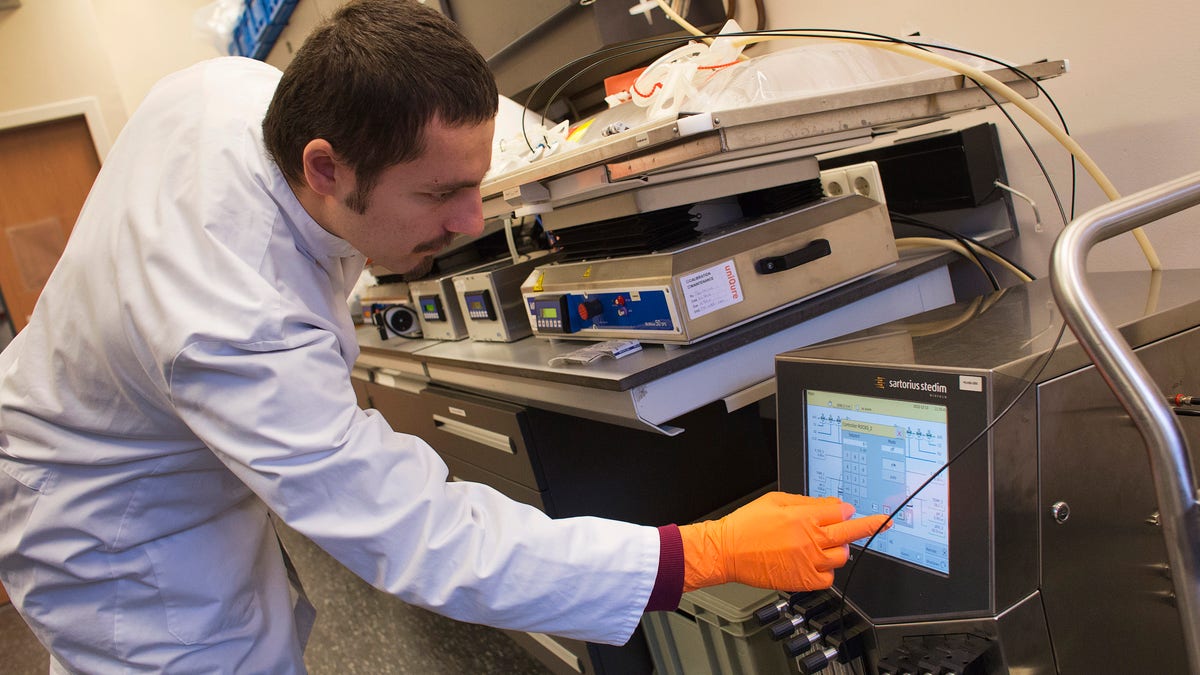

A uniQure bioprocessing engineer checks a monitor of a sterile disposable plastic cell culture bag as it is placed onto a rocking platform in a laboratory at Dutch biotech company uniQure in Amsterdam December 13, 2012. REUTERS/ Michael Kooren

GlaxoSmithKline is close to seeking European approval for a gene therapy drug to fight adenosine deaminase severe combined immune deficiency (ADA-SCID) in the latest sign of a renaissance in the technology to fix faulty genes.

A recent spate of deals has ignited investor interest and several large drugmakers are now buying into a high-risk field that is recovering from some disastrous clinical trial results in the late 1990s and early 2000s.

Gene therapy last year won $3.0 billion of financing, up 510% on 2013, according to the Alliance of Regenerative Medicine, and the pace has continued in 2015, with Bristol-Myers Squibb investing in Dutch gene therapy company UniQure this month.

GSK will be the first big pharmaceutical company to file for marketing approval for a gene therapy when it submits its drug for ADA-SCID in Europe imminently, according to people familiar with the situation.

The British company has so far said little about its programme, beyond the fact that a filing is possible in 2015.

ADA-SCID affects around 350 children worldwide, leaving sufferers extremely vulnerable to infection. Some live in a plastic, germ-free chamber. The disorder become widely known in the 1970s and 1980s when the media nicknamed a prominent sufferer, David Vetter, as the "bubble boy".

That makes it a commercially tiny opportunity, like the Western world's first gene therapy from UniQure, launched recently for an ultra-rare blood disorder.

But the field has potential to widen, with promising clinical trial results in other blood disorders and research spreading into the mass-market condition of heart failure, the focus of the tie-up between Bristol and UniQure.

Investor interest in gene therapy has grown in the past 18 months, with Bluebird Bio, UniQure and Spark Therapeutics all staging successful Nasdaq floats.

The number of deals involving gene and cell therapy, a related field, has also risen, according to data compiled by Thomson Reuters Cortellis.

Yet the risks are high, as shown by Sunday's failure of a heart gene therapy from Celladon.

While gene therapy promises a one-time cure for intractable and expensive-to-treat diseases, the process of inserting healthy genes into people using viruses is extremely complex.

The high-profile death of an American patient in 1999 and cases of leukemia in French children three years later were due to immune system reactions or cancers sparked by the way the viruses were introduced.

Scientists have developed better and safer viral delivery systems, encouraging big companies including Pfizer, Sanofi, Bayer and Baxter into the space.

Researchers in Britain, Italy and France have led a number of the advances, reflecting the fact that Europe remained open to gene therapy when the U.S. retreated after the earlier setbacks.

HOST OF CHALLENGES

Nonetheless, a host of challenges remain, including how to design clinical trials to test the long-term effects of treatments in very small groups of patients.

Germany recently put on hold its appraisal of UniQure's approved blood drug Glybera (alipogene tiparvovec) because of efficacy questions.

Drug manufacturing and supply is another hurdle, especially for a product like GSK's ADA-SCID treatment which requires cells to be taken from the patient, processed and injected back.

"The pharmaceutical industry is going to have to think very hard about what the business model is," said Patrick Vallance, GSK's head of research and development. "It challenges all sorts of things around the supply chain."

It's an issue that preoccupies Nick Leschly, CEO of Bluebird, whose father ran SmithKline Beecham before it merged with Glaxo, in the days when the drugs industry made its money by packaging simple white pills.

Bluebird, whose most advanced product is a treatment for adrenoleukodystrophy, a deadly disease made famous by the film "Lorenzo's Oil", is very different. "This is not a shipped drug company. In fact, it's nothing close to that," Leschly said.

Perhaps most tricky of all is pricing.

Glybera made history as the first drug to carry a $1 million tag and Biomarin believes $1 million would also be a "reasonable" price for its experimental haemophilia gene therapy, since it should free patients from regular infusions of costly blood-clotting factors.

Ultimately, governments and insurers will have to decide if the price is right and gene therapy can save money over the long term.

"The promise is so compelling for patients that it behoves us a community to find solutions," said Kevin Lee, Pfizer's scientific head for rare diseases.