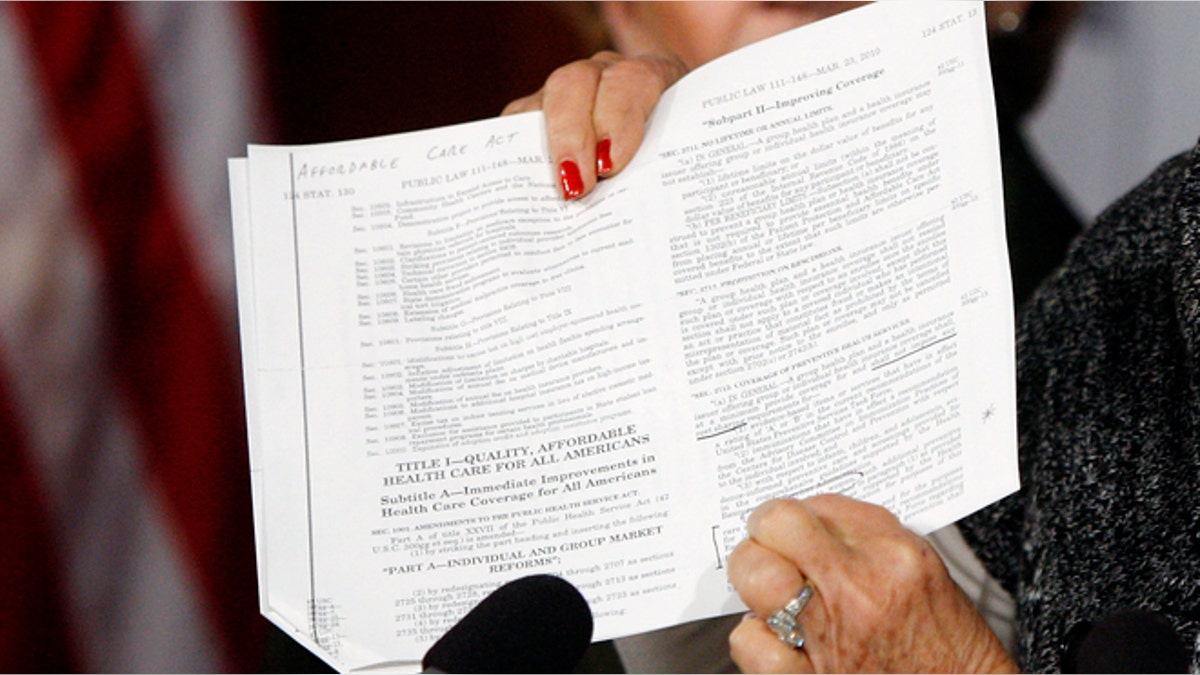

U.S. Senator Barbara Boxer (D-CA) holds a copy of the Affordable Care Act (commonly known as Obamacare) at the U.S. Capitol in Washington, September 30, 2013. (Reuters)

Obamacare officially debuts today with the opening of health care exchanges in all 50 states. Some of these exchanges may be more ready than others – exchanges in Colorado, Oregon, Vermont, and the District of Columbia, for example, will not be fully operational. Still, the opening of exchanges will give most Americans the first view of Obamacare in operation.

That first view might not provide the best first impression. After all, there have already been more than a few of what the administration euphemistically calls “glitches.” For example, the software that determines how much people actually have to pay for the insurance can’t actually calculate the price. Then again, the system also can’t verify your income or whether your employer offered you “affordable” coverage.

So there might be a few problems.

The American people are about to be the lab mice for one of the great experiments in government, and there is going to be a great deal of confusion. Among people’s most common questions:

What is an exchange?

An exchange is a government regulated insurance marketplace designed to help consumers purchase individual insurance plans. Think of it as e-surrance as designed buy a committee of government bureaucrats. Essentially, it’s a website where shoppers can compare and buy health insurance. Some states are operating exchanges on their own, but in most states the federal government will be running it. While the government runs the exchanges, the insurance is being sold by private companies. It is not a government insurance plan, in the sense of a single-payer system like in Canada or Europe. However, it is also not a free market; the insurance plans are highly regulated and choice is limited.

Do I have to do anything?

Probably not. Despite all the hype, the opening of the exchanges won’t impact the average American. If you receive insurance through your job, for example, nothing much is likely to change, at least in the short-term. However, if you are uninsured, buy your insurance on the individual market, or the insurance that your employer provides costs you more than 9.5 percent of your income, you will be able to purchase insurance on an exchange. Others may also be able to buy insurance on an exchange if they want to, but will not be eligible for subsidies.

