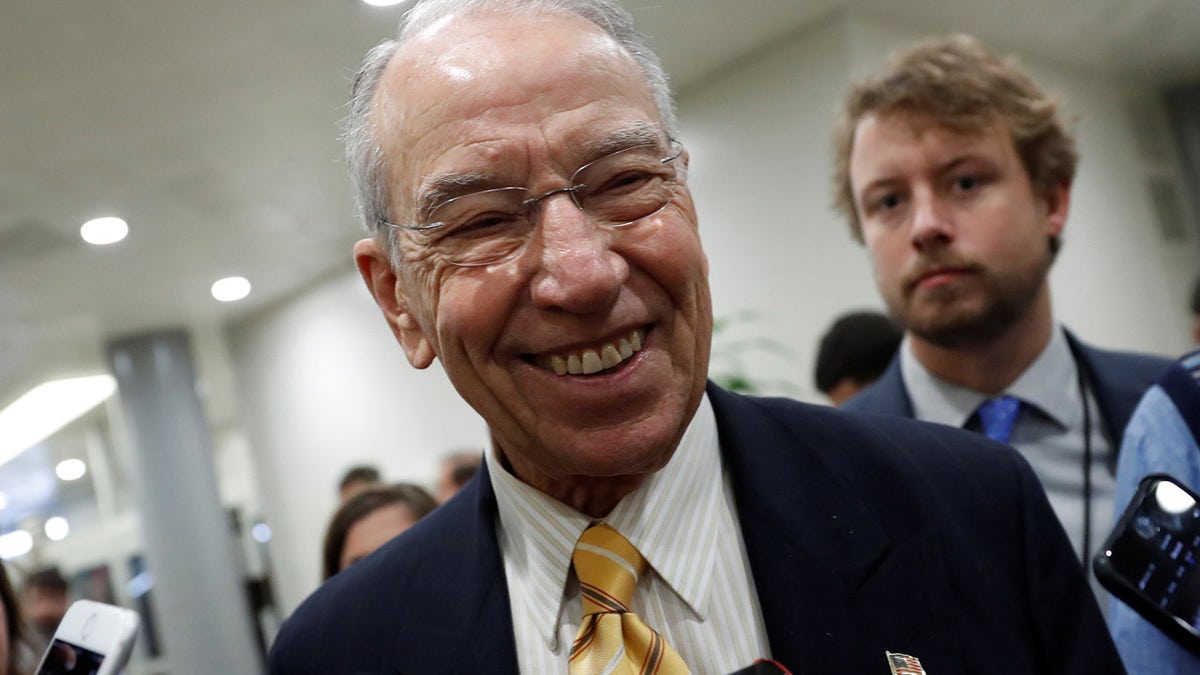

Sen. Chuck Grassley (R-IA) speaks with reporters ahead of the party luncheons on Capitol Hill in Washington, U.S. November 14, 2017. REUTERS/Aaron P. Bernstein - RC173F1C2CC0

Sen. Chuck Grassley, R-Iowa, said in an interview Saturday that he is in favor of getting rid of the federal estate tax—a tax generally aimed at the wealthy— and implied that other tax cuts could favor those who waste their money on “booze or women or movies.”

Grassley, a member of the tax-writing Finance Committee in the Senate, told The Des Moines Register that the federal estate tax could force farm families to liquidate in order to pay the so-called death tax.

“I think not having the estate tax recognizes the people that are investing, as opposed to those that are just spending every penny they have, whether it’s on booze or women or movies,” he told the paper.

The comments led to criticism on social media.

Jon Cooper, the chairman of the Democratic Coalition, tweeted, “GOP Sen. Grassley makes clear his disdain for the working class,” while linking to another article on IowaStartingLine.com. He tweeted again, “GOP Senator Chuck Grassley Implies Working Class People Don’t Deserve Tax Cuts Since They’d Just Waste Them on “Booze Or Women Or Movies.”

Grassley's office issued a statement to Fox News to clarify the comments.

“My point regarding the estate tax, which has been taken out of context, is that the government shouldn’t seize the fruits of someone’s lifetime of labor after they die," the statement read. "The question is one of basic fairness, and working to create a tax code that doesn’t penalize frugality, saving and investment. That’s as true for family farmers who have to break up their operations to pay the IRS following the death of a loved one as it is for parents saving for their children’s college education or working families investing and saving for their retirement.”

Grassley has long fought against the estate tax because he reportedly sees it as a burden for farmers and their families. The Register's report pointed out that the estate tax is a “40 percent tax on wealth assessed when a person dies, and currently is applied to assets above $5.5 million for individuals and $11 million for couples.”

Only the wealthiest 0.2 percent of estates owed any estate tax at last count, according to IRS data and the Center on Budget and Policy Priorities.

The Register’s report also points out that both the Senate’s and House’s bills ease the death-tax burden.

The House’s bill abolishes the tax in 2024 and the Senate’s bill doubles the exemptions on both individual and couples. The report said that the death tax likely affects a few dozen farms and a few dozen small businesses across the entire U.S., yet generates tens of billions in revenue, annually.

The estate tax affects a very small — and very wealthy — number of Americans. Only the estates of about 2 out of every 1,000 Americans who die face this tax right now.

Senate Republicans negotiated through early Saturday morning to pass their sweeping, trillion-dollar tax reform bill, putting the GOP and President Trump on the threshold of a major legislative victory this year.

“It’s getting harder all the time to have a family farm or family-run business,” Grassley said in a statement in January. “Congress ought to do everything possible to encourage family enterprises to stay in operation and get next generations involved.”

The Associated Press contributed to this report