Tim Scott warns of dire consequences from Democrats opaque spending negotiations

South Carolina senator joins 'Life, Liberty & Levin'

South Carolina Republican Sen. Tim Scott joined "Life, Liberty & Levin" on Sunday to analyze the state of Congress, criticizing Democratic majority leadership for locking out Republicans from negotiations on the multi-trillion-dollar socioeconomic overhaul legislation dubbed human infrastructure.

Scott told host Mark Levin that Democrats did not receive a proverbial mandate from voters in 2020 to enact such a sweeping transformation of the American socioeconomic system, given that they cling to a three-vote margin in the House plus three vacancies. In addition, the U.S. Senate has no outright majority save for Vice President Harris' tie-breaking position in the 50-50 split therein.

"We have no idea, except for what we read in the newspapers… what's actually happening behind closed doors. It's like those old days of smoke-filled rooms in the middle of the night," Scott said. "The deals are being cut, the American people are left out and the entire Republican Party, representing half of the votes in the Senate, literally relegated to the sidelines with no ability to actually have an input."

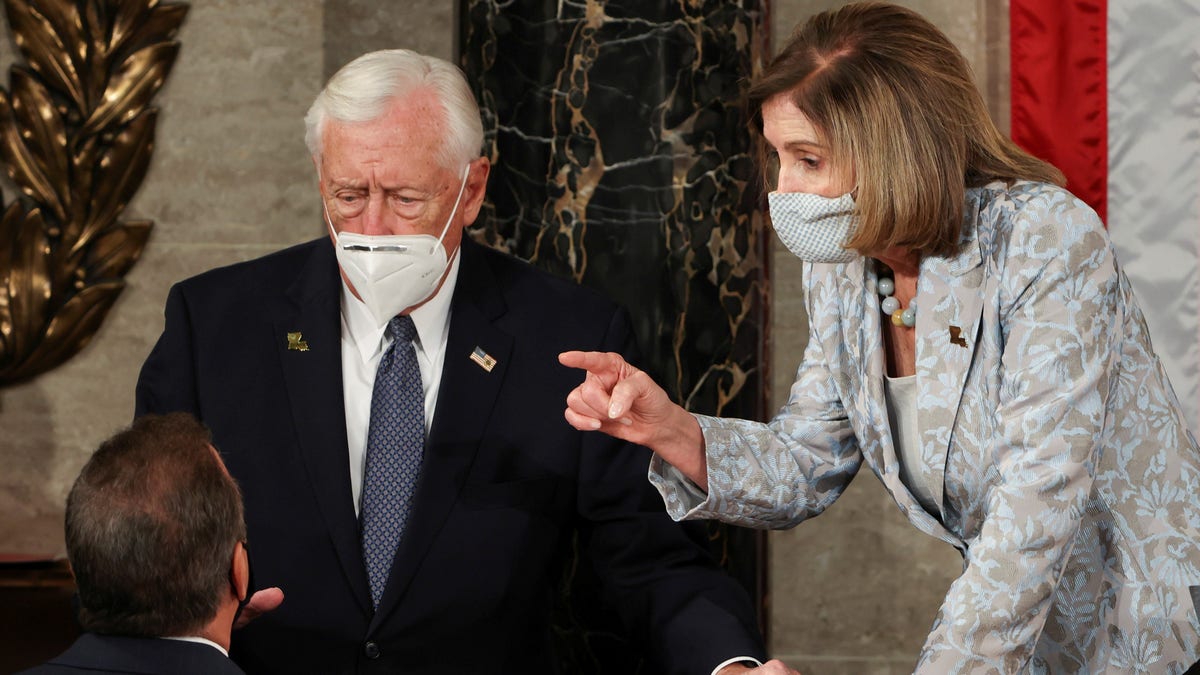

U.S. House Majority Leader Steny Hoyer (D-MD) and Speaker of the House Nancy Pelosi (D-CA) wait during votes at the first session of the 117th Congress in the House Chamber at the U.S. Capitol in Washington, DC, U.S., January 3, 2021. Tasos Katopodis/Pool via REUTERS

"There are no committees that are meeting and talking about the greatest transformation in a negative way of the greatest economic system ever known to man literally behind closed doors… A one-way ticket to socialism."

Scott, the first Black Republican from the South elected to the Senate since Mississippi's Hiram Revels and Blanche Bruce in the 1870s, said the American system does not need such an overhaul. He pointed to himself as an example of one of its success stories:

"This system that has allowed the poorest kids in this country to become some of the wealthiest kids; to allow for kids like me who nearly failed out of school to one day become a United States senator. It's because our system works," he said. "Sure, we can make it better, but this is not making it better."

Scott warned the American people foremost of the Democrats' opaque plan to tax unrealized gains, appearing to differ from the left's implicit claims such levies only hurt the wealthy.

"Part of their strategy right now is not only to increase the tax rates but to find new ways to generate revenue from revenue that is not [in] your account yet," he said

"That is something that is not just problematic. That is something that actually discourages the system itself."

An unrealized gain is a financial gain an American makes on paper that has yet to be pocketed, or "realized." Such examples include stock options that remain in one's fund account but have not been liquidated or withdrawn.

The Internal Revenue Service Building is seen in Washington DC

The IRS taxes capital gains when they are realized, whether they are reinvested in another fund or transferred to an account holder's bank for liquid access. Taxing unrealized gains would be a red flag that would undermine the entire incentive for Americans of all stripes to participate in the market, Scott inferred.

"[E]very American who sells a house or sells a business that is a once in a lifetime transaction. To be double taxed on that is wrong," he said.

"But to take it from 23% now to 43% or to 30%, those earned 7-point increases or a 20 point increase – that is a 100% tax increase. We can't afford it," the North Charleston lawmaker said.

"We can't kill the goose that lays the golden eggs. And this administration is antithetical to all things free enterprise, hoping for liberty and justice for all. … That is not what you're seeing. They're embedding discrimination in the middle of their economic platforms in ways we've never even seen before in our country."

Scott reiterated that these legislatively opaque yet destructive policies are not what the American people voted for when they essentially chose to give neither party a mandate in Congress, while other observers similarly point to President Biden being chosen as the "moderate" choice on the Democratic side in 2020 versus socialist Vermont Sen. Bernard Sanders.