In the long run, however, your employer may decide to drop your coverage. Already many businesses are dropping coverage for the spouses of workers or part-time employees. In that case, you will have no choice but to buy new coverage on the exchange.

Will I have a choice of plans?

Yes, within limits. All plans sold on the exchanges must fall into one of four groupings – bronze, silver, gold, and platinum – depending primarily on the size of deductibles and other out-of-pocket costs. Bronze plans require the most cost-sharing, platinum the least. Several insurers may offer each type of plan. However, because the government requires all plans to provide the same “essential benefits,” all plans at each level will be substantially the same. One bronze plan will look very much like all other bronze plans, regardless of which insurer offers the plan. Exchange plans resemble Henry Ford’s Model T—you could have any color you want as long as it was black.

In addition, many insurers have decided not to participate in the exchanges. For example, in California, Aetna, Cigna, and UnitedHealth have chosen not to participate in the exchange next year. Moreover, not a single plan available on California’s exchange offers health-savings accounts. In 36 of Mississippi’s 82 counties, among them some of the poorest counties in the state, there are currently no insurers offering plans through the exchange.

Other states hardly fare better. Individuals purchasing insurance through the exchange in North Carolina will have only three options. People in Maine will be stuck with a virtual monopoly: They can choose between Anthem Blue Cross Blue Shield, the state’s largest insurer, which already sells most of the individual policies in Maine, or Maine Community Health Options, a new nonprofit start-up. In New York, Aetna, the state’s third largest insurer will not participate.

How much will the insurance cost me?

That depends on the state you live in and the type of plan you buy. In addition, if you earn less than 400 percent of the poverty level ($94,200 for a family of four), you could receive a subsidy to help you pay for the insurance. The federal government says that for a 27 year old, for example, your premium for a low-cost “bronze” plan with high deductibles will range from $48/month in Alaska to $112/month in Arizona, after applying all the subsidies.

Those premiums are somewhat lower than earlier forecasts. However, according to a study by National Journal, most Americans will still pay more in premiums for ObamaCare plans than they do for employee plans today.

And, out-of-pocket costs — deductibles, copayments, co-insurance — are all likely to be higher for exchange-based plans, especially the low cost plans like the ones quoted above. A study by Avalere Health found that ObamaCare’s “affordable” bronze plans had an average deductible of $5,150, more than four times higher than the average deductible in employer-sponsored coverage this year.

Anyone expecting “free” health care is apt to be sorely disappointed. In fact, the official Obamacare website, Healthcare.gov., has quietly removed references to “free” from the site.

Will my new insurance cover my current doctor?

Maybe not. Many insurers on the exchanges are trying to control costs by cutting down the number of hospitals and doctors in their networks. Blue Shield of California, for example, has dropped nearly two-thirds of the physicians it previously included in its network. Cedars-Sinai Medical Center, one of Southern California’s most prestigious and expensive hospitals, is not included in any plan offered on California’s state exchange. One-third of the hospitals in southern Maine will be excluded from plans offered through the state’s exchange, and so on.

Will my personal information be safe?

There are reasons to be concerned about the personal information that you will have to provide being adequately protected from identity theft. Here’s why: to figure out who’s eligible for subsidies or Medicaid, the exchanges will collect both tax and health-care data from applicants — everything from last year’s income to the prescription drugs you take.

But the administration missed repeated deadlines for testing, reporting and correcting security risks for the computer network managing this information. In fact, the program was only officially certified yesterday. Moreover, the British company in charge of the program’s data collection, Serco, has a troubled history. In 2011, the company’s files were hacked, resulting in the theft of Social Security numbers and other personal information for some 120,000 participants in the federal Thrift Savings Plan. That’s not exactly reassuring.

Can I refuse to buy insurance?

Yes, but if you don’t sign up by March 1, 2014, you will have to pay a tax equal to one percent of your adjusted gross income or $95, whichever is higher.

The most important thing to remember is that today represents just the start of long process for implementing Obamacare. In the short-term, some individuals may find new opportunities for purchasing insurance, while others will find higher costs and fewer choices. The longer term consequences, from job loss and slower economic growth to higher health care costs and reduced access to care, will not be visible for some months or even years to come.

But today we can say that the great experiment has begun.