Sen. Marsha Blackburn reacts to Biden vetoing bill restricting ESG: 'Very political move'

Sen. Marsha Blackburn, R-Tenn., joined 'The Faulkner Focus' to discuss Biden's first veto and the impact of Biden's policies on the border crisis.

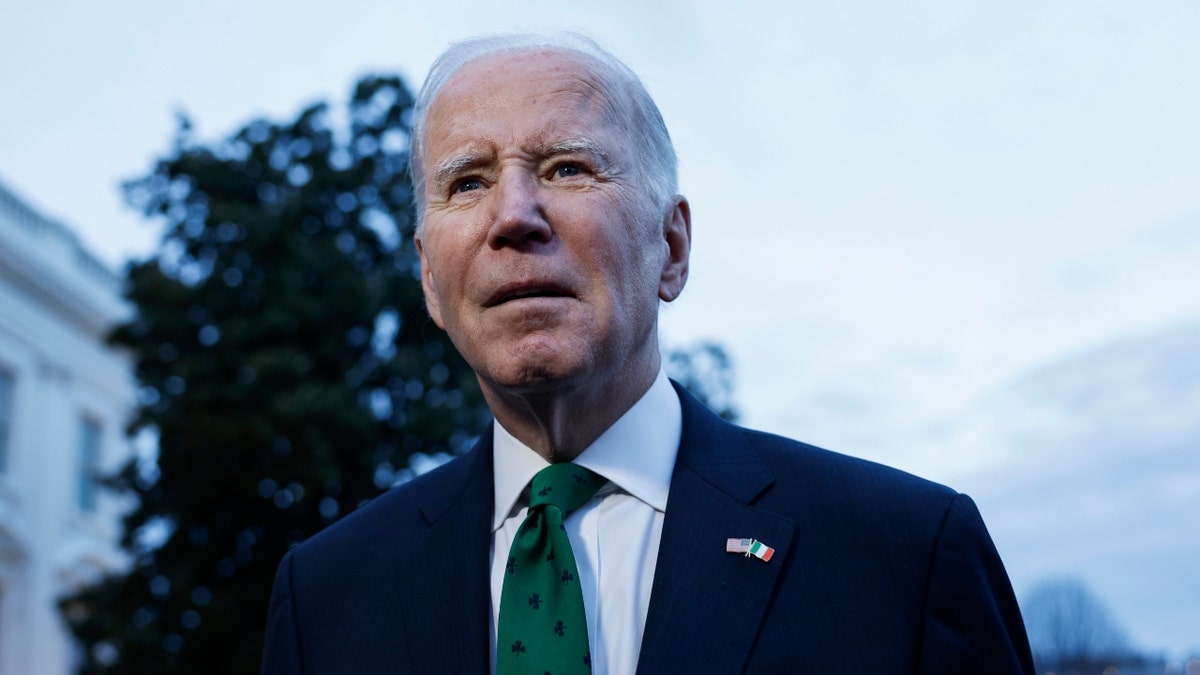

On March 20, President Joe Biden issued the first veto of his presidency, a move that could result in some employers and plan managers using your hard-earned retirement account to promote left-wing causes.

Biden’s veto applied to Republican-led legislation that sought to overturn a new Department of Labor rule that allows private-sector investment managers to consider environmental, social and corporate governance (ESG) issues when selecting investment options for employees. Under a previous rule put into place by President Donald Trump, plan managers were required to prioritize financial returns for workers.

By changing rules governing investment managers, Biden is hoping to redirect the massive amount of wealth American workers have amassed in their private retirement accounts. In June 2021, the total value of all U.S. 401(k) accounts was $7.3 trillion.

President Joe Biden speaks with reporters before departing from the South Lawn of the White House on Marine One on March 17, 2023. (Anna Moneymaker/Getty Images)

Although some ESG factors promote causes all Americans agree on, such as ending child labor, many are designed to promote left-wing ideological views. For example, some of the most influential ESG ratings systems measure companies based on the ratio of various racial groups in their workforce, as well as their commitment to battling climate change and providing funding for social justice initiatives.

