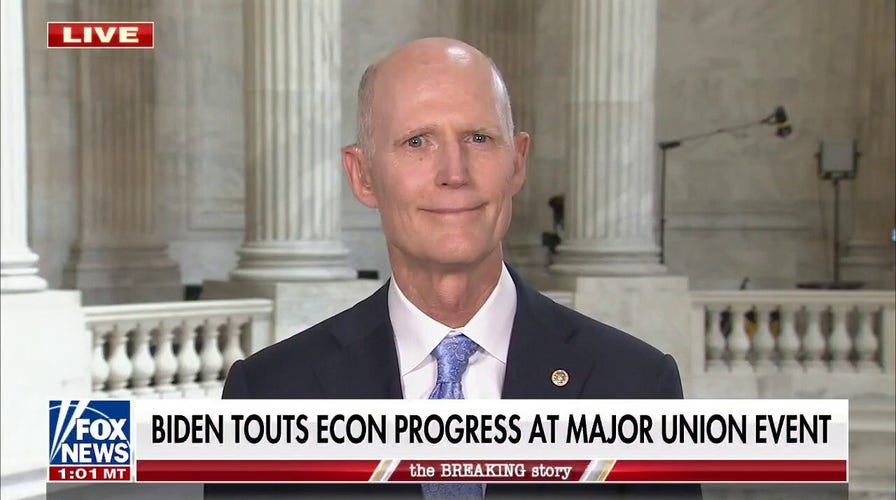

Sen. Scott rips Biden's economy: He has 'no plan' to reduce inflation

Sen. Rick Scott, R-Fla., responds to scathing comments from President Biden against his proposed tax plan on 'The Story.'

Ben Bernanke, who served as chairman of the Federal Reserve from 2006 to 2016, published an op-ed in the New York Times Tuesday arguing that the United States is "almost certainly not" in danger of the economic woes that plagued the nation from 1966 through 1981. He based this assumption on "the Fed's credibility."

The article, titled "Inflation Isn’t Going to Bring Back the 1970s", contended that while "it’s true there are some similarities" between the 1970s and today, "there are critical differences as well."

Regarding these differences, Bernanke argued that in the 1960s and 1970s, the Federal Reserve was met with stiff political resistance to raising interest rates.

"First, although inflation was very unpopular in the ’60s and ’70s, as it (understandably) is today, back then, any inclination by the Federal Reserve to fight inflation by raising interest rates, which could also slow the economy and raise unemployment, met stiff political resistance," he wrote.

INFLATION ‘POLICY ERRORS OF THE 1970s ECHO IN OUR TIMES’, FINANCIAL TIMES COLUMNIST WARNS

In this May 10, 2013 file photo, Federal Reserve Chairman Ben Bernanke waves goodbye after speaking during a banking conference in Chicago. (AP Photo/Paul Beaty, File)

"In contrast, efforts by the current Fed chairman, Jerome Powell, and his colleagues to bring down inflation enjoy considerable support from both the White House and Congress, at least so far," he said.

In June 2021, Powell maintained that inflation would be transitory. At the time, the Fed kept policy on hold and said the temporary period of above-trend inflation would likely not result in the Fed hiking rates before 2023.

Bernanke also wrote that today, Federal Reserve officials see themselves as having a greater role to play in bringing down inflation than they did in the 1970s. "Besides the Fed’s greater independence, a key difference from the ’60s and ’70s is that the Fed’s views on both the sources of inflation and its own responsibility to control the pace of price increases have changed markedly," he wrote.

Today, the Fed is raising interest rates and selling off its balance sheet, which it added $120 billion a month to during the height of the pandemic.

BIDEN’S RHETORIC GETTING MORE ‘DESPICABLE,’ FORMER TRUMP ADVISER WARNS

The news conference of Federal Reserve Chairman Ben Bernanke appears on a television screen at a trading post on the floor of the New York Stock Exchange, Wednesday, Dec. 18, 2013. (AP Photo/Richard Drew)

Bernanke noted that inflation only ended in the early 1980s when Fed Chairman Paul Volcker raised interest rates to 20 percent. "Inflation gained momentum over the decade, ending only with the shock treatment applied by the Fed under Paul Volcker in the early 1980s, which resulted in a deep recession," he wrote.

The former Fed chairman claimed, without evidence, that "the lessons learned from America’s Great Inflation, by both the Fed and political leaders, make a repeat of that experience highly unlikely," then admitted the economy’s condition was misdiagnosed by the Fed in 2021.

"After a delay caused by a misdiagnosis of the economy in 2021, the Fed has accordingly turned to tightening monetary policy, ending its pandemic-era bond purchases, announcing plans to shrink its securities holdings and raising short-term interest rates," he said.

Powell is being encouraged by business leaders and some in the media to ‘go big’ on inflation.

Current and former Federal Reserve Chairmen Jerome Powell (L) and Ben Bernanke, respectively

Bernanke concluded that the Fed's credibility will be what prevents a return to the 1970s.

CLICK HERE TO GET THE FOX NEWS APP

"The Fed’s greater policy independence, its willingness to take responsibility for inflation and its record of keeping inflation low for nearly four decades after the Great Inflation, make it much more credible on inflation today than its counterpart in the ’60s and ’70s," he said. "The Fed’s credibility will help ensure that the Great Inflation will not be repeated, and Mr. Powell and his colleagues will put a high priority on keeping that credibility intact."

Powell and Treasury Secretary Janet Yellen both incorrectly said inflation would be ‘transitory’ in 2021, a claim the latter recently admitted was a mistake.