70 million more reasons to hate the IRS

Despite government-wide budget cuts, embattled, 'tone-deaf' agency is set to pay $70 million in employee-union bonuses

This is a rush transcript from "On the Record," June 19, 2013. This copy may not be in its final form and may be updated.

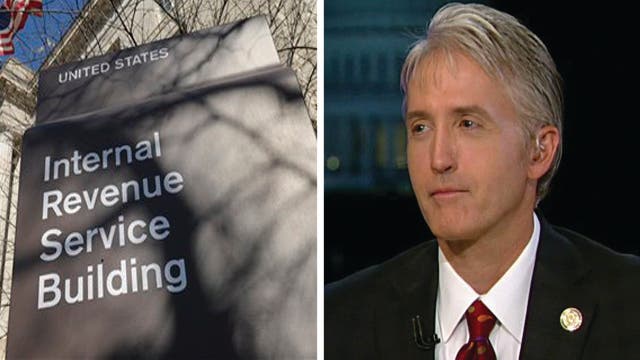

GRETA VAN SUSTEREN, FOX NEWS HOST: Congressman Trey Gowdy calling the idea of IRS bonuses "mind-numbingly stupid." Congressman Gowdy joins us.

So you don't like $70 million in bonuses for the IRS?

REP. TREY GOWDY, R-S.C.: I don't like bonuses for public services employees who do great jobs, like prosecutors or judges. I certainly don't like public service employees who have broken trust with the American people being eligible for anything other than remedial training.

VAN SUSTEREN: This is un -- I'm -- you know, we go from the sadness of a major actor dying to the most incredible outrage. How in the world does anyone at the IRS -- and I realize not everyone is involved in the line dancing or the $20,000 in squirt toys or the $50 million in two years' worth of parties -- we didn't audit the other years -- or the targeting of conservative groups. But I mean -- but still, $70 million in bonuses? How does this happen?

GOWDY: It happens when you have collective bargaining agreements that are negotiated and there's nobody on the table on behalf of the taxpayer. So you have the IRS negotiating with their employees. And I'm not justifying it. You asked how it happens...

VAN SUSTEREN: No, I asked how it happens.

GOWDY: This is how it happens.

VAN SUSTEREN: I understand you -- if you're calling it mind- numbingly stupid, I don't think you're in favor of it in any way.

GOWDY: Well, and in fact, I am currently drafting legislation to either vitiate or rescind the collective bargaining agreement. So is Chuck Grassley, the senator from Iowa.

It is impossible to understand -- in the best of budget circumstances, you should only be eligible for a bonus if you do something that's significantly exceeds the expectations. I mean, if you do far beyond what was expected, perhaps you may be eligible for bonus. I don't give them in my own office, but I understand some people do.

All right, the IRS has not met any rudimentary level of expectation. And to take $70 million, set it apart because of a collective bargaining agreement -- however, in the agreement, if there's a budget shortfall, they're not eligible for it.

So you would think that the IRS would say, Well, we have a budget shortfall, sequestration. We're cutting everything. We're not going to give bonuses out. That's not what they're doing. They're using this as a negotiating ploy in the next collective bargaining agreement!

VAN SUSTEREN: All right, there was an April directive from the White House budget office which says -- it was written -- it says that -- that they would stop sort of these extra payments. But this one -- was it get under -- is there a way that this one doesn't get stopped?

GOWDY: Yes. The directive that was issued said no more bonuses based on performance, unless there's a legal requirement to give it. Well, that covers all collective bargaining agreements. I mean, that's a contract. You've already agreed, contracted to provide these bonuses.

Now, if it was drafted by anyone other than a 3rd grader, you would have these clauses that can get you out of it, rescind it, amend it. And one of the clauses is if there's a budget shortfall, we're not going to give any bonuses.

VAN SUSTEREN: How about lack of merit? I mean, isn't -- wouldn't you think that -- I mean, even if you're legally obligated to bonuses, if there's no merit justifying the bonus -- maybe -- you maybe can't produce receipts for two years of parties on the taxpayer's dime. Maybe -- maybe you're, like, spending it recklessly. Maybe even -- you know what? Maybe even looked the other way when you saw people were targeting because, Well, that's not my department. You know, what -- why not -- well, can't they be denied on merit, if someone just doesn't deserve it?

GOWDY: We're going to find out. And we're going to take that money and we're going to put it in a fund for people who have been victimized by the IRS, either the groups that were targeted or potential criminal conduct.

Greta, today, in my hometown, there's a trial going on. A police officer was shot in the face in the line of duty. He's not eligible for a bonus. And the prosecutor who's working even at 10:00 o'clock at night is not eligible for a bonus.

There -- when you go into public service, you understand you're trading something. You want to feel good about what you do, but you're not going to make what people in private sector make. To have as dysfunctional an entity as the IRS, to have broken trust with all the American people and then on top of that, to be eligible for a bonus shows a level of disconnect that is staggering, even for this town!

VAN SUSTEREN: Can the president do anything?

GOWDY: Sure, he can! He could come out and say, You know what? Public service employees don't need to negotiate contracts that are not in the taxpayers' best interests! He could do it tomorrow morning! Will he? No!

VAN SUSTEREN: How about merit? Could he say that this -- this $70 million, maybe -- maybe even though (INAUDIBLE) collective bargaining has a clause where it says that they're eligible for bonuses, can he say there just simply isn't merit and block it?

GOWDY: I don't know that he can, but he can certainly direct the IRS director, Mr. Werfel, to say, You know what? No more collective bargaining agreements! We're going to invoke the budget clause. We're not going to pay them. And if you don't like it, take to us court and try to convince 12 people you've earned it!

VAN SUSTEREN: Congressman, thank you, sir.

GOWDY: Yes, ma'am.