State Farm suspends home insurance sales in California

Tech entrepreneur Peter Rex joined 'Fox & Friends Weekend' to discuss his reaction to why the company is halting the insurance sales in the Golden State.

Allstate has joined other leading insurance companies in pausing its sales of new home insurance policies in California due to wildfires and higher costs of doing business in the state.

"The cost to insure new home customers in California is far higher than the price they would pay for policies due to wildfires, higher costs for repairing homes, and higher reinsurance premiums," Allstate said in a statement to Fox News Digital.

The company said it stopped offering new home, condominium and commercial insurance policies in California last November but would continue to offer home insurance to current customers in California.

Smoke from a wildfire rises above a residential area in Laguna Niguel, Orange County, California, U.S. May 11, 2022 in this picture obtained from social media. ( Tim Wheaton/via REUTERS)

When wildfires ravaged the state in November 2018, insurance loss claims topped $12 billion.

Allstate also cited regulations and the impact of inflation in California for cutting new policy sales.

Company spokesperson Brittany Nash said that Allstate couldn't adjust prices when inflation hit due to California's Prop 103, which requires the state's Department of Insurance to approve rates first.

"The cost to insure new customers and pay claims would be higher than the price they pay for policies," Nash said.

STATE FARM CEASING NEW APPLICATIONS IN CALIFORNIA FOR PROPERTY INSURANCE, OTHER POLICIES

California Gov. Gavin Newsom, left, and Nevada Gov. Steve Sisolak talk as they tour destroyed home by wildfires near where the Tamarack Fire ignited earlier in July in Gardnerville, Nev., Wednesday, July 28, 2021. (AP Photo/Sam Metz) (AP Photo/Sam Metz)

Another leading insurance provider, State Farm, recently announced similar reasons for its decision to stop accepting new applications for business and personal lines property and casualty insurance in the state.

"State Farm General Insurance Company made this decision due to historic increases in construction costs outpacing inflation, rapidly growing catastrophe exposure, and a challenging reinsurance market," the company said in a statement last week.

Insurance Commissioner Ricardo Lara responded to State Farm's decision by saying those factors were out of the California Department of Insurance agency's control.

"The factors driving State Farm’s decision are beyond our control – climate change challenges, higher reinsurance costs affecting the entire insurance industry, and global inflation," Lara said in a statement.

Allstate had previously stopped providing new homeowner policies in California from 2007 to 2016, the San Francisco Chronicle reported, "after state regulators questioned the company’s request for a 12.2% rate increase."

CLICK HERE TO GET THE FOX NEWS APP

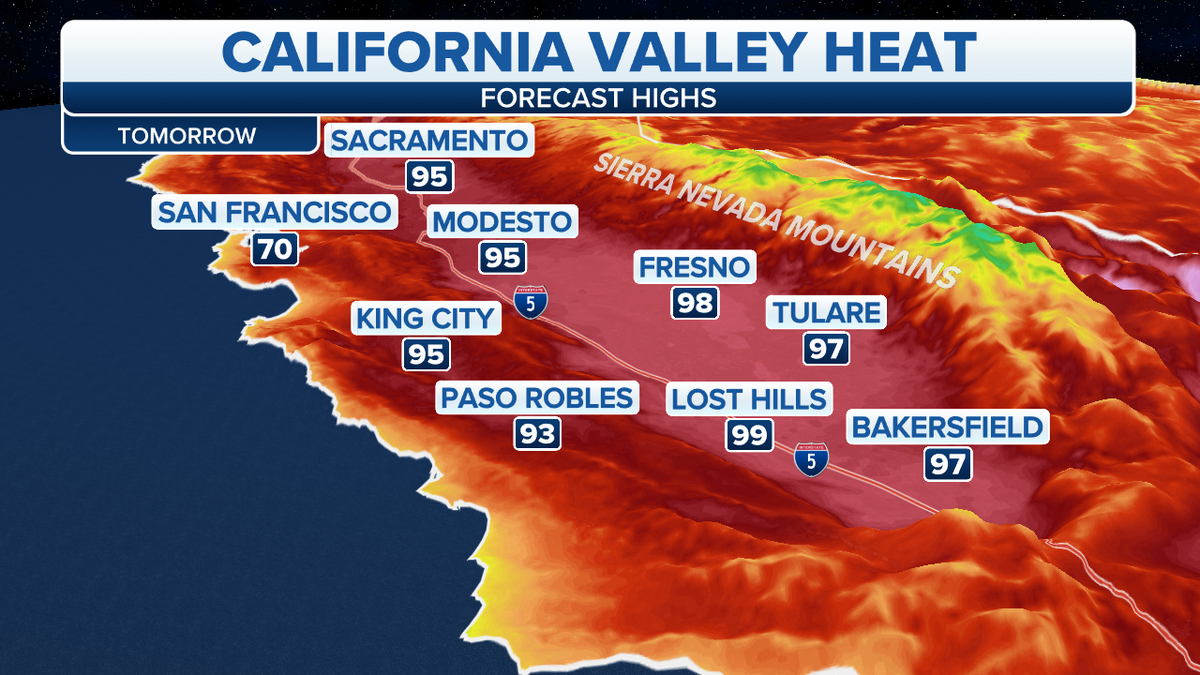

High temperatures forecast in California for Tuesday, May 16. (Fox News)

Last August insurance giant GEICO, closed all 38 of its agent offices in California, laid off hundreds of employees, and announced it would no longer sell insurance through telephone agents in the state.

Tech entrepreneur Peter Rex, who moved his real estate firm from California to Texas, believes insurance companies quietly limiting their business in the state will impact families and small businesses the most. He argued that burdensome regulatory policies are forcing businesses to leave the state and costly home building mandates are driving up house prices for families.