Neb. governor looks to end state income, corporate taxes

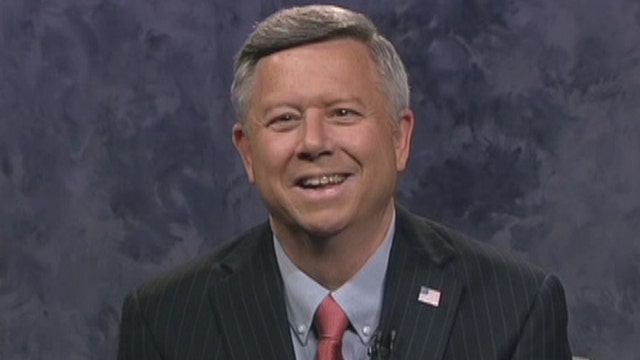

Gov. Dave Heineman embarks on an ambitious tax overhaul plan

Gov. Dave Heineman proposed an ambitious plan Tuesday to scrap Nebraska's income and corporate taxes while eliminating as much as $2.4 billion in sales-tax breaks for businesses, with all industries except for food on the bargaining table.

The Republican governor unveiled his tax overhaul plan and budget proposal in his annual State of the State address to lawmakers.

"Are we going to be satisfied with a mediocre tax system that won't create the jobs of the future for our sons and daughters?" Heineman asked. "Or, are we willing to consider reforming the tax code so that we have a modern, simpler and fairer tax code? Are we willing to consider a bold, innovative and strategic tax reform plan that would create a top ten business climate in Nebraska?"

Heineman said he would introduce "alternative options" for lawmakers in the next few days. And in a news conference immediately after the address, Heineman said all exemptions -- minus food -- were on the table, including breaks for manufacturing and agribusiness, two of the state's largest industries.

The plan would require lawmakers to eliminate as much as $2.4 billion in sales tax breaks for businesses, many of whom will likely fight to protect their particular exemption. Currently, the state exempts $5 billion in purchases a year, more than it collects. In fiscal year 2014, Nebraska is projected to bring in $1.5 billion in sales and use taxes.

However, Heineman said he has approached Nebraska business leaders in recent months to see if they were willing to trade their sales tax exemptions for lower corporate and individual taxes.

Nebraska allows exemptions on 84 different goods and services, from newspapers to airplane fuel to bull semen. Sales on American Indian reservations are tax-exempt, as are seeds sold to commercial growers.

Some of the biggest exemptions go to farmers, ranchers and agribusiness. The industry received at least $1.2 billion in exemptions last year, including $630 million for farm animals and $300 million for water and veterinary medicines.

The governor said he has spoken with farmers and ranchers who are willing to talk about the trade-off.

"You may be surprised, but many are willing to have that discussion," Heineman said. "They want simplicity and fairness. They want a modern tax code that rewards productivity, profits and job creation rather than having their lawyers and accountants spending time mining the tax code for exemptions."

Lawmakers have signaled an interest in eliminating both individual and corporate taxes this year, with several bills already introduced. But they had mixed reactions to Heineman's plan.

"This is a major tax shift reducing the burden on high-income earners and people at the top of the tax bracket," said Sen. Jeremy Nordquist, of Omaha. "The Warren Buffetts of the world are going to see a significant reduction in their taxes and lower-income families are not going to see as much of a reduction."

Speaker of the Legislature Greg Adams said he anticipates a battle over the tax exemptions.

"Conceptually, I think the idea of trying to find balance is a good one, but the devil is in the details on which tax exemptions and how much," Adams said.

State Sen. Brad Ashford, who is running for Omaha mayor, said the governor's proposal could produce a cash windfall for Nebraska cities. Cities are allowed to impose a sales tax of up to 1.5 percent, and ending exemptions for certain goods and services would allow them to collect more.

Heineman said he could agree to a plan that would lower income tax rates instead of eliminating the tax altogether. The governor's proposal also would exempt military retirement pay and Social Security income from state income taxes.

Also Tuesday, Heineman unveiled his proposal for a new, two-year budget that sets the stage for a showdown on several issues. It includes no money to expand Medicaid coverage, an optional part of the federal health care law. Some lawmakers are expected to push for expanded coverage as a way to lower health care costs, and Heineman has promised to oppose them.

Sen. Heath Mello of Omaha, the new chairman of the Legislature's budget-writing committee, said it's too soon to know whether he would support the governor's budget plan. But he said the governor's proposal is a good way to start the conversation about the state's priorities.

"There's a lot of potential for common ground between the Legislature and the governor and his proposal," Mello said.

Still, some parts of the governor's budget will almost certainly raise objections from lawmakers.

Heineman's proposed spending plan would de-fund prenatal care services for illegal immigrants and other low-income women. Lawmakers overrode the governor's veto of the bill last year and approved $786,000 per year for coverage, despite his strong objections.

Heineman's budget also calls for an additional $62.1 million to the University of Nebraska and a $6.2 million increase to the Nebraska State College System, which has three schools.

In exchange for the extra money, the schools have agreed to freeze tuition for two years. Heineman said he has offered a $10.7 million increase in funding to Nebraska's community colleges if they agree to a similar freeze.