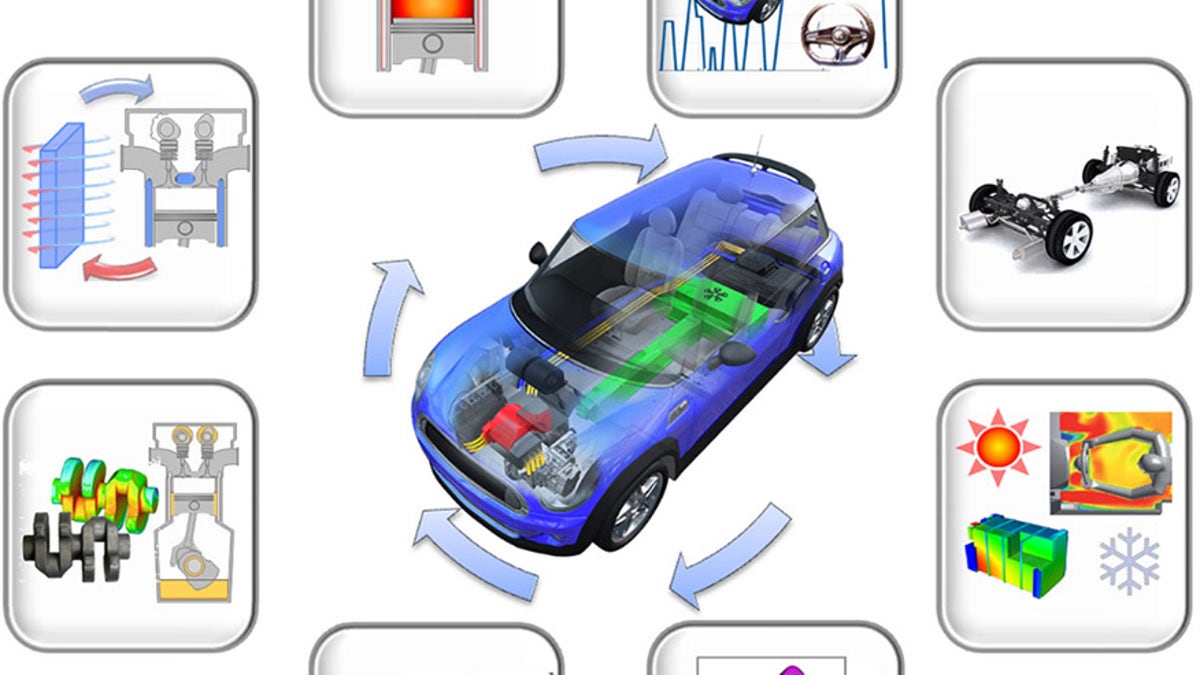

(Mentor Graphics)

Last week, the U.S. Department of Transportation and the National Highway Traffic Safety Administration released a policy statement about self-driving cars. U.S. Secretary of Transportation Anthony Foxx boiled it all down to this: "The self-driving car raises more possibilities and more questions than perhaps any other transportation innovation under present discussion. That is as it should be. Possessing the potential to uproot personal mobility as we know it, to make it safer and even more ubiquitous than conventional automobiles and perhaps even more efficient, self-driving cars have become the archetype of our future transportation."

There's a lot more, and you can download the whole document here but the take-away you care about is that the government recognizes that fully self-driving cars are coming, and it's time to decide how they're going to work, not whether they're going to be allowed.

The modern automobile is dramatically more complex than any vehicle in history. The Saturn V rockets that took men to the moon were wind-up toys compared to the 100 million lines of code embedded in a modern Mercedes-Benz. That fact puts software companies front and center when it comes to developing your next car. To take a deep dive, we took a look at the software that never makes it into the car, but which allows the engineers to design the systems that make your new car work properly and meet a phonebook-thick set of technical requirements.

Building the Tools

More From Digital Trends

Mentor Graphics is an old software company with deep roots in the integrated circuit design business. Quite by accident, the company got into automotive electrical systems design.

"Freightliner took our tools and used them for something they were never intended for," says Mentor's CEO Wally Rhines. "They developed the original wiring tool, which was called L-Cable at the time. That later evolved into the Capital electrical systems design product family."

Today, about 20 percent of Mentor's revenue derives from automotive electrical design tools, with fingers into automotive connectivity, secure vehicle communications, autonomous vehicle design, active noise cancellation, and electric vehicle developments. The company has created a division known as Mentor Automotive to handle the growing business.

"It happened over a period of time, not because the automakers wanted to, but because they couldn't design the next generation of cars by hand," Rhines explains. "What happens as cars, planes, trains, put more electronics in? When do they get to the point where people can't do it by hand anymore? When do they move to virtual design and simulation? It came very slowly because automotive companies don't change easily. Over time, we built a significant portion of our business just doing electronics for cars."

Andy MacLeod is Mentor Automotive's Director of Automotive Marketing, and he's a deep thinker in Mentor's automotive strategy.

"We're engaged with 17 of the top 20 OEMs (Original Equipment Manufacturers), which is a strong global footprint," MacLeod says. "And we're very much aligned with the specific challenges faced by OEMs in emerging areas of automotive technology."

Related: Your next car will update itself while you sleep, and maybe watch you too

Those emerging areas loosely break down to connectivity, autonomous driving, and electrification.

"One third of US cellular subscriptions in Q1 of 2016 were for cars," MacLeod explains. "Automotive connectivity is now a trillion dollar business in America."

To translate that into different numbers, about five percent of new vehicles sold in 2014 included connectivity in excess of a Bluetooth smartphone connection, meaning that the car itself is capable of receiving a 4G/LTE data signal. The automotive industry expects that percentage to grow to 57 percent by 2019, and 89 percent of all new cars sold by 2024.

"If you look at some of the security challenges, We have to have a hardened operating system," MacLeod says. "Whenever there's a risk, that has to be patched immediately, and not once a year when the car goes in for service. That means propagating security software patches over the air."

Electric Mobility on Demand

Another area where electronics design software comes into play is autonomous or self-driving cars, including a business area that the industry calls Mobility on Demand.

"Mobility on Demand would be Uber Robo-taxis, for example," MacLeod says. "You could call up an app on your smart phone, or the car could even connect to your calendar and then appear and take you where you're going. Also, it's the concept of buying trips rather than buying vehicles. It's all a part of New Mobility."

Autonomous vehicles are expected to be a $25 Billion market by 2020. That's why new players such as Mentor Automotive are springing up to take the auto industry into the New Mobility era.

"The whole supply chain is being redefined," MacLeod explains. "There's investment coming in from non-OEM supply chain players -- cloud computing and big data analytics of course, deep learning and artificial intelligence, and government money especially. The value of new mobility will be measured in trillions, so investment money is coming because there's an opportunity to modify this in a big way."

By 2040, industry experts believe that 35 percent of new vehicle sales will be battery electric vehicles. The shift is already underway, moving in fits and starts as development efforts produce advancements and the global oil market and geopolitical situation fluctuates. Mentor Automotive's clients now include Tesla, electric motorcycle manufacturer Brammo, and electric bus maker Proterra.

"When you bring in electrification, all of a sudden you have a multiple voltage domain," MacLeod says. "So it's not just 12 volts any more, it's 48 and 115 and sometimes all three in the vehicle. There's a pyramid of engineering challenges.

The Paperwork Challenge

As if it wasn't enough of a challenge to integrate connectivity, autonomy, and electrification into an automobile, there's another hurdle to pass before new mobility makes the leap from the lab to your driveway. Because modern cars are so complex, and the automotive industry is among the most tightly regulated and product-liable industries in the world, there's a mountain of product requirements paperwork to manage for even the smallest features. Automakers need to make sure that multiple marketing, engineering, and regulatory needs have been met, and they have to be able to prove it.

"Think about everything involved in delivering a product," says Eric Nguyen, Vice President of Demand Generation at Jama Software. "We manage everything from high-level documentation of requirements all the way down to design specifications, testing and verification. We tie all that information together in highly compliant or regulated industries like aerospace, automotive, or medical."

Jama Software is just one of dozens of companies formed to help automakers manage complex requirements tracking challenges

Jama's product allows the company's clients to set up each specific product requirement with a web of dependencies and relationships to facilitate verifying that the requirement has been met, and also to monitor the effects of development on other product requirements.

"At the end of the day, we document that everything a product is supposed to do, it does. And everything it's not supposed to do, it doesn't," Nguyen says.

Jama's CEO is Scott Roth, and he sees a wide open playing field ahead.

"There's an opportunity that's unfolding in the marketplace," Roth says. "Every single company that's building products is figuring out how to build software and connectivity into them. That opens the door wide for us."

A Practical Example -- Noise Cancellation

So, why should you care about software companies working behind the scenes? Because without them, the features you want on your next car probably won't happen.

"The days of solving a problem individually are finished," MacLeod insists. "Now it's, how do all these things interplay and conflict with each other in their requirements. How do you simulate that and solve for all these challenges?"

Among the projects that Mentor is working on is assisting automakers in zeroing in on noise cancellation technology. While this will appear first on premium luxury vehicles, the underlying benefit is actually in improved fuel economy for all cars.

"Our solution does two things," explains Anil Khanna, Senior Product Marketing Manager at Mentor Automotive. "We tackle engine noise cancellation, but we're also looking to cancel road noise. This is an altogether different beast, because road noise is extremely random, it depends on the road surface, and it changes every second."

To handle a dynamic challenge that requires a predictive solution, you need sophisticated software modeling.

"We need an algorithm that is extremely quick at adapting and reacting to noise sources," Khanna says. "We have a solution and we're working with some automakers to get this into production, but there are cost issues that need to be addressed."

The solution integrates a software solution with the automobile chassis and sensors.

"Noise is nothing but vibrations until it reaches our brains," Khanna says. "So we actually mount sensors under the car so we can pick up vibrations as they travel through the chassis and the body into the cabin, and that becomes our reference source, which we want to cancel out. Those sensors, unfortunately, are very expensive and cost-prohibitive to install in a production vehicle. But as technology gets better it becomes cheaper, so it's coming."

Active road noise cancellation will allow automakers to reduce the amount of passive sound dampening in any given car. At the current time, an average passenger car carries between 50 and 100 pounds of sound dampening material. If cars can be made lighter, they also become more fuel-efficient and offer better performance.

Companies like Mentor and Jama are providing the software expertise to allow the automobile manufacturers to create the next generation of technology features that will ultimately be found in all cars. Projects like self-driving cars, advanced wireless connectivity, and electrification require new work in artificial intelligence, electrical system design, and software security.

"The world is ripe for change," Rhines says, "and that's why it's exciting. It creates jobs."