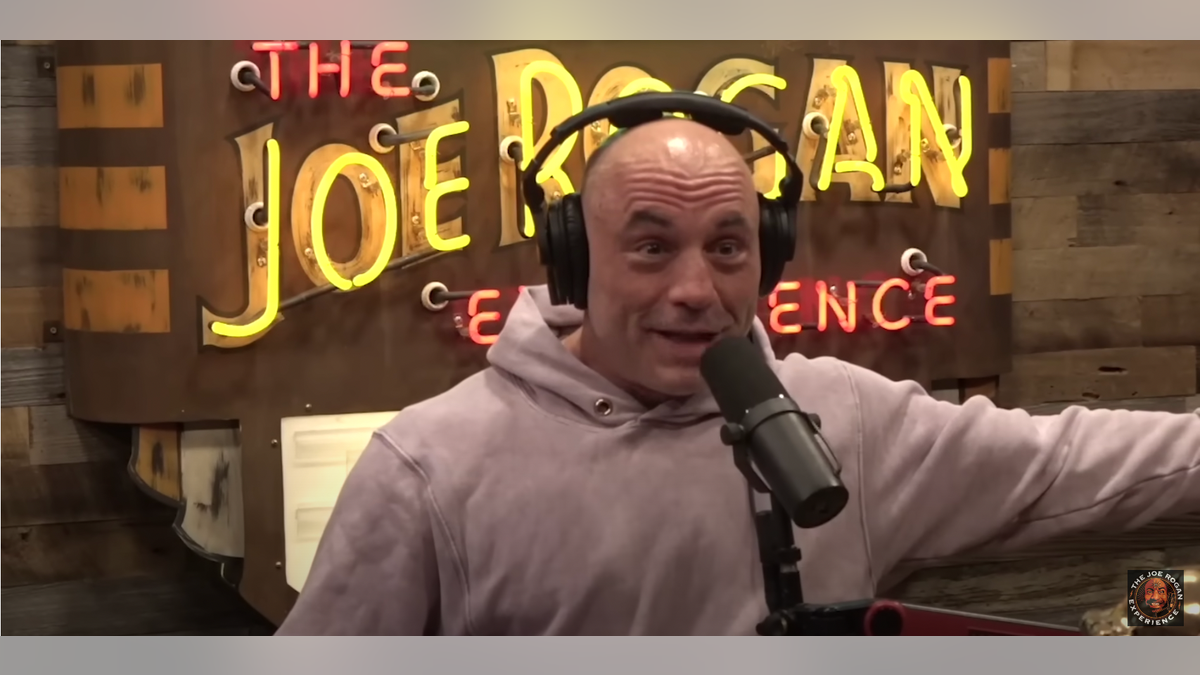

Podcast host Joe Rogan laughed at Budweiser's new patriotic ad intended to quell backlash to Dylan Mulvaney controversy. (Screenshot/YouTube/JoeRoganExperience)

Perhaps most important is for analysts to understand Anheuser-Busch’s long-term thinking: "If Bud Light doesn’t turn around, is this support sustainable, or are layoffs and austerity measures inevitable?"

The answer is critical. Not just because cuts are always painful, but because just last week, Bud Light proudly announced it was "protect[ing] the jobs of our frontline employees" and "providing financial assistance to our wholesalers."

CLICK HERE TO GET THE FOX NEWS APP

Retaining idle workers is an expensive strategy, and one that can only last so long; staking a PR campaign on it is a risky endeavor. In the end, Anheuser-Busch’s latest PR move appears to be more of the same — try anything, so long as it doesn’t involve addressing the controversy directly — rather than part of a long-term strategic plan.

Anheuser-Busch has a lot to answer for. If the company has not yet figured out how to respond, it needs to do so now, because come July 28, there will be no hiding from shareholders.