HOA horror stories: Georgia homeowners share nightmarish legal brawls

About one in five Georgians live in neighborhoods governed by community associations. One woman whose HOA bought her house out from under her after she fell behind on dues payments and legal fees said the associations have too much power.

Georgia residents who have faced foreclosure proceedings and, in at least one case, lost their house to their homeowners association detailed frustrating conflicts stemming from what they described as an abuse of power.

"I would never, ever buy a home with an HOA again," said Karyn Gibbons. She nearly lost her Gwinnett County condo last year after her homeowners association didn’t cash most of the checks she sent to cover her dues, she said.

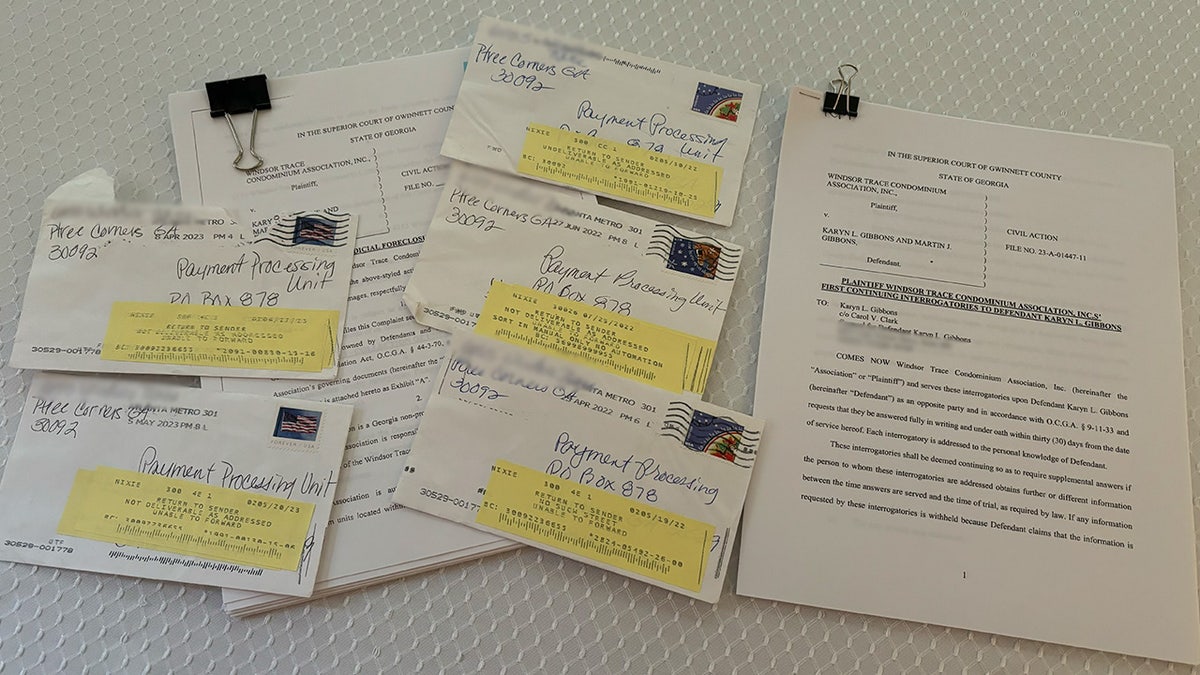

Karyn Gibbons almost lost her home after she says her condominium association sporadically cashed her dues payments and initiated foreclosure proceedings against her. (Photos courtesy Karyn Gibbons)

Tricia Quigley said she didn’t realize her former HOA had foreclosed on and purchased her Cherokee County house in metro Atlanta for $3.24 until they served her with an eviction notice.

"I don't even know when I'm going to be able to retire now," Quigley told Fox News Digital. "I can't buy another house. It just has totally changed my life."

Nearly 2.3 million Georgians live in neighborhoods governed by HOAs, more than 20% of the state’s total population, according to 2021 data from the Foundation for Community Association Research. The organization estimated HOAs collect almost $3.2 billion each year from Georgia residents.

HOA fees can cover shared facilities like gyms and pools, as well as maintenance.

"Georgia law is very explicit that owners are obligated to pay their assessments, and associations have certain rights to collect those assessments, ultimately including but very rarely, foreclosure," said Julie Howard, an Atlanta-based attorney who represents homeowner and condominium associations.

Howard said HOA governing documents typically allow homeowners to request a hearing before the board if they want to challenge any fines.

But Gibbons said the rules and regulations can be confusing. In her case, she said she couldn’t get clear communication from HOA leadership.

WATCH MORE FOX NEWS DIGITAL ORIGINALS HERE

Month after month, Gibbons said she mailed a check for her homeowners association dues to the address she was given when she closed on her condo. The first check was cashed around May 2022, she said, but after that, the envelopes started being returned and stamped "not deliverable."

Gibbons said she would put the payment in another envelope, write the same P.O. Box address on the front, and send it again. In two years of owning the home, she said only about five payments were ever cashed.

"It was just very strange. We never got any phone calls, emails, text messages, not even a letter in the mail saying, you know, you're late on your payments or anything," Gibbons said. "No one contacted us whatsoever."

But the HOA had no problem tracking her down in the spring of 2023, when Gibson said she was served with a notice of foreclosure on her home.

Karyn Gibbons said she mailed check after check to the address given to her when she closed on her condo, but many of the payments were returned. She told Fox News Digital she didn't hear anything from her HOA about the missed payments until they served her with a notice of foreclosure. (Courtesy Karyn Gibbons)

'CHRISTMAS LAWYER' WHO WENT TO WAR WITH HIS HOA IS NOW FACING ANOTHER FIGHT — THE IDAHO STATE BAR

Gibbons got an attorney but said the HOA’s representatives took weeks at a time to respond to her lawyer's questions, then tacked on thousands of dollars more in fees for each response.

It felt like "a real scam," she said. "It just seemed like they just wanted to keep adding more and more and more to what we owed and not resolve anything."

Gibbons said the actual amount the HOA left uncashed was only $7,000, but in the end she paid $34,000 total in interest, fines and attorney fees to end the ordeal.

Quigley wasn’t so lucky.

She bought her home in Woodstock, a city north of Atlanta, in 2001. But she became frustrated with the biannual dues payments, which she said totaled about $800 a year. Quigley said she never received first notices for the dues, only second notices, with late fees tacked on. Even after calling the HOA, she says the problem continued.

So in 2010, she decided not to pay.

"Which was fairly not a smart thing to do," she admitted in hindsight.

One in five Peach State residents live in neighborhoods governed by HOAs, according to the Foundation for Community Association Research. (Joe Sohm/Visions of America/Universal Images Group via Getty Images)

THIS RED STATE IS BECOMING AN ‘EXPAT’ COMMUNITY FOR FAMILIES FLEEING WESTERN LIBERAL BASTIONS

Soon, she started receiving letters from a law firm hired to collect the debt. When the HOA filed a lien on her home, Quigley said she realized it was time to give up the fight.

She said she sold her car and brought the attorneys a check for the $2,700 they told her she owed.

But a few months later, Quigley said she started getting more bills, first for $3,000 and then for $6,400. She later learned these were post-judgment fees and 18% back interest. Quigley struggled to keep up, and eventually hired a bankruptcy attorney.

She thought she had finally escaped the debt, and said she started paying her dues again, too. So she was caught off guard when, in 2018, she said she received an eviction notice.

Her HOA was the new owner of her house, having purchased it for $3.24 at auction the year prior. In the meantime, the HOA continued to accept dues payments from Quigley, who made another $4,600 in home loan payments on the house she no longer owned, according to an 11Alive investigation.

"I literally just could not believe it. I was in shock," Quigley said. "My first thought was, ‘I'm going to be friggin’ homeless.’"

Quigley’s former HOA and its law firm did not respond to requests for comment.

The HOA later sold Quigley’s house to a woman involved in the foreclosure, who then reactivated her real estate license and sold the house again, 11Alive reported. While critics say that seems like a conflict of interest, Georgia law doesn’t prohibit HOA board members or other individuals linked to association-initiated foreclosures from profiting off the actions.

An attorney who represents HOAs and condo associations said it's "just not possible" for a foreclosure to come as a surprise. (Getty Images)

CLICK HERE TO GET THE FOX NEWS APP

"It’s just not possible for someone to have been foreclosed upon out of the blue under Georgia law," said Howard, who doesn’t represent Quigley’s former HOA, but said broadly that Georgia has "strict parameters" for levying fines and for foreclosure.

Howard added, "When a lawsuit’s filed, you have to be personally served. So the sheriff would have come out and served them with the lawsuit." She said homeowners would have received further notices when a judgment is reached and that a notice of foreclosure would have to run for four weeks in the county legal paper.

Quigley said she was served with the initial lawsuit, but that after she filed for bankruptcy and started paying her dues again, she was not personally served with any additional notices.

Gibbons added that HOA bylaws should be more "concise and readable" to prevent confusion.

"It makes no sense for any community to have a book's worth of rules and regulations," she said. "The more information you have, the more confusing it is and less chance it is going to be read or even understood."

To hear more from Gibbons, Quigley and Howard, click here.