Fox News Flash top headlines for March 31

Fox News Flash top headlines are here. Check out what's clicking on Foxnews.com.

Three years have passed since COVID-19 sparked a near-total closure of American society, and we are still counting the cost. From the death toll of the disease itself to the impact of virtual schooling on Generation Z, the effects of the pandemic and government-imposed lockdowns cut deep and range wide.

But, for all that, we should not forget how much worse things could have been. When state and local governments across the country began shutting down the economy, millions of small businesses and tens of millions of workers faced financial ruin.

In April 2020, more than 20 million Americans lost their jobs. Economists predicted 8 million additional layoffs in May. That would have meant the highest unemployment rate since the Great Depression, not to mention a cascading crisis in real estate.

In response, I led Congress in creating the Paycheck Protection Program (PPP), which in less than two weeks began distributing forgivable loans to small businesses. In May alone, the program sent $150 billion to employers, who used that money to keep their workers on payroll and even bring back furloughed or terminated employees.

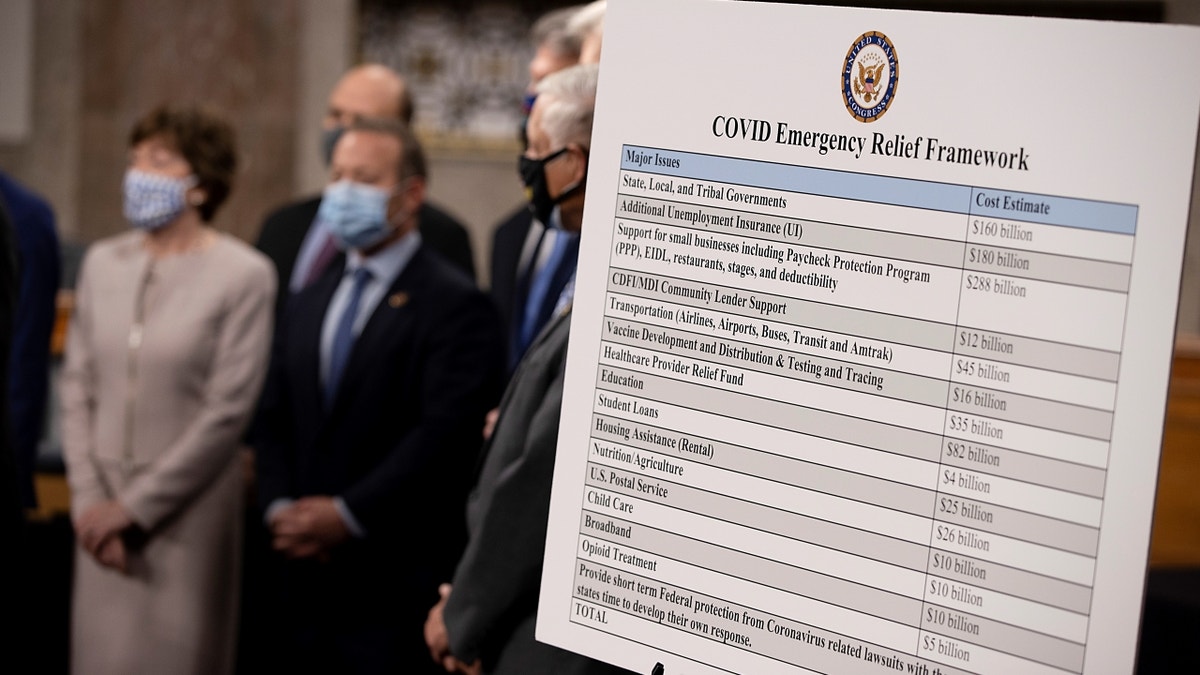

A bipartisan group of Democrat and Republican members of Congress as they announce a proposal for a COVID-19 relief bill on Capitol Hill on December 01, 2020, in Washington, DC. The roughly $908 billion proposal includes $288 billion in small business aid such as Paycheck Protection Program loans. (Getty Images)

The result was nothing short of remarkable. Instead of losing jobs in May, the economy actually gained 2.5 million of them, overcoming the crushing impact of the lockdown orders.

Today, it’s fashionable for the media to blame PPP for fraudsters who exploited the system, but those critiques are wrongheaded. To be effective, the program had to be implemented at a breakneck speed with the understanding strict enforcement would come after the crisis passed. The Biden administration’s failure to verify borrowers’ information before forgiving the loans, on the other hand, was negligent at best, criminal at worst.

Even accounting for fraud, however, the program was an overwhelming success. Roughly 90% of the $800 billion issued in forgivable paycheck protection loans went to legitimate businesses for legitimate purposes.

Moreover, the vast majority of those funds went to critical industries, of which manufacturing benefited the most. Altogether, the program supported 55 million jobs — including 6.1 million in my home state of Florida — with an average business size of 20 employees.

One economist, Douglas Holtz-Eakin, called PPP "the single most effective fiscal policy ever undertaken by the United States government." Without it, Wall Street would have received the same sweet deal it got in 2008. Washington would have issued bailouts to big banks and corporations, which would have used the crisis to buy, consolidate, and sell their smaller competitors. But Main Street — and America — would never have been the same.

This isn’t just a story about macroeconomics, though. It’s the story of Tony Alonso’s family-owned construction company, which used a PPP loan to bring back furloughed employees, pay health insurance premiums, and take care of rent and utilities within a week of the loan’s approval. It’s the story of Flags of Valor, a veteran-operated business that "restored our entire team back to work" through the program.

CLICK HERE TO GET THE OPINION NEWSLETTER

And it’s the story of Viv Helwig, who relied on PPP to build up his specialty manufacturing firm. That firm is Vested Metals, a Florida-based startup that supplies "everything from the fan blades of a Rolls-Royce airplane engine to the implant prosthesis used in spinal-fusion surgery."

It’s the kind of high-growth innovator crucial to ensuring national strength in the 21st century. But, for Viv and his workers, it’s also a vital source of income and represents the dream of a better life. The pandemic lockdowns threatened the worst to Vested Metals, but PPP enabled Viv to power through the crisis — and to double his staff from seven to 13 along the way.

Even accounting for fraud, however, the program was an overwhelming success. Roughly 90% of the $800 billion issued in forgivable paycheck protection loans went to legitimate businesses for legitimate purposes.

These stories demonstrate the effectiveness of the program’s design, which my bipartisan colleagues and I arrived at via our determination to keep Americans connected to the workforce. Our goal was always to issue forgivable loans, but we insisted on one condition — that 75% of those loans go to payroll. We wanted to protect the workers in addition to the small businesses, and we were successful.

CLICK HERE TO GET THE FOX NEWS APP

Looking back on pandemic relief spending as a whole, it is obvious that the Democrats turned many of the initial short-term, targeted measures into a massive boondoggle, creating the inflation we continue to suffer from today. But I would do PPP all over again without hesitation. I have no regrets, because I was not going to sit back and let lockdowns destroy the economy.

Though it’s fashionable to play the cynic, I believe the Paycheck Protection Program truly is one of our nation’s great success stories — one Americans can be proud of for generations to come.