WHAT ESG INVESTING IS, AND WHY SOME POLITICIANS ARE AGAINST IT

The legislative attempt to block the rule from going into effect included support from Democratic Sens. Joe Manchin, of West Virginia, and Jon Tester, of Montana.

Now that Biden’s plan is sure to go into effect, employers and investment plan managers will have the ability to consider ESG factors when choosing plan options for workers. That means if you have a private-sector retirement plan, such as a 401(k), your hard-earned retirement savings could soon be used to advance ideas with which you do not agree.

Perhaps even more importantly, depending on which ESG options your employer chooses, your retirement account could also soon take a financial hit because of Biden’s rule. As one writer for the Harvard Business Review reported in 2022, academic researchers have found "ESG funds certainly perform poorly in financial terms."

What can you do to ensure that your retirement savings are protected from Biden’s far-reaching ESG rule? The following five steps are a good place to start.

1. Talk to your plan manager and employer

The first step working Americans with a 401(k) or similar retirement plan should take is to talk with their employer’s human resources representative and retirement plan manager to find out if they are considering imposing ESG options in the future. If they are, demand that they continue to offer non-ESG options as well.

HONEY, BIDEN JUST SHRUNK OUR PENSION

The Biden rule does not require plan managers to offer ESG; it only makes it possible. By putting pressure on employers and plan managers, you and other employees could stop Biden’s plan in its tracks.

2. Switch from the 'default' option

Many employees enrolled in an employer-sponsored retirement account can choose from a list of investment options, but those who elect not to choose their own option allow their investment managers to make choices for them.

Under the Biden rule, employers and investment managers now have the ability to make the default option an ESG investment. That means if you don’t take charge of your retirement, you could end up promoting ESG causes and getting lower returns, even though you might not have to.

3. Pay close attention to investment fees

Investing in retirement funds usually requires a fee. Although investment fees have been falling for more than two decades, ESG funds often charge significantly higher fees than other kinds of funds. In some cases, fees associated with ESG funds are five times higher than non-ESG funds.

Regardless of whether you choose to invest in an ESG fund or not, pay special attention to the fees associated with the various options, and demand that plan managers offer as many low-fee alternatives as possible.

4. Hire a private investment adviser

Investment managers hired by your employer work for your employer. Although they are supposed to make decisions in your best financial interests, Biden’s rule allows them to focus on ESG causes too.

CLICK HERE TO GET THE OPINION NEWSLETTER

Sen. Joe Manchin says President Biden's veto of Republican-led legislation shows he is putting a "radical policy agenda" over the economic desires of Americans. (Leigh Vogel, Yuri Gripas/Abaca/Bloomberg via Getty Images)

If your employer and investment manager decide to go all-in on ESG, consider hiring an investment adviser of your own. Investment advisers are not nearly as unaffordable as many people might think, and they are legally and ethically obligated to provide you with the advice you ask for. So, if you want to find the best ways to avoid ESG in your retirement, they can help, and they might even be able to get you a better return on your investment than your employer’s management firm.

5. Consider a Roth IRA instead

Similar to 401(k) plans, Roth individual retirement accounts (IRAs) provide significant tax benefits, although they work differently than 401(k) plans.

Instead of making contributions tax-free and then paying taxes on withdrawals later in life – the way a traditional 401(k) works – workers contribute funds to a Roth IRA account after they have paid taxes on the money. That means contributions to a Roth IRA grow tax-free.

CLICK HERE TO GET THE FOX NEWS APP

Roth IRAs provide more options for those seeking alternatives to 401(k) accounts, and often provide much more flexibility and freedom for workers, allowing Americans to avoid ESG investments.

Roth IRA accounts do have limitations, and certain higher-income earners are not eligible to use them, so workers interested in these investment vehicles should speak with an investment advisor before making contributions.