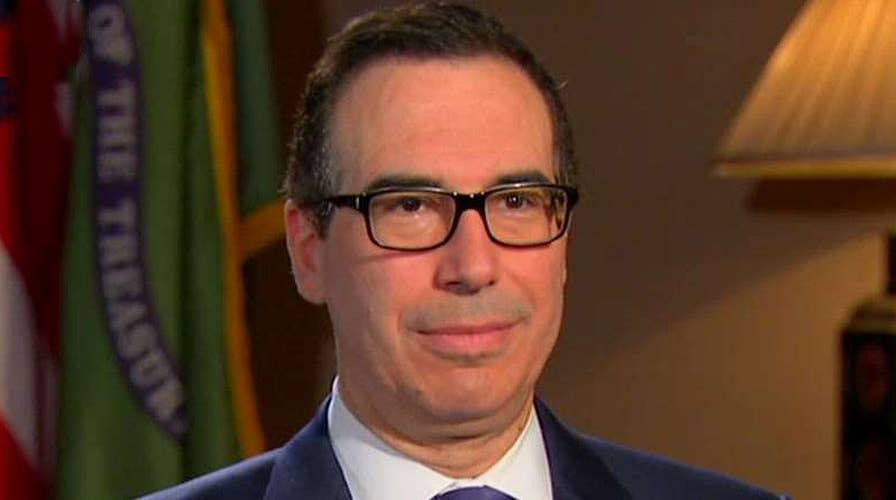

Secretary Mnuchin: President Trump will deliver on tax cuts

On 'Your World,' the treasury secretary discusses the infrastructure plan, defense budget, ObamaCare, tax cut plan

Treasury Secretary Steve Mnuchin confirmed Wednesday that the Trump administration aims to lower business tax rates to 15 percent, saying a forthcoming proposal will constitute the “biggest tax cut” for Americans in history.

“This is going to be the biggest tax cut and the largest tax reform in the history of our country,” Mnuchin said, as administration officials prepare to outline Wednesday afternoon what he described as “principles” of their tax plan.

Mnuchin, speaking at a Washington forum, would not reveal many specifics but confirmed that they want to lower the business rate to 15 percent.

“I will confirm that the business tax is going to be 15 percent,” he said. “[Trump] thinks that’s absolutely critical to drive growth.”

He indicated that the rate for small businesses and the corporate tax would both drop to 15 percent. The top small business rate is 39.6 percent; the current corporate tax is 35 percent.

Mnuchin also said the administration wants to “do the whole thing,” and not pursue tax reform piece by piece. Amid concerns that such sweeping tax cuts would significantly reduce revenue for the government, he suggested economic growth will help pay for the plan.

The plan, though, is likely to run into tough questions from Democrats and some fiscal hawks about the impact on the federal deficit and national debt.

On Tuesday, the official scorekeeper for Congress dealt a blow to the argument that tax cuts pay for themselves.

The nonpartisan Joint Committee on Taxation said a big cut in corporate taxes, even if temporary, would add to long-term budget deficits. This is a problem for Republicans because it means they would need Democratic support in the Senate to pass a tax overhaul that significantly cuts corporate taxes.

After holding a briefing with congressional lawmakers Tuesday night, Mnuchin and top White House economic adviser Gary Cohn are set to brief the media later Wednesday on tax plan details.

Mnuchin said Wednesday morning that the House, Senate and administration are all “on the same page” and called tax reform a “major priority.”

The administration also is looking at a big increase in the standard deduction.

The current standard deduction would rise from $6,300 to $12,600 for individuals under the proposal. For married couples filing jointly, it would rise from $12,600 to roughly $24,000.

The Associated Press contributed to this report.