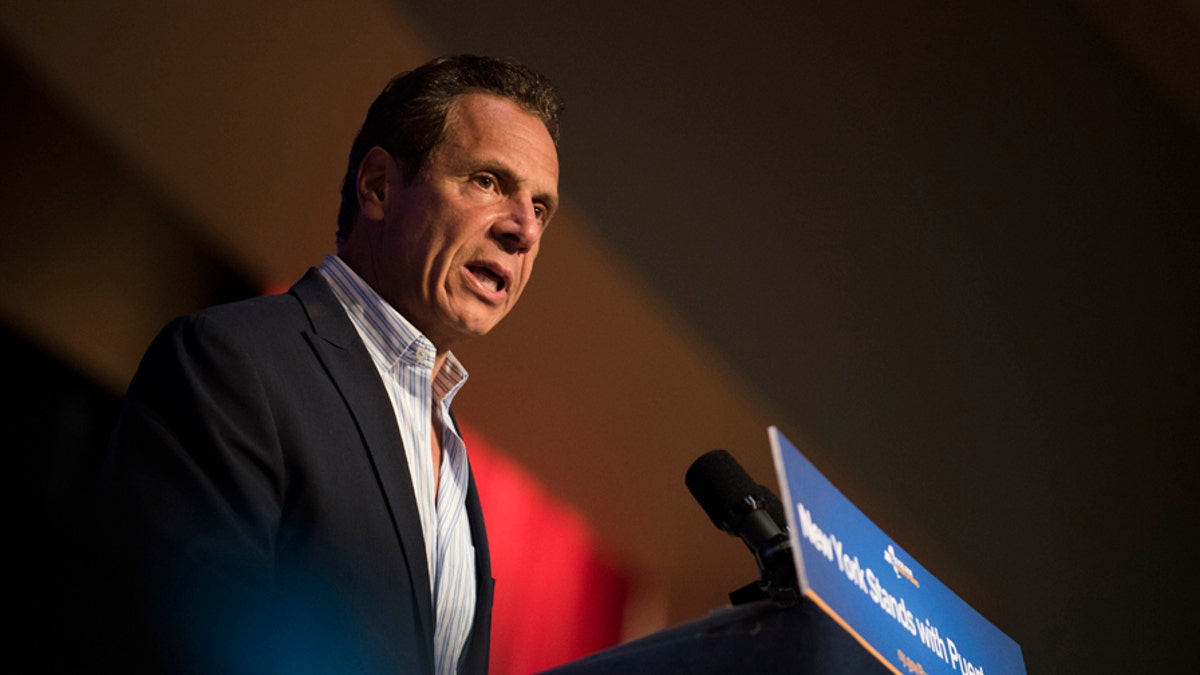

Governor Andrew Cuomo announces new hurricane recovery efforts for Puerto Rico Sunday, Sept. 24, 2017 in New York. The effort include partnering with private and government organizations to get aid to Puerto Rico. (AP Photo/Michael Noble Jr.)

Homeowners in tax-happy blue states could find a bitter pill inside the new Republican tax plan, which would kill their ability to write off the property taxes that can cost even middle class families more than $10,000 per year.

The plan rolled out Tuesday would keep in place deductions for mortgage interest and charitable donations. But, in a move to help offset other major cuts in the plan, many other itemized deductions would be scrapped.

Chief among them are deductions for property taxes, which in Democrat-dominated states like New York, California, New Jersey and Illinois, dwarf the levies of more fiscally sound states. The taxes fund schools, streets and uniform services, but they also pay for the swollen union contracts and crippling pension debts that have several states on the brink of bankruptcy.

New York Democratic Gov. Andrew Cuomo slammed the proposal, saying the loss of the deduction could cost New Yorkers more than $17 billion.

“It would penalize this state,” said New York Gov. Andrew Cuomo, who said the “death blow” could cost residents of his state a collective $17 billion. “It is the height of hypocrisy. You have an administration saying, 'I want to cut taxes,' and now literally they want to tax you on the taxes that you pay.”

TRUMP SELLS TAX PLAN: 'THERE'S NEVER BEEN TAX CUTS LIKE WE'RE TALKING ABOUT'

According to the Tax Policy Center, the state and local tax deduction cost the Internal Revenue Service $96 billion in 2017 and will add up to $1.3 trillion over a 10-year period by 2026. About one-third of tax filers choose to claim a deduction for state and local taxes paid, with high-income households more likely to benefit.

The White House argues the proposed change will not impact those who take the far more popular standard deduction. The new plan calls for roughly doubling that deduction -- or the amount of income that is tax-free.

“You expand the base by getting rid of the loopholes,” White House economic adviser Gary Cohn told reporters on Thursday. “We are going to give middle-class Americans a tax cut.”

The debate over the proposed shift could end up pitting lower-tax states against higher-tax states. Caught in the middle could be Republicans in high-tax states.

“It is clear people on Long Island would definitely lose under this tax reform,” Rep. Peter King, R-N.Y., said. “That deduction is really essential.”

REPUBLICANS UNVEIL TAX PLAN, CALL FOR DOUBLING DEDUCTION AND CUTTING RATES

King took to Twitter slamming the plan, underscoring the argument that the deduction protects taxpayers from being taxed twice.

“Any tax reform legislation must retain the state and local tax deductions. Hard working New Yorkers must not be taxed twice,” King tweeted Wednesday.

Senate Minority Leader Chuck Schumer, D-N.Y., said on the Senate floor Thursday that the effort to eliminate the state and local deductibility would be “a downfall of this plan.”

“I know the ideologues say, ‘let’s go after the states that charge taxes!’ Let me tell you, there are 40 or 50 Republican congressmen from well-to-do suburban districts in high tax states like New York, California, New Jersey, Pennsylvania, Illinois, and Maryland whose constitutes will be clobbered by removing state and local deductibility,” Schumer said. “Clobbered.”

The Tax Policy Center estimated that the elimination of the state and local tax (SALT) deduction would increase federal revenue by $1.3 trillion over 10 years—18 percent of that revenue would come from California.

According to a Los Angeles Times report this week, SALT allowed Californians to reduce their taxable income by $101 billion in 2014.

It may come as no surprise that California lawmakers are not happy.

“Californians in particular could be harmed by this proposal. The Republican plan eliminates the deduction for state and local taxes, a deduction claimed by more than 6 million California households,” Sen. Dianne Feinstein, D-Calif., said. “This plan is a nonstarter for me. I don’t believe California should suffer in order for President Trump to give tax cuts to the rich